Clients want greater access to cryptocurrency through their adviser, but licensees are still keeping their powder dry due to regulatory and insurance concerns, a webinar has heard.

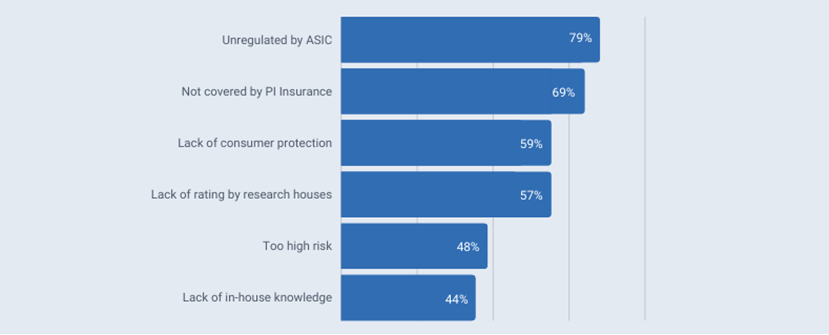

Adviser Ratings surveyed 62 of the top 300 licensees and found almost four-in-five would not allow crypto on approved product lists (APLs) because it is currently outside the scope of Australian Securities and Investments Commission regulation.

Concerns about PI insurance, consumer protection and knowledge are also keeping crypto off many licensees’ APLs.

However, many licensees said they would reverse their position if these barriers were removed, Adviser Ratings research shows.

Chart 1 – Top Reasons for Licensees Disallowing Crypto on APL

Source: ARdata

Addressing the barriers

According to the National Head of Business Development at Independent Reserve, Lee Eaton, work is being done to create more regulatory certainty.

Mr Eaton said one of the first milestones in this area was a bipartisan Senate report in October, which made 12 recommendations, primarily around consumer protection, custody and the licensing regime.

“The process is now at the point where people like Independent Reserve are working with solicitors and the government to draft up that initial legislation,” he explained.

He said it was unclear when the legislation would reach Parliament, but he hoped it was “sooner”, for the sake of both regulators and the industry.

Meanwhile, Cosmos Asset Management chief executive Dan Annan said he’s also working on accessibility.

“The first thing we’re doing is really figuring out how to design products to give access in a financial product listed on an exchange,” he said. “The next step is how do we make these available to advisers?”

Mr Annan said he has been consulting with research houses in Australia to help them understand the crypto products so they can be rated, to enable advisers to use them on their platforms.

“But it has to be two ways,” he said. “In order to get a product available on an APL, there has to be some sort of demand from advisers.”

Mr Annan encouraged advisers to try to work with product providers on finding solutions to these problems.

“Crypto – A Future Asset Class On Your APL” is a three-part webinar series exploring the risks and benefits of crypto, how to be prepared for clients and how advice can play a role in both a regulated and unregulated setting. Adviser Ratings’ founder and managing director Angus Woods is joined by expert panelists, Dan Annan and Lee Eaton to bring this free crypto information series to Australian advisers.

You can watch the replay of the live session here. We'll send you a reminder to join the second session which will air in around three weeks (live streaming date to be confirmed).

Article by:

Comments4

"As fiat currencies devalue, one after another, and central bank balance sheets continue to expand, people will naturally try and find a way to store wealth that does not diminish over time. When the debt fuelled bubble bursts or authoritarian governments freeze assets or steal citizens' gold, people will want safety. Bitcoin is uniquely designed as the only asset that can solve these problems, hence the exponential adoption curve and why it has outperformed every asset class since its inception. I see it as a prudent long term investment strategy. My advice is to educate yourself as quickly as possible, regardless of how long it takes ASIC, licensees or PI insurers to come to the party. Start off with BTC (What is it? / Why is it important? / How does it work?). Once you understand this, the other layer 1 "smart contract" stuff (ETH, AVAX, SOL etc) will make more sense. Godspeed!"

Daniel Budreika 00:16 on 03 Mar 22

"Just no….APL’s hold investments - crypto is speculating, there is a fundamental difference. Until there is a well regulated exchange to access crypto investments the answer has to be no…and even if a well regulated exchange arrives I would still say no. I don’t advise my clients on what horse to back - I suggest advisers leave gambling as a client directed activity. "

Ben Maw 15:44 on 02 Mar 22

"I can invest in ~2400 companies listed on ASX (plus derivatives etc) most of which are small specs (no revenue / no profit / no dividends). Why do I need to add cryptos with opaque background"

BeenThereB4 15:41 on 02 Mar 22

"“In order to get a product available on an APL, there has to be some sort of demand from advisers.”... There is demand from advisers and clients - but licensees and ASIC are sticking their heads in the sand. I went to my licensee a year ago and said that we need to be able to provide advice on crypto to be able to help our clients navigate this field with the help of a professional, not some kid on YouTube. My licensee said that they haven't heard of anyone wanting to invest in crypto and that they will just wait for ASIC. I have been investing in crypto such as Bitcoin, Ethereum and Chainlink since 2018 and I find it sad that I am a licensed professional and I am unable to assist my clients, yet some 12 year old on TikTok can give all their followers advice. Actions, not words is what we need. "

Financial Adviser & Crypto Investor 15:31 on 02 Mar 22