For almost a decade, ever since the Ripoll inquiry was handed down in 2009, the entire Australian financial sector, in particular the wealth industry and financial advisers, has been struggling to retain the trust of the public and regulators. With the spotlight from the Royal Commission in 2018 and the subsequent recommendations announced in early 2019, this erosion of trust has deepened.

There has been much media focus on the issue recently, with several reports outlining the risk the trust deficit poses directly to financial advisers with alternative actors like super funds ready to fill the gap created in the traditional advice industry. Industry participants are calling for advisers to embrace and promote initiatives such as the FASEA code of ethics directly to the public to show how the sector is responding to the much publicised criticisms and raise the standards of professional and ethical behaviour across the board.

Significant changes are being implemented to restore trust back into the sector so consumers can feel comfortable that advisers and the general banking and wealth sector are looking after their best interests. With a $2.9 trillion pool of superannuation funds and the 4th biggest pension market globally, it not only represents a significant opportunity for the financial advice industry and its participants but is also important for the economic security of the country and the retirement savings of the wider public.

Market To Increase

In the next decade, the Australian wealth market is expected to grow to $4.6 trillion and $9.5 trillion by 2035 (Deloitte Economics). This is partly driven by the structural foundations of the Superannuation Guarantee and its increase to 12% by 2025.

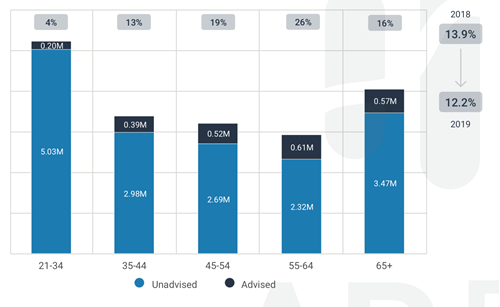

With the Royal Commission and a rationalisation of client bases, the number of Australians 21 and over receiving advice actually fell by more than 10% in the last 12 months. 12.2% of Australians were advised in 2019 (or 2.29M), down from 13.9% in 2018. This data is supported by consumer research commissioned by ASIC in 2019, which found 12% of consumers saw a financial adviser in the preceding 12 months. Our chart shows the number of these “Advised Australians” by age group at the end of 2019.

With the rationalisation of client bases and a higher cost to service, the natural focus by advisers and product manufacturers remains more geared towards High Net Worth (HNW) and Ultra High Net Worth (UHNW) individuals. As investor trust in establishment financial institutions has decreased, the associated fragmentation of the advice industry away from the big institutions has meant that financial advisers have moved to boutique business models to help meet the shifting demand. This shift also is places pressure on traditional models that fund managers to the industry have relied upon to distribute their products.

74% of “advised Australians” are aged 45 and over – this has a large bearing on the fact that of the $2.9 trillion pension fund market, $1.54 trillion or 53% is currently estimated to be under some sort of professional adviser, comprising any of financial adviser, accountant, stockbroker or lawyer. That means nearly half of this growing pool is unadvised. As the population ages and the super pool increases there will be ample opportunity for advisers to capitalise on this growth – but only for those who can demonstrate their adherence to the best interests of their client and by doing so win back the trust of the community.

Article by:

Comments2

"I for one, welcome our new insect overlords..."

Kent Brockman 12:31 on 29 Jan 20

"Time to get on board. The changes aren't going anywhere and are here to stay. Embracing it is the only option."

Aiden 12:19 on 29 Jan 20