We can sometimes forget that we are living in extraordinarily advanced times when it comes to what technology offers us. Are advances in technology always progress or sometimes do we get too much of a good thing? We take the example of Google and online searches and ask whether we are making the most of the opportunities we have.

Searching online is more normal than ever. It is so second nature that we don't even consider that more often than not, it is the pathway we take to get to an information source. When was the last time you wrote down a URL, character by character, and then typed it into your navigation bar in your browser? 1999 perhaps?

It’s no secret that online research has become embedded behaviour for the majority of people in today’s society. In years past we were encouraged to save our legs and let our “fingers do the walking” by flipping through the ‘yellow pages’*. With the arrival of the internet search our fingers have become rocket powered information finders that have made the yellow pages and many other information services redundant, changing the land scape of how we find things forever. Nowadays, if you want to find something out – search online. Google is the market leader in searching online, indeed it is is now so ubiquitous it has morphed from a noun (a thing) to a verb (a doing word). Want to know something? – Google it!

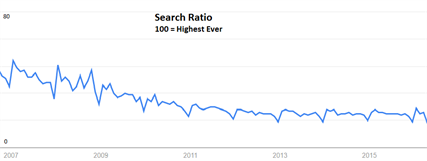

With this in mind we had a little look at some search behaviour (available at Google Trends) to see what was happening in our neck of the woods - Financial Advice. The following charts indicate the number of searches for the listed term in comparison to all other searches on Google. A peak of 100 indicates the highest ratio for that term against all other searches (not necessarily more searches – but a greater proportion of searches for that term compared to all searches on Google).

Taking 2007 as our starting point, worldwide we can see that see that searching for “Financial Advice” has decreased in proportion to total number of searches on Google.

Source: Google

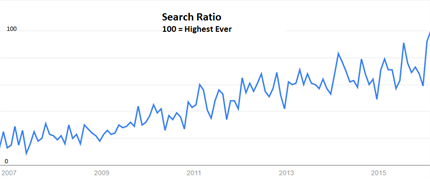

However, searching for “financial adviser reviews” has been steadily increasing its ratio against overall searches in the last decade. It would be fair to assume that this means people are becoming more sophisticated in their searches as well as becoming more familiar with review sites for financial advisers and as a result, using them increasingly to help make decisions about where to get financial advice. And now every individual or business is expected to be peer or customer reviewed - everyone is now Googling you, whether you like it or not.

Search term: Financial Adviser Reviews

Source: Google

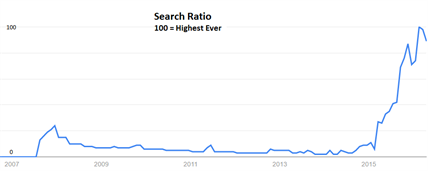

Another interesting trend can be seen regarding “Robo advice”. Following a brief spike in its search ratio around 2008 (possibly associated with interest in "robo-lending" practices and the GFC), it had basically flat lined till 2015, when it suddenly spiked massively – in line with the launch of several Robo-advice platforms and associated media attention.

Search term: Robo Advice

Source: Google

Again, these charts don’t give us absolute numbers of searches - what they do tell us is effectively how much the given term is searched compared to all other searches and hence when there is interest in a particular topic or event.

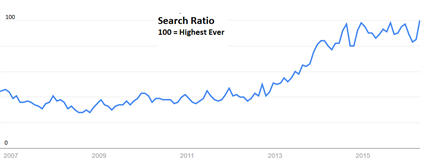

The rise of internet searches has undoubtedly given us the ability to get enormous amounts of information about pretty much whatever we want and to save massive amounts of time in doing so. As a society, we could be much more productive as a result – or we could use that saved time watching “Cat videos” on the internet, which as the following graph shows – search proportions have never been higher!

Search term: Cat Videos

Source: Google

Technology arguably affords us more opportunity and possibility than at any other time in history but it can be a double edged sword if not used with expertise. Just because it could be used effectively doesn't mean it will be. As the old adage says, you can lead a horse to water, but you can't make it drink!

Are you making the most of what technology has to offer you?

* If you don’t know what the Yellow Pages are, ask someone over 30.

Article by:

Comments6

"Thanks for the comment Digital Marketer - it was mentioned in the article the figures are "worldwide" - not actually US. Australia has similar trends for the topics they decide they have enough data to graph (eg Robo Advice and Financial advice) but it doesn't much effect our point - that technology can sometimes be a double edged sword! (Also in the US they spell it Advisor but we use Adviser so this may effect results!!)"

Adviser Ratings 14:33 on 07 Apr 16

"Trends are definitely in the right direction, but it is important to note that the figures are for the US only. Australia's search numbers in this space are so small, Google doesn't even bother to map it. See for yourself - scroll down to the bottom for regions. https://www.google.com.au/trends/explore#q=financial%20advisor%20reviews"

Digital Marketer 11:51 on 07 Apr 16

"Alan - I think you'll find that consumer expectations and the expectations of those they have a relationship with are changing significantly. In the last 6 weeks, we have had more than a dozen advisers who have "been told" to get onto Adviser Ratings by their very own clients. Family and friends referrals no longer just cut the mustard and was very evident in our research - consumers need more validation than ever before. Also, it's not the online referral you should be concerned about, it's the fact that any referral or existing client is now researching online more than ever - in fact the retiree market or baby boomer market sitting on billions of cash are now more inclined to make a decision based on their research online."

Adviser Ratings 16:19 on 06 Apr 16

"If the internet population in Australia is 19.6M, and Google's is the top brand in terms of audience online (18.1M unique users), with a 92.4% active reach into the Australian internet population, then you could say that your online presence (and in particular search-ability) is critical to your success - unless you have an existing client list whose referral rate is consistent enough to keep the business ticking. "

Sharon 16:04 on 06 Apr 16

"I think you'll find that customer habit are changing Alan. In the AFR just today there are plenty of stories on how banking and wealth management are going to be disrupted in the coming years. Robo Advisers as mentioned in this email are on the way and only the beginning."

Craig 14:27 on 06 Apr 16

"In my experience the value of an internet presence for Advisers is limited. You may get the occasional query from a random but for me and I suspect most advice businesses referrals are the main source of new clients. You need a website to help them find your phone number but that's about it."

Alan W 13:52 on 06 Apr 16