As time-poor advisers become more selective about their client base, it will become increasingly important to nail the right communications strategy.

Adviser Ratings research shows 20 per cent of the average adviser’s book is made up of one-off clients, which highlights the importance of getting communication right from the very first meeting. Using clients’ preferred financial language may help advisers efficiently turn one-off clients who fit the firm’s needs into return business.

We also know the rising cost of servicing clients is driving many advisers to orphan unprofitable clients. This means being able to connect with consumers and quickly identify those who fit within the practice’s overall goals is a key skill.

With that in mind, investment management firm Invesco Consulting has shared some of its recent research with Adviser Ratings around what investors look for from their adviser. The findings may help advisers talk to clients in language they understand and respond to favourably.

The communication factor

Invesco Consulting and Prince & Associates surveyed affluent clients about their likelihood of adding money to investment accounts via an adviser. They found that communication, specifically around the client’s financial situation, was an even bigger driver of those decisions than investment performance.

The research showed high performance on its own prompted just 15 per cent of clients to want to add to their accounts. However, good communication prompted 31 per cent to want to top up their accounts, independent of performance.

Words matter: The language clients prefer

Further research from the investment firm identified the words and language clients like to hear from their advisers.

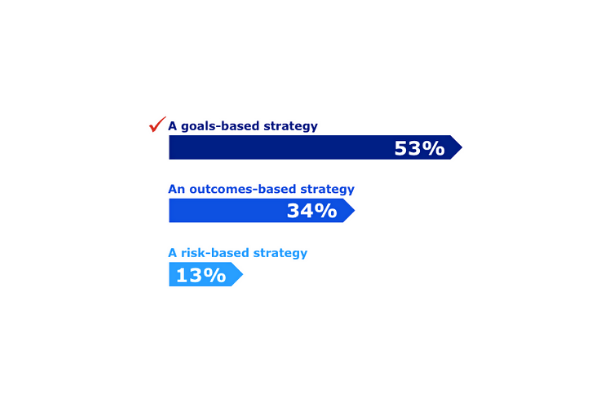

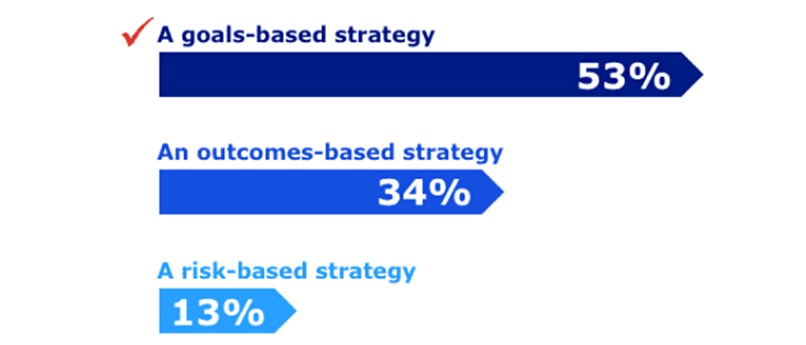

Invesco asked 800 investors which strategy they’d prefer: “goals-based strategy”, “outcomes-based strategy” or “risk-based strategy”. More than half (53 per cent) chose a goals-based strategy, while a third (34 per cent) chose outcomes-based strategy. Perhaps unsurprisingly, due to its connotations, a risk-based strategy was the least favoured, with 13 per cent picking the terminology as their preference.

Figure 1: Which investment strategy is most appealing?

Source: Invesco Consulting survey of 800 investors.

When asked about whether they’d prefer “buckets” or “baskets” to allocate their investments, 60 per cent chose baskets.

Meanwhile, when surveyed about how an investment should perform, the favoured phrase was across “both good and bad markets” (43 per cent) compared with in “a variety of economic environments” (32 per cent) and over “a full market cycle” (24 per cent).

Invesco Consulting said there were several jargonistic words to avoid using with clients, including futures, pioneers, beta, short, unconstrained, hedge, derivatives and arbitrage.

Given advisers know their clients best, each practice will have its own, tailored communications shortcuts. However, these Invesco insights, from hundreds of investors, may give a general sense of the language to which clients respond.

Article by:

Comments0