The "Active vs. Passive" argument, depending on which side of the debate one is on, allows you to prove - or at least argue the point - that active management is better than passive in spite of the higher fees involved, or conversely, that passive or index investing is not only as good - or better - than active, but cheaper as well.

As such, it might be safely assumed that FundMonitors.com leans towards the active side of the debate, given there are 650 actively managed funds for comparison on FundMonitors.com. However, as indicated above, it's never quite that simple.

Firstly, there's the data: It's worth remembering the old adage "lies, damned lies, and statistics" simply because it is easy to find plenty of examples to prove either side of the argument. Equally, it's difficult not to win the argument that fees on passive funds are lower than their active cousins.

Statistics in this case generally revolve around either the average return of a certain type of fund, or the percentage which out, or underperform either the index, passively managed funds. And while quoting old adages, it's also worth remembering another one, namely "that when your feet are in the freezer, and your head is in the oven, overall your temperature is average."

Averages, although we frequently use or calculate them, can be useful (for instance when wanting to prove a point in an argument) or misleading. Maybe misleading is a little too strong, so let's just say they can be deceptive, or in the wrong hands can cloud the facts.

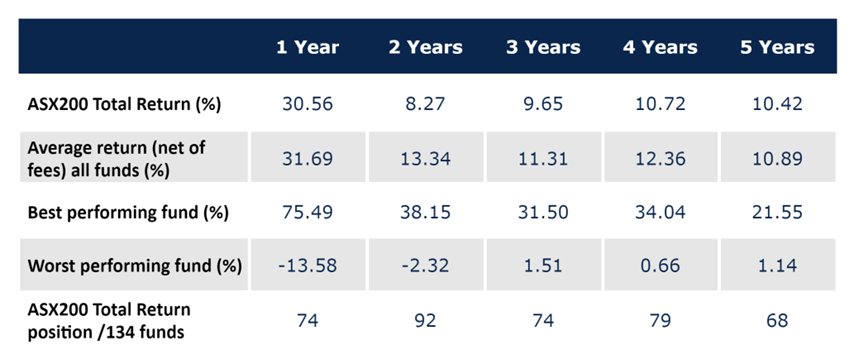

For example, take the 134 actively managed funds listed on Fundmonitors.com which invest in Australian equities, and which have a five year track record to the end of September 2021: Depending on which side of the argument you're on, you can use the table below to prove your point.

Either that (assuming an index or passive ETF's returns are broadly in line with the ASX200 Total Return) you can get better performance, and with lower fees than many actively managed funds.

Or, if you’re a believer in active management, you can outperform the passive funds by a factor of 2-3 times if you're in the best fund - which of course doesn't stay the same over each time period. However, statistically approximately 50% of the active funds outperform the index or passive funds. Alternatively, that means 50% of the actively managed funds underperform the index. Take your pick!

Our point is this: Investing in passive funds is a low cost, simple way to gain exposure to the average return of the 200 companies which make up the ASX200 index. Importantly, it requires limited knowledge or skill as such, and therefore may be suitable for small or early-stage investors, or to provide the core component of an equity portfolio.

However, it’s only going to provide average performance.

Investing in active funds requires information, and the knowledge of a suitably qualified and experienced adviser. It also requires time, and ongoing monitoring and attention. Above all, it requires an understanding of the investor’s risk and return profile when selecting the correct funds to create an appropriately diversified portfolio.

Taking the time, and doing the research, can make a world of difference.

Australian Fund Monitors was established in 2006 and provides trusted, target research on over 650 managed funds available in Australia.

Article by:

Comments1

"Some of those numbers seem at odds with S&P's SPIVA report, so i'd be interested to know if any of the 134 actively managed funds included by Fundmonitors are internally geared share funds? Those 1 - 5 year returns look like those from Australian Geared Share Funds and you would need to remove the gearing ratio to make a fairer determination of the managers stock picking expertise. As you wrote "lies, damned lies, and statistics". "

john k 15:23 on 03 Nov 21