Accountants who flooded into the financial advice market a few years ago have been just as quick to exit, with fewer than 500 remaining under the limited licensee model.

In the 2021 calendar year, the volume of limited licensed advisers fell by 48 per cent, from 936 to 489. At the same time, the number of limited licensees has fallen to 339, from more than 600 in 2019.

Meanwhile, another destination of choice for tax professionals – the privately-owned SMSF Advisers Network – now licenses fewer than 300 people.

It comes as the overall adviser universe continues to contract, with 16 per cent of advisers departing in 2021 and adviser numbers falling below 20,000 for the first time. Adviser Ratings recently tipped the workforce would fall as far as 12,000.

A rapid rise and fall

The shrinking accountant footprint is a stark contrast to the situation in late 2018, when almost a tenth of the 25,000-strong adviser universe was made up by accountants. The frenzied push into the limited licensee space followed the 2016 repeal of the accountants’ exemption, which had limited the way accountants could advise on starting or closing a self-managed superannuation fund (SMSF) without a licence.

However, just three years later, the pressures from increasing operating costs and professional standards have become too much for many accountants, who saw SMSF advice as just one part of their overall business objectives, Adviser Ratings has been told.

Last year, a number of accounting groups were among those calling for the Australian Securities and Investments Commission (ASIC) to ditch its planned levy hike. Although ASIC offered a reprieve, accounting bodies say pressures on their advising members continue to mount.

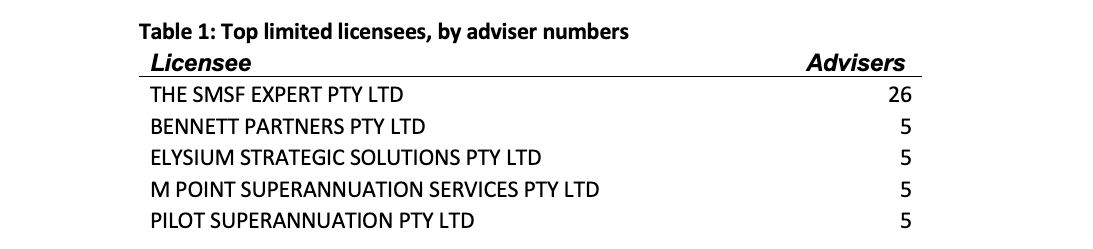

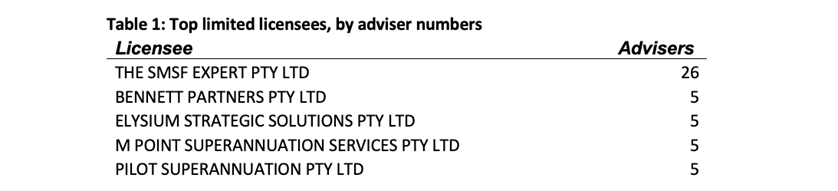

Table 1: Top limited licensees, by adviser numbers

Source: ARdata

Limited licensing ‘unworkable’

In fact, the Chartered Accountants of Australia and New Zealand says the current licensing model has become “unworkable” for its members.

Specifically, the body said multiple licensing and registration requirements and education standards have made it too costly for advisers to provide – and clients to receive – advice.

It has suggested replacing the limited licensee model with what it calls a “strategic advice model”, which would allow suitably qualified professionals to give scaled and strategic advice (decoupled from products) without an Australian Financial Services licence. The idea has been pitched to government, including Treasury and Financial Services Minister Jane Hume.

Although there are now fewer than 500 accountants advising under limited licensees, the association said earlier this year it expects many of its members to consider cancelling their AFSL, given the December 31 deadline for passing the adviser exam.

Article by:

Comments6

"Agree with most of the comments so far. I have read the article a few times now, as well as Craig's submission, and still can't figure out what his point is other than to bag this useful and well respected forum. I don't see the articles as advice, rather providing facts, data, and industry comment with a forum for us advisers to vent our spleen or make useful contributions. In my 36 years in advice, I have seen way too many SMSF's set up by accountants that were just fee generators. Advisers saw what a goldmine an accountant's data base could be. Accountants became aware of the significant amount of money to be made, particularly in risk insurance. Alliances were made, and the rest is history. Not to say that many of these alliances were good, professional outfits that provided sound advice to their clients. Not surprised to see accountants walking away and focusing on what they do best. "

Deputy 17:40 on 17 Mar 22

"Interesting. So accountants have found it too hard to do financial planning. "

Deen McGoldrick 09:54 on 17 Mar 22

"With respect, I would not put much countenance in Adviser Ratings. I was sceptical when they started and I am even more sceptical now. Limited Licencing was never a viable proposition from the start. Imagine, I want to be a "limited licence doctor" ! Does not work! Accountants know ,or should know, that just like any profit center in a Firm, you need to have the right people and the right knowledge , Research and Administration . But more importantly, a Firm needs its own licence. There are countless compliance systems to assist in this task. Brett Walker Solicitor has a brilliant online compliance system which he has perfected over 20 years. If run well, like any division within a Firm, the Clients and the Firms can greatly benefit. Evidence of this FACT is everywhere in Chartered Firms across Australia including mine. Again with respect, Advisor Ratings is NOT the company I would be taking advice from in this area. It sprung from the "insurance agent" days and a poor attempt to "rate" agents turned advisors. I do not see that in engineering, medical specialists, doctors, lawyers( but they tend to tell you how good they are so take a grain of salt.) I rate this Article as poor. Yes, it just talks about limited licences. However, Accountants are perfectly placed to incorporate Financial Advice within a professional Firm "

Craig Offenhauser 04:28 on 17 Mar 22

"Even today, folk can go on-line and set up an SMSF. The fundamental contradiction inherent in the words "Self Managed Super Fund" and the regulatory approach remains. Back in the day, ease of establishment was intended to make it inexpensive and , inexpensively allow members to keep direct control of investments. If extensive reliance on professionals is now required, with the associated cost, then how is it self managed ? If you check the legal cases that have come before the courts.....property developers and others also played a role."

Jim Skinner 16:52 on 16 Mar 22

"Well said Kym but never a Royal Commission into bad advice provided by accountants ?? There are still thousands of SMSF's out there which are a total joke but accountants and auditors still feeding from the carcasses."

Rod Goodall 16:22 on 16 Mar 22

"Whilst ever superannuation is defined as a "product" under the Corporations Act, the problem remains. And, as there has been so much abuse of the ability to easily establish a SMSF and rollover APRA fund balances, I can't see this changing quickly. Accountants must share some responsibility for the parlous state the regulatory burden has become. If it can be said that some financial planners set-up SMSFs to get funds under management then it can be equally said that some accountants set-up SMSFs to guarantee annuity fee revenue. Self interest is everywhere and it is that nut that needs cracking before the regulatory burden is loosened. "

Kym Bailey 15:31 on 16 Mar 22