Like the financial advisers themselves, the research house sector is a highly influential gatekeeper to money flows. However, the rise and rise of direct investing and managed accounts in recent years has sparked the emergence of stockbrokers and fund managers as challengers to the incumbent investment research and consulting groups. And in terms of corporate action, not since S&P shutdown it’s leading Fund Services business in 2012, this sleepy hollow has suddenly sparked into life with a trio of significant transactions in 2020. Demonstrating the strategic importance of this sector, institutional investors in Generation Development Group and Five V Capital took stakes in Lonsec and Zenith respectively, and this new funding facilitated Zenith’s subsequent acquisition of Chant West.

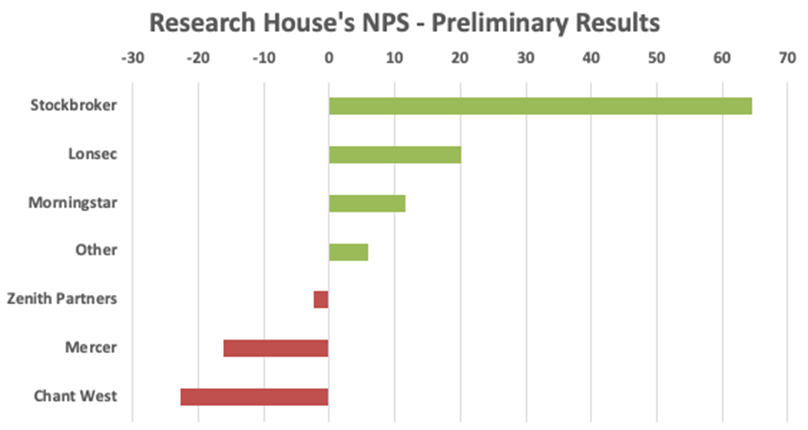

The current league table of research house NPS scores below are judged by advisers in our current 2020 Financial Advice Landscape benchmarking study. Advisers are increasingly relying on stockbroking research to satisfy their clients’ direct investing appetite, which has pushed the three leading research houses in Lonsec, Morningstar and Zenith down one place in the league table from 2019, while Chant West has dropped two places as this ubiquitous provider of super fund comparisons is now being challenged by competing solutions from Lonsec and others.

Source: Adviser Ratings Financial Advice Landscape study, Nov-Dec 2020 (n=900)

The business end of the research game is about controlling money flows through investment committees, asset allocation and the design, construction and maintenance of managed accounts and model portfolios. And while there has always been a question mark about research objectivity when charging fund managers for ratings, now researchers are charging basis points for their consulting services. No wonder then that we continue to see the emergence of new boutique investment consulting firms (we have named 30 in our survey!). And fund managers are choosing to impose themselves into this space as well, extending out their presence beyond managing SMA / MDAs and offering broader traditional consulting support by leveraging their extensive internal capabilities.

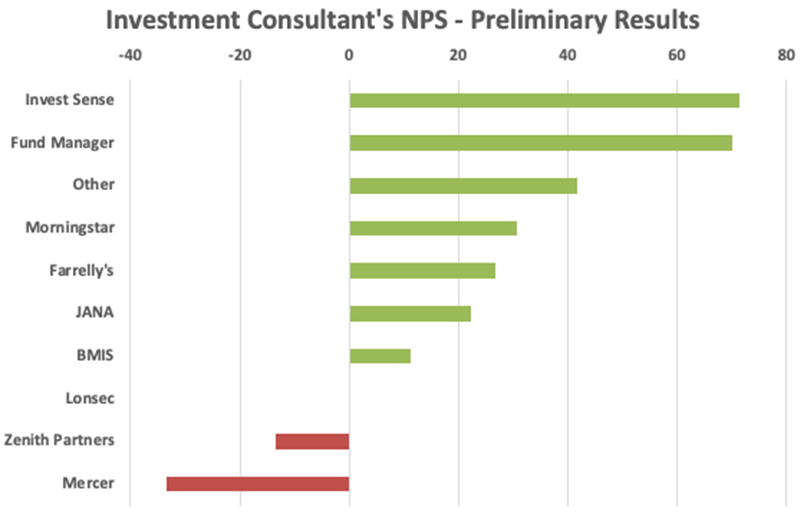

In the NPS league table below, Lonsec, Zenith and Mercer have all dropped multiple places due to the emergence of boutiques like Invest Sense, Farrelly’s and BMIS, while JANA’s arrival reflects a growing interest from the institutional asset consultants in the retail sector, at least in the “mezzanine” space of HNWI-focused licensees, private banks and family offices. To its credit, Morningstar has held its ground amidst all this jostling for position, anecdotally helped by its broadest offering to advisers across consulting, research and a suite of financial research software tools.

Source: Adviser Ratings Financial Advice Landscape study, Nov-Dec 2020 (n=900)

In reviewing adviser qualitative comments, some interesting perspectives are emerging:

Corporate actions

The corporate activity described earlier seems to be too recent to have registered with advisers in terms of their verbatim comments, although Zenith, Chant West and Lonsec have all been rated lower. It will be interesting to see if the new institutional support of these businesses will translate into new and improved services, although the core of the business case behind these acquisitions appears to be about controlling money flows and generating higher revenues from asset-based fees.

Gaggles?

What do you call a group of researchers – a gaggle? Rarely does a licensee use just one research house and that continues to be the case, with many advisers commenting that they needed to source information from multiple firms to ensure coverage of their preferred product choices. That is much less the case for investment consulting, although the most highly rated boutique consultants all suffer the lack of capacity to dominate.

COVID-19 and review cycles

The market correction in March from COVID-19 was challenging for all advisers as they consulted with their nervous clients. It also put a harsh spotlight on the researchers and consultants to respond with appropriate consul. While many advisers acknowledged the increased level of communication and market updates from their researchers through timely research notes, there were also complaints about the lack of updates on specific fund managers across multiple asset classes. Unlike direct equities research which is generally updated real-time when notable changes occur for each subject firm, managed funds research is heavily qualitative (in Australia in particular) and conducted on inflexible annual cycles. Out-of-cycle coverage is limited by the size of teams and their ability to respond to change. Demand for greater responsiveness will either force bigger teams and higher costs of research, or higher degrees of quant in the research and potentially lower quality or level of inspection. What is preferred?

If you have some strong views on research houses and investment consultant firms, please have your say at www.adviserratings.com.au/yoursay and be in the running to win prizes from our $30,000 prize draw.

Article by:

Comments2

"Hi Anthony, Thanks for your comment. Net Promoter or Net Promoter Score (NPS) is the percentage of customers rating their likelihood to recommend a company, a product, or a service to a friend or colleague as 9 or 10 ("promoters") minus the percentage rating this at 6 or below ("detractors") on a scale from 0 to 10. Respondents who provide a score of 7 or 8 are referred to as "passives" and enter into the overall percentage calculation. The result of the calculation is expressed without the percentage sign. It is a metric management tool used as a measure of customer satisfaction and has been shown to correlate with revenue growth relative to competitors. I hope this helps."

Stacey - Adviser Ratings 10:34 on 17 Dec 20

"What the hell does NPS mean or what do the initials stand for? Is NPS another reasearch house - a researcher of researchers?"

Anthony D Gillett 00:17 on 17 Dec 20