By Alec Berry

We as Australians have a tendency to be bad savers. This is not exclusive to any one generation - it isn’t just millennials, Australians of all age groups are guilty of it. From a cash flow and savings perspective, this fact is becoming increasingly relevant in the face of a subdued return outlook in the medium-term – industry findings point towards the advent of a recession in the next five years as being more likely than not.

To help you break the cycle and get a handle on your cash flow so you can hit your personal and lifestyle goals in the face of a challenging and volatile future investment environment, we have shared four tips below that you can implement today.

Think Like A CFO

Why is personal cash flow management so important? Think of it like this: at work whether you are managing the cash flows of an entire firm or simply working on a project within the parameters of a budget, properly monitoring cash flows is a matter of high importance. In the workplace, the consequences of not doing so can be severe, and as a result are regarded with a significant degree of attention. One could be forgiven for not regarding their personal cash flows as equally important – the ramifications may not seem as daunting. However, adopting a ‘business mindset’ can help keep you accountable and help you maintain control of your cash flow.

Build A Cash Flow Strategy

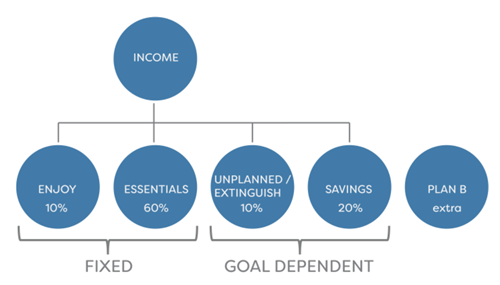

Constructing a cash flow strategy is a great way to stay on top of your finances and keep you accountable. A good starting point for this is developing a budget which will enable you to grasp a deeper understanding of your cash inflows and outflows, as well as your direct debits. It is important to ensure that any strategy you develop is specifically suited to you. Everyone has different goals and different circumstances surrounding their capacity to achieve these goals, so no two strategies will be the same. An example of what a cash flow strategy could look like can be seen below:

Developing your own cash flow strategy cold turkey can be challenging, we know. We have access to a tool that can make your life easier by streamlining the management of your cash flows. Email us if you would like more information.

Find Your Quick Wins

Understanding your current cash flow situation can help you establish whether or not any “quick wins” are available and jump on them if they are. Evaluations on a number of your expenses could prove vital in the optimising your cash flows, and sometimes finding ways to reduce costs can be easy. Whether it is as simple as cancelling a Foxtel subscription you barely use, or ensuring that you have taken the time to look into the interest rates on your accounts in the past few years to prevent yourself from overpaying, reducing your personal expenditure doesn’t always have to be a complicated process. Debt repayment in particular, although often not considered to be, is a form of return. And when you take into account the added bonus of it being risk free, it has the potential to be a source of a simple yet effective way of improving your current cash flow situation.

Put Your Strategy To Work

Around the country there has been a notable increase in the demand for good cash flow strategy, a trend evidenced by the common presence of multiple offset accounts and automatic cash flow structures offered by banks. These more flexible approaches come from a more dynamic perspective on cash flow management, moving away from traditional one-size-fits-all approaches to actually meet your needs.

If you would like some assistance in setting up the right cash flow structures for your personal circumstances, or would appreciate a fresh perspective on the strategies you currently have in place, please don’t hesitate to get in touch with us on (07) 3391 5055 or advice@mgdwealth.com.au for a complimentary, obligation-free appointment.

Disclaimer: This article contains general information only and is not intended to constitute financial product advice. Any information provided or conclusions made, whether express or implied, do not take into account the investment objectives, financial situation and particular needs of an investor. It should not be relied upon as a substitute for professional advice.

Article by:

Comments0