The average Australian adviser is fast becoming unrecognisable from just a few short years ago. Banks exiting wealth, changing adviser business models, and rapid renovation of client lists and service providers have morphed the adviser into a persona characterised by working for a privately-owned licensee environment, dealing with a shrinking client base, higher net worth clients, and demanding greater responsiveness from service providers.

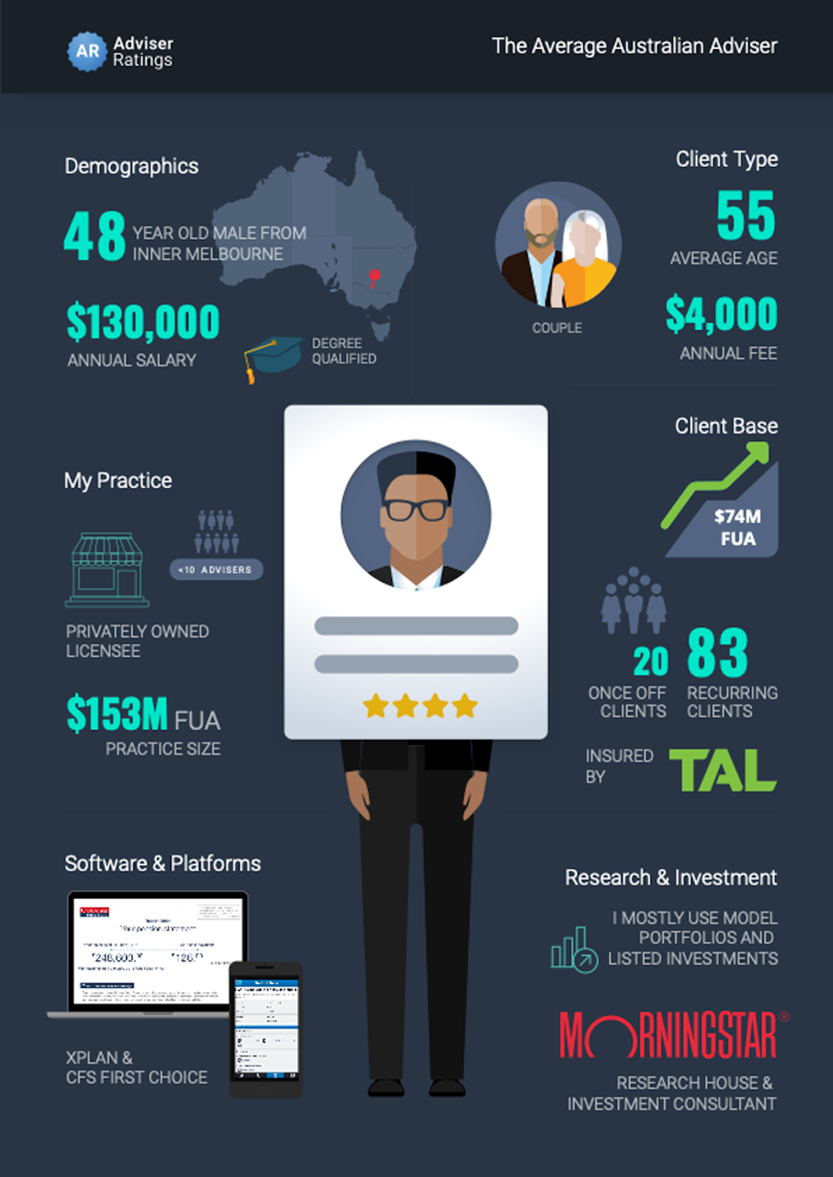

Culling of unprofitable clients and attrition by under-serviced or fee-for-no-service clients reduced recurring client numbers from 85 to 83, however, there was an uptick in the number of one-off clients. The winnowing of low-value clients on top of equity markets surging since this analysis was last undertaken has raised average FUA / client from $656,000 to $744,000.

Median fees paid have increased on that basis from $2,800 in 2019 to $3,256 in 2020. The average salary increased slightly in 2020 from $128,000 to $130,000, although most advisers worked far longer hours and those who owned practices are still struggling to keep their cost bases under control. There was significant interest in software solutions beyond the incumbents to help navigate legislative requirements.

Advisers are seeing changing demand patterns from clients, with a large uptick in one-off advice, particularly as it relates to budgeting and Superannuation. In 2020, leads through our platform saw more requests for help with shares, alternative assets, home loans, aged care and Super demonstrating both an ageing population in search of help but also the diversity of areas where advisers can assist consumers, particularly coinciding with the surge in retail interest in the stock market.

Article by:

Comments0