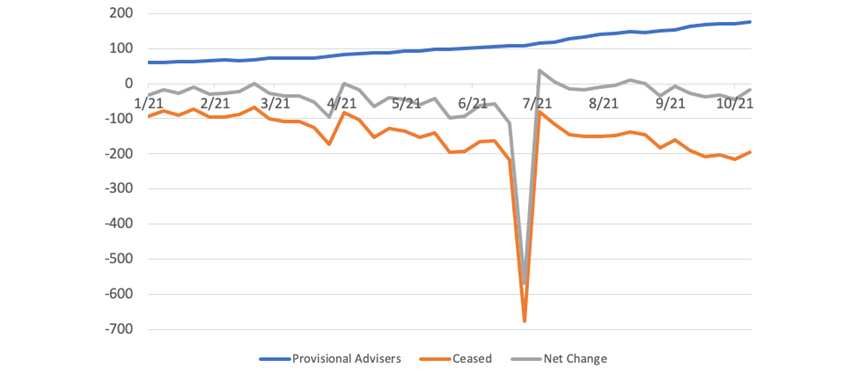

As the financial advice market continues to struggle with finding new supply, a small number of provisional advisers is trickling in each week.

Our analysis shows the number of provisional advisers has doubled in the past six months, but from a very low base. In fact, as the 2021 calendar year draws to a close, there are fewer than 200 listed on the Financial Advisers Register.

To put that into perspective, we have reported the number of ceased advisers has surpassed 3,000 since the start of the year, and in the same period about 120 provisional advisers have registered with licensees. In other words, we’ve seen around 25 adviser exits for every new provisional adviser.

ASIC states that a new adviser can call themselves a provisional adviser when they’ve passed the exam and received authorisation from a licensee to provide retail advice.

Figure 1 – The adviser landscape in 2021

Source: ARdata

Adviser Ratings is aware of several challenges for provisional advisers. For one, finding supervision, mentorship and support is becoming more difficult in a contracting advice market. Secondly, with some of the biggest licensees exiting the advice space or reducing their presence, we’re told some budding advisers have struggled to find a suitable home.

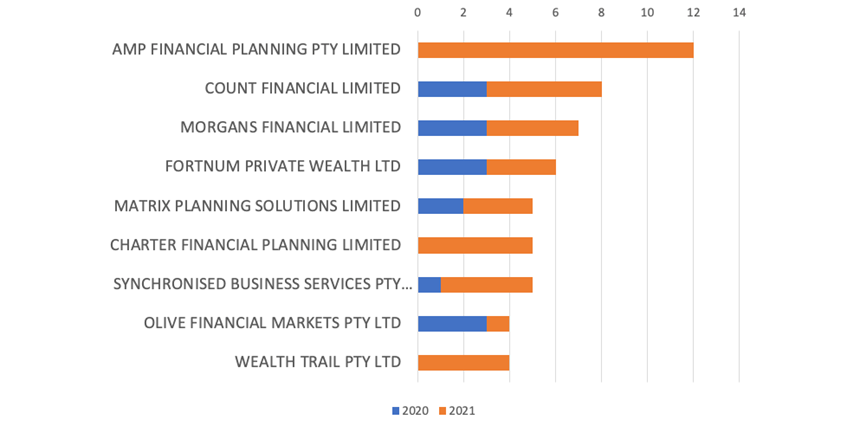

Figure 2 (below) shows, large licensees, including AMP Financial Planning, Count Financial and Morgans Financial top the table for provisional adviser placements. Again, it’s important to note we are talking about relatively small numbers here.

Figure 2 – Top licensees for provisional advisers in 2021

Source: ARdata

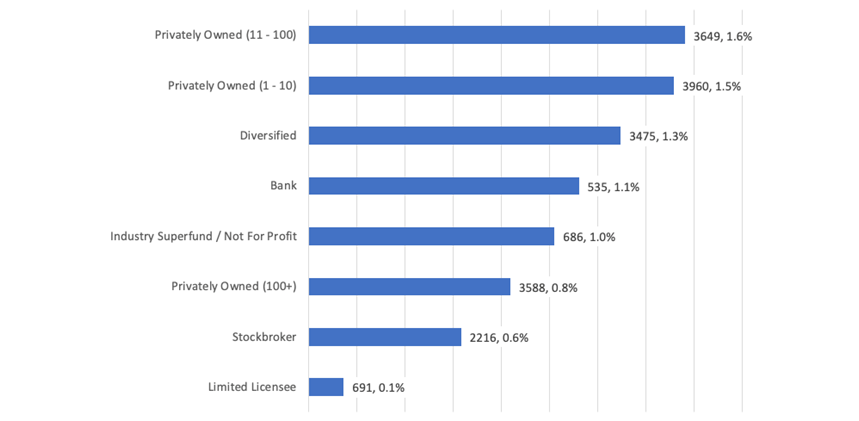

If we look at where provisional advisers fit in the total universe of licensed advisers (Figure 3), they account for less than 2 per cent of the small and mid-sized marketplace and just over 1 per cent of the bank and diversified space. Unsurprisingly, given broader industry trends, just one provisional adviser was licensed in the limited licensee space this year.

Figure 3 – Proportion of provisional advisers by licensee type

Source: ARdata - Note: Numbers represent the total number of advisers and percentage of provisional advisers.

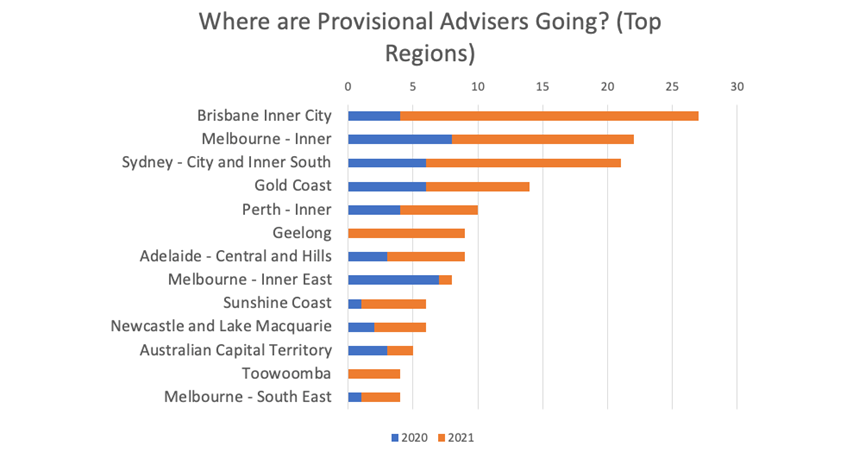

Finally, when it comes to where provisional advisers are choosing to set up, Brisbane appears to be the city of choice, followed by Melbourne and Sydney.

Figure 4 – Provisional adviser destinations of choice

Source: ARdata

So, what can we conclude from this data? To begin with, while a small, weekly increase is a promising sign, further intervention is needed to provide work and training for this emerging cohort. With fewer of the traditional opportunities from large licensees available, the industry – which includes licensees, associations, advocates, legislators and fellow advisers – will have to find ways forward for provisional advisers. Without those pathways and assurances, financial advice will become a less attractive profession.

Article by:

Comments7

"I agree with Scott that being a financial planner is not only a poor career choice but an evil I wouldn't wish on my worst enemy. Consequently I wouid suggest that the provisional advisers are the children of advisers looking to leverage some value out of their near worthless practices and mentoring the only people they would have time for in this environment. After all, with the compliance and potential legal liability, you wouldn't mentor anybody other than your own child surely! "

Craig 18:16 on 10 Nov 21

"I note that regional and non metropolitan numbers are pretty much non existent. People in regional Australia will be left behind. "

Jason 16:31 on 10 Nov 21

"I absolutely agree with your comment that "... further intervention is needed to provide work and training for this emerging cohort." I have been pushing FASEA and My local member of parliament to adopt what the Victorian legal system have - Fully fledged training system - that is approved by the Supreme Court . Law graduates have the option to attend the Leo Cussen Centre to complete their training and receive their practising Certificate from the Supreme Court. FASEA has referred my suggestion to Treasury and I hope this is fully explored by Treasury and the government. Basically, if you can't find an adviser to take you on, there should be a training centre for financial advisers similar to what the lawyers have. These graduates would be prized assets that could hit the road running when they are hired as provisional advisers - they would be well versed in all areas of financial planning!!"

Joseph 16:02 on 10 Nov 21

"As one who adheres to the conspiracist theory I would say the regulators/industry super/labor party etc are well on their way to achieving their goal ... "

John 15:49 on 10 Nov 21

"What we can determine from this data is that financial planning is a poor career choice and something needs to change for it to be anything other than a poor choice."

Scott 15:45 on 10 Nov 21

"With so many Advisors and in particular those in Stockbroking, older advisors, say 55 to 60+ year olds are either calling it a day or moving into management, for the one reason --- it's been so long since they've had to sit for an exam --- a computer styled exam, which is too foreign for them. So all that knowledge and experience is disappearing, the one group which could offer the role of mentoring. These people are good, if they weren't they would have been exposed years ago. "

DAVID baker 15:35 on 10 Nov 21

"Great info, thank you. However, it would be interesting to know the age demographics of new Provisional Advisers and breakdown of male/female if possible. It would be helpful to know if millenials are the the majority of new provisional advisers. 25 departures per 1 new provisional adviser is of great concern"

Anon 15:30 on 10 Nov 21