There is a large segment of the population who baulk at the cost of getting financial advice. What do advisers do when confronted with “less lucrative” clients and how can the industry solve the “scaled advice” problem - that would see people introduced to financial advice at a more attractive price point and encourage and enable more people to access professional financial advice?

An interesting statistic uncovered by Adviser Ratings' recent adviser survey, was the number of advisers who have minimum income and investment levels (that new clients must achieve, prior to be taken on by the adviser).

Adviser Ratings has spoken to numerous advisers about the types of clients they take on, and while the majority of advisers will offer their services to anyone willing to pay for them, several advisers bemoan that their valuable time is taken up by what can be described as “tyre kickers” – those people who are not familiar with advice, not aware of its cost and who are just sniffing the breeze as to whether it is something they might actually engage with.

Minimum thresholds can reduce the number of “tyre kickers”, although the reasons advisers have a minimum income or investment requirement, may be due to the fact that their specialisation as an adviser is dealing with particular “high income” scenarios, tax law, high-risk investments or investment vehicles designed for large amounts of money.

However, we should not shy away from the obvious fact that advisers get paid more by servicing wealthier people. People with higher incomes will often require a more diverse range of services. Advisers hope to cover the cost of delivering a basic Statement of Advice (SOA). The more complex this document, and the more complex the financial requirements being asked for by the client (as well as other additions like more comprehensive insurance cover for those who can afford it) make a client more lucrative for an adviser.

Fig. 1 Minimum Income Threshold of financial advisers in Australia, that their new clients must meet, to access their advice.

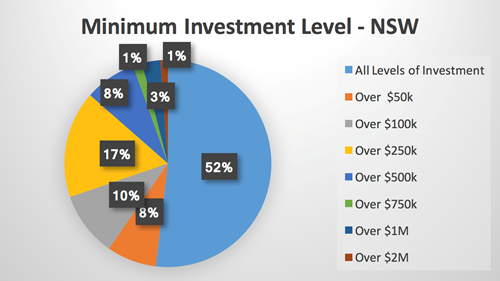

Fig. 2 Minimum Investment Threshold of NSW financial advisers, that their new clients must meet, to access their advice.

One of the key challenges (in getting more people to seek the benefits that professional advice can afford them) is the initial financial entry barrier. People don’t miss what they haven’t got and if they’re faced with an initial cost of over $1000 to receive advice, many will baulk at the prospect. This begs the question: how can the industry best serve the large cohort of people who would benefit from financial advice, but who are put off by the price advisers are forced to charge, because of the requirements of running their business?

Currently, the oft-quoted figure is that around 20% of Australians seek professional financial advice. There are those in the industry who would challenge whether this figure is one that could or indeed should, increase. They say simply that professional advice is not for everyone – some people just don’t earn enough to benefit from financial advice.

We would suggest that this kind of thinking is inaccurate. Even if it were “true” (and we believe it isn’t), it would seem that the justification for the statement precludes any sort of innovation or development in or around the industry. A person thinking horses and carts do the job for transporting goods is never going to come up with the idea for a railroad.

The "holy grail" that would solve the entry-barrier problem is a comprehensive “scaled advice” model. Ideally, people on lower incomes could enter the industry and receive “basic” or “limited” advice, that would still be beneficial to them and pay a minimal amount (far less than the many hundreds if not thousands, of dollars that are usually required to enter the quality advice market).

The problem advisers face in delivering this model is two-fold. First, quality advice starts with the adviser finding out the goals and objectives of their client, along with their current financial situation. They can then use their talent and experience to come up with tailored solutions. Even though people may be in the same “income bracket”, their goals and objectives may be vastly different and as such, need different solutions. This process takes time.

Second, if servicing “less lucrative” clients such as these, an adviser would need to service more to maintain the same revenue that fewer, more lucrative clients could generate. How to “scale-up” these numbers efficiently and effectively is the question.

It is this scaling problem that has left a gap in the market that has been looking for a solution. It’s not that advisers are unwilling to service this particular cohort of client, but servicing enough of these, with limitations of time and geography makes it a more precarious proposition.

In recent times, the idea of “auto-solutions” and “robo-advice” have taken hold. There are currently over 30 businesses that fall under the umbrella of “robo-advice solutions”. This number is growing, and the appetite in the business community for backing these solutions shows no signs of abatement.

These tech solutions can solve the problem of scale – geography is not an issue (as they are accessed on-line) and time is only limited by the willingness of the prospect to engage. As these solutions increase their sophistication, in terms of both the user experience (UX) that they provide and the solutions that they offer, it is hard to see how they will not become a fixture in the advice landscape in Australia.

We believe, that rather than being a threat to human advisers, robo-advice can diversify the market and introduce more people to financial advice.

By bringing down the entry-level for advice, and making advice accessible to more people, "robo-advice solutions" can help funnel a greater number of people towards human advisers, further along in their financial advice journeys, when their financial requirements gain greater complexity and require the type of unique, comprehensive, and reassuring advice and solutions, that only a person can provide. Investigating and or partnering with these tech solutions may result in a productive and beneficial pipe-line of potential clients for those advisers willing to engage with this channel.

by Rodney Lester, Adviser Ratings

Article by:

Comments4

"Withheld, that assumes that cashflow management and budgeting isn't included in the advice. This is where the biggest gains can be achieved for the "mass market". Realistically the government doesn't want these people to see financial planners for some reason or they incorrectly believe the current legislation and advice requirements are efficient (I think it is the second with the current lot and the first with the ALP). Net position I have a business to run and will do so and whilst I don't have a set minimum of assets or income I do have a set minimum fee and often tell people I would love to assist them but can't do so because of the fee involved which largely comes back to the unwieldy process that needs to be followed to provide advice in a compliant manner. Lets get honest anything more than a 3 page SOA is not of benefit to anyone as it just makes it harder to hide something if you are so inclined."

Scott 12:33 on 03 Mar 18

"That sounds pretty reasonable Ray. What do you think the biggest obstacle would be to this - changing the legislation around SOA's? It would be good to trial such an approach. Simple financial tips around money and strategy would definitely help some people - but so much can be found on the internet as well."

Brent M 09:34 on 01 Mar 18

"I don't believe it's possible to provide GOOD tailored advice (no matter how simple) for a few hundred dollars. Throw in a genuine fact finding session and goals & objectives discussion, analysis of existing situation, consider alternatives and proposal of advice a written SOA document, the cost alone is in the hundreds if not low thousand. In my opinion the only way to give low cost advice to the public would be to have an SOA exemption for certain circumstances (i.e. no product advice but strategy only), for advisers who have met a certain criteria (experience, education, exam). Think of it like a GP for financial advice. Keep all file notes and workings on file, but no requirement to document via an SOA. The expectation is that the financial advice GP has enough skill, experience and diligence to give verbal advice or written advice in a short e-mail or letter. They keep evidence of analysis and alternatives on file, and point the client in the right direction. If detailed full personal advice is required, that is the advice given to them. In my view that's a good way to get it done, charge the client a smaller amount for the consultation and work, and they are left better off after getting your advice. "

Ray Ong 16:21 on 28 Feb 18

"I'm one of those sceptical that everyone needs financial advice. The cost is prohibitive for some people but that's because the gains from particular advice rise are multiplied according to the amount of money we're talking about. If advice can save you 10%, if you have $100K it will save you $10K - easily worth the price of advice - put if you only have $1000 to invest, it will save you $100 - less than what the advice will cost. Some people just aren't in the market."

Withheld 15:30 on 28 Feb 18