The IOOF acquisition of MLC Wealth was always going to send ripples through the adviser market.

Since the first whispers, Adviser Ratings data has shown an uplift in advisers moving to new licensees, with other AFSLs absorbing former practices and advisers from the MLC family.

The activity predictably escalated in the most recent quarter, as moves occurred from MLC to IOOF, but historical analysis shows the trend away from NAB/MLC has been years in the making.

In the past month, the MLC acquisition was finalised, with IOOF telling the Australian Securities Exchange (ASX) it resulted in $494bn in funds under management and the addition of 406 MLC advisers.

IOOF chief executive Renato Mota said the 406 advisers account for 84 per cent of MLC businesses in “IOOF’s target set”.

Where the losses and gains have been

With the formalisation of the arrangement, we expect to see further adviser movement in the coming quarter, especially as other licensees actively recruit from former IOOF and MLC-aligned businesses.

However, an analysis of the numbers from the past few years shows departures from formerly NAB-owned MLC groups began well before the acquisition.

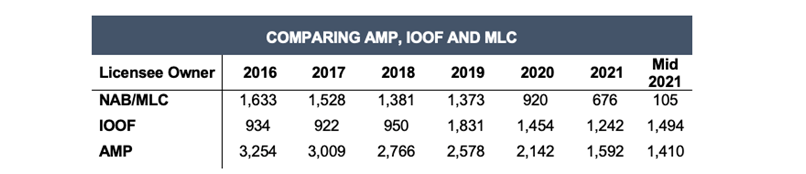

Having said that, the numbers pale in comparison to the losses from beleaguered AMP, as the table below shows. It’s important to note some of the exits are departures from the industry.

Source: AR Data

Under the NAB/MLC umbrella, our analysis shows five licensees collectively lost more than 700 advisers between the start of 2016 and 2020.

The affected licensees were Apogee (-86), Godfrey Pembroke (-79), GWM Adviser Services (-174), Meritum Financial Group (-54) and National Australia Bank (-320). Again, it’s a combination of industry departures and moves to other licensees.

Noticeably, NAB has the highest volume of losses. It was not part of the IOOF sale and now has 105 advisers remaining, compared to 655 at the start of 2016.

In the same 2016-2020 period, IOOF licensees gained 520 advisers, while AMP lost more than 1100.

From AMP, the biggest losses over the period were from AMP Financial Planning (-534) and Charter Financial Planning (-486).

IOOF gains

Since January this year, Adviser Ratings' analysis shows five IOOF-owned licensees have picked up just over 400 advisers. The largest gains were at Consultum Financial Advisers (+209) and RI Advice Group (+84), the latter of which mainly came from Bridges.

An additional 131 MLC advisers chose not to go to IOOF in the six-month period, our analysis shows.

Again, we anticipate shifting between licensees will escalate further in the next quarter and we will bring you that analysis in our quarterly Musical Chairs report.

Article by:

Comments2

"Hi Amanda, the table groups in all advisers that were licensed under the NAB/MLC umbrella (Apogee, GWM, Meritum etc.), but the 655 number refers to advisers that were under the "National Australia Bank" licensee."

Adviser Ratings 07:05 on 01 Jul 21

"Am i reading this info wrong. You have stated there were 655 Nab advisers at start of 2016. Your table shows 1633 for the year 2016. Thanks"

Amanda Mellor 16:55 on 30 Jun 21