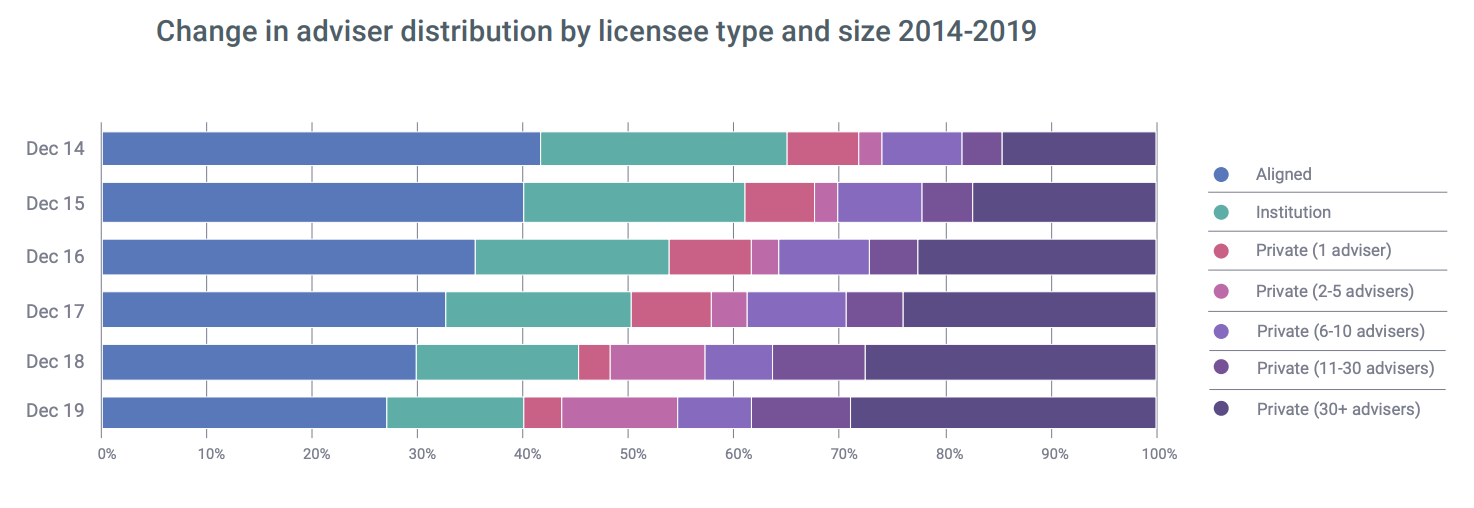

With 3 out of every 5 advisers now part of privately-owned licensees, it’s worth noting the changing make-up of this part of the licensee market. It is no longer appropriate to think of the privately-owned sector as one homogenous group, but rather a family of siblings - each with their own challenges and some going through their own existential crisis. Here we take a more detailed look at the different sections of the licensee market and examine the breakdown of the privately-owned licensee sector according to number of advisers. The last five years throw up some interesting figures about where we’ve come from and where we might be heading in terms of licensees in the future.

Our chart shows the breakdown of adviser numbers for institutional, aligned and privately-owned licensees. The private space is also broken down according to the size of the licensee by adviser numbers. We can see the number of self-licensed single adviser practices has dramatically decreased – going from over 1,500 to 856 in five years. The number of advisers covered by a two to five-person licensee has exploded from 481 to 2,578 in the same period. Growth of this group is being fuelled in two directions – by the single adviser practices rolling up and others departing the institutionally owned and aligned sectors. There has also been a dramatic increase in the two larger segments of advisers licensed by privately owned licensees.

The last five years has seen growth in the 11-30 person licensee segment from representing 831 advisers to 2,225 advisers, while the 30+ segment has more than doubled from 3,258 advisers to 6,847. The changing nature of the dominant licensees over the last five years represents a key transformation in the advice industry.

The last five years has seen growth in the 11-30 person licensee segment from representing 831 advisers to 2,225 advisers, while the 30+ segment has more than doubled from 3,258 advisers to 6,847. The changing nature of the dominant licensees over the last five years represents a key transformation in the advice industry.

It has a direct impact on at least two sections of the industry. Firstly, it has impacted advisers themselves, in particular how they access the adviser services they need to run their businesses. In the past these were provided and, in many cases, subsidised by licensees themselves, and through product cross-subsidisation. This is still the case, however, the regulatory-driven taint on vertical integration is compelling many advice businesses to reduce or eliminate dependency on product revenues. At the same time, licensees are raising fees to more accurately reflect true cost, contributing to this mad scramble of advisers between small and large licensees, looking for the right balance of support, independence, and profitability.

The second part of the industry directly affected by these licensee changes are the industry product providers who rely on advisers to distribute their product to Australian consumers.

The mass movement of advisers around the licensee world is creating dislocation in their own service and support models. They can no longer rely on their adviser client base to remain loyal as many advisers change product allegiances under new licensees that dictate different approved product lists and model portfolios.

Although many may assume the recent Royal Commission and the associated fallout has been the driving force of much industry flux, we can see from the trend in these licensee figures that large structural change has been steadily happening for at least the last half decade. FOFA was the initial catalyst, compounded by subsequent imposts represented by FASEA and LIF, among others. In short – traditional vertical integration, which saw product providers own and subsidise licensees and in turn advisers (who were expected if not required to favour in house products), has been replaced by fragmentation in the licensee market.

Regulatory change such as best interest duty (BID) and changes to commissions and remuneration has complemented and most likely hastened these developments. Many business models will not be able to continue in their current configurations. Some businesses, most prominently AMP, could be said to have been caught flat-footed. However, at the same time, the last few years has seen more pro-active companies establish alternative business models in the licensee space. Elements include building closer equity-linked partnerships between licensee and practice, focusing on more specialised advice areas and embracing integrated service models that combine advice with accounting and mortgage broking. It fair to say most are now re-thinking how they operationalise and resource their businesses.

In the coming weeks we’ll take a look at some emerging licensee business models, to see what advisers are looking for and can expect, should they join the thousands of their colleagues who have already changed licensee in the last 12 months.

This analysis and more is freely available in the Adviser Ratings Q4 2019 Musical Chairs report. To see it and other analysis we have available, visit the Adviser Ratings pro-site here

Article by:

Comments0