Against the backdrop of a shrinking financial adviser market, the cost of participating in the blooming profession is rising substantially by the year.

The latest indication of that is the increasing ASIC levy, which is slated to grow by almost a third (31 per cent) in a single year to $1500 a year for licensees plus $3138 per adviser in 2020-21, from $2426 per adviser in 2019-20.

The regulator’s estimate is based on ASIC recovering more than $71m from just shy of 3000 licensees and 21,308 advisers listed on the Financial Advisers Register.

However, as the Financial Planning Association (FPA) has stressed, the estimate and the final bill that hits businesses’ desks has a history of varying.

“The FPA notes last year’s estimate was wrong by 54 per cent (i.e. between the CRIS and the final) so the actual levy figure could be significantly higher,” it said in a statement.

The industry association has called on ASIC to review the funding model “before more planning businesses are forced to close”.

Adviser Ratings analysis suggests by next year, there will be far fewer licensees and advisers to share the industry funding cost in future years. In fact, we predict the number of advisers may have dropped below the 17,000 mark. In our last Musical Chairs update for Q2, 2021, the number of listed advisers had dropped below 20,000 for the first time.

Rising costs mean rising fees

For advisers reading this, it will be no secret the cost to advise is escalating at a rate previously unseen, in part due to the professionalisation of the market. For example, data from Striver and Adviser Ratings shows the average graduate is brought in at $55,000, but businesses often pay 1.45 times that when they account for the professional year, on-costs and licensing. For practices, there’s also PI insurance and the cost of education for existing employees – whether that be a full degree or the exam bridging requirements.

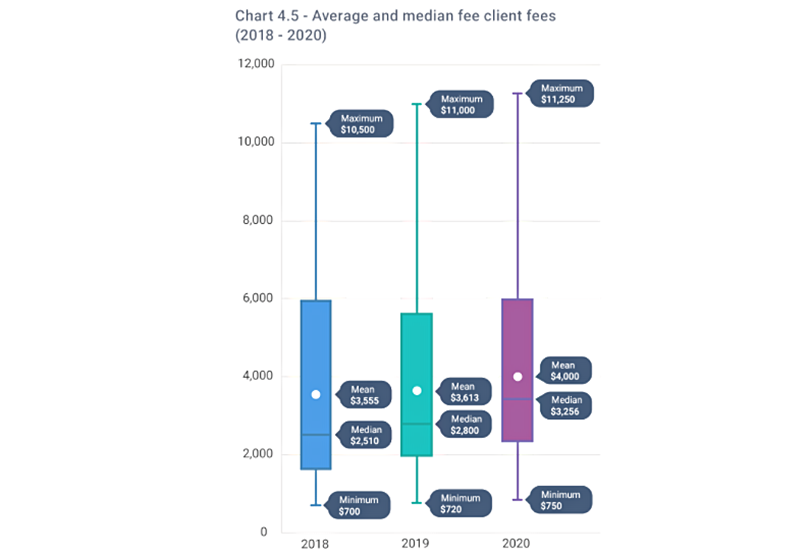

Source: AR Data

Perhaps unsurprisingly, these costs have been at least partly passed on to clients. Our research shows the median fee has risen by 16 per cent in a year to $3,256 and most advisers are charging fixed fees. As the costs to advise increase, it’s likely we’ll see fees rise further.

At the same time, advisers are having to part from unprofitable clients, with revenue pressures directing many businesses towards a smaller pool of high net-worth clients. Again, this will likely put upward pressure on the cost of advice.

As ASIC raises its industry funding levy, the regulatory body has also been conducting an inquiry on how to make affordable advice available to a larger number of Australians.

However, with a smaller number of advisers, rising costs and fees and a shallow pipeline of new talent, it may be quite a challenge.

Article by:

Comments4

"The industry isn't being professionalised it is being bureaucratised! We are being strangled by red tape. I ran into a CEO of a large financial institution on my daily walk recently who knows Frydenberg and he said once the Royal Commission recommendations are fully implemented Frydenberg will leave us advisers alone. I should have told him to tell Frydenberg there won't be many of us left by then. Not one profession in Australia suffers from the red tape suffocation and therefore massive cost imposts advisers are currently facing! Why because the institutions who have departed did all the damage and the small business owners who remain are paying a massive price. Its unfair and uncalled for. Yet no one listens. The bureaucrats are only too happy to choke us with red tape because ultimately it keeps them employed doesn't it. If 33% of doctors, dentists, lawyers, accountants had left their profession in a 2 1/2 year period there'd be an outcry and it would be on the front page of the newspapers but with us no one cares. Therefore politicians and the regulators can do as they please. It's a crying shame."

Daryl La' Brooy 17:16 on 25 Aug 21

"My wife is an accountant, which I would consider to be a profession. Her fixed costs are less than 30% of mine as a financial planner. The costs associated with being a financial planner and professionalism are not linked, they are due to the gouging of this industry (we aren't a profession whilst things like the FASEA exam extension happen). Anyone becoming a financial planner now must really hate themselves as there are many more attractive occupations."

Scott O'Donnell 15:13 on 25 Aug 21

"There article errs in referring to financial planning as a "blooming profession". It is a dying profession. Josh Frydenberg is systematically and most deliberately destroying it with great big new taxes and burdensome red-tape. There is no upside to what is going on except for the Big Banks who will now move into robo-advice and the Big Super Funds who will continue with an expanded intra-fund carve-out. "

Chris 15:02 on 25 Aug 21

"Classic ASIC - they have no idea about the Financial Planning Industry but now are in charge of it. The Levy is the only Policy Tool they have available to them. They have no idea how to regulate the industry in an appropriate manner other than to push people out of the industry - the levy is just one example. - it is hideously expensive and there is absolutely no service provided for the payment - it's an industry levy that will ultimately force more Advisors to rethink why they shoudl stay in the industry - because the cost of over Regulation is putting the Cost of Advice so high that mum and dad investors will never be able to afford proper advice going forward. Well done ASIC - the very people who should be protected by being able to source proper advice will now not be able to on the basis of cost. They will now be more exposed to bad decision making than ever before. Since Haynes the over regulation and cost imposed on the industry has just about destroyed it - well done !"

Mr Brendan Comensoli 14:51 on 25 Aug 21