Recent analysis of adviser’s movements for Quarter 2, illustrates a strengthening of the trend towards the preference for privately owned licensees amongst advisers. This week we can take a look specifically at the 657 advisers who have switched to a new licensee in Q2.

For the purposes of our analysis, the advisers included here have moved from one licensee to another within 6 months – and have completed this transition in Q2.

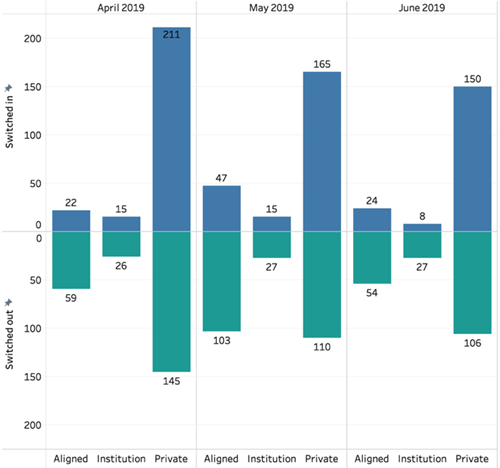

Our chart indicates licensee distribution of switching advisers (transition period < 6 months), and shows that privately-owned licensees remain the overwhelming preference of switching advisers. Looking at the chart, the bottom green section represents advisers switching out of licensees, while the top blue section shows the type of licensee that is the destination for the adviser.

Our chart indicates licensee distribution of switching advisers (transition period < 6 months), and shows that privately-owned licensees remain the overwhelming preference of switching advisers. Looking at the chart, the bottom green section represents advisers switching out of licensees, while the top blue section shows the type of licensee that is the destination for the adviser.

We can see that more advisers are switching into privately-owned licensees than are switching out, and conversely, more advisers are switching out of institutionally owned and aligned licensee, than are switching in.

In fact, of the 657 advisers who switched licensees in Q2, 526 of them (80%) chose a privately-owned licensee. We mentioned last week that our analysis for the same movements in Q1 and Q2 showed that the trend towards privates as a ratio has increased from 2:1 in Q1 to 4:1 in Q2, and that privately held licensees are now the overwhelmingly dominant destination for advisers when considered as a whole.

However, digging deeper into the data, we have also identified a preference for larger licensees among moving advisers. The numbers also show that 300 (42%) of all advisers that have transitioned to a new licensee in Q2 have migrated to a private licensee with 30 or more advisers. This preference for larger sized licensees echoes the numbers we identified for returning advisers (those advisers who have been unlicensed for more than 6 months, who have returned to the industry) – who are also preferring to migrate to larger licensees. In fact, over 60% of these returning advisers choose licensees with more than 50 advisers. It shows that this preference for larger sized licensees may apply to switching advisers as well, albeit to a lesser extent.

It will be interesting to see if this movement towards larger sized licensees will continue. We’re currently doing more research with key participants in the industry to help ascertain the motives behind these movements.

Coming up, we’ll look at what some advisers we’ve spoken to have said about the reasons for their switch of licensees. We’ll also hear from some service providers about their experience with advisers who have changed licensee, and some of the key observations they have shared with us regarding the transition process.

Article by:

Comments2

"Are the stats skewed by the Westpac move of advisers to Viridian during the quarter? Potentially a big one-off move doesn't make a trend."

Casual Observer 16:32 on 24 Jul 19

"30+ advisers is not a big licensee. Licensee margins are tiny - they will have to be at least 100 strong to offer decent options for advisers."

Fragmentation back to consolidation 15:42 on 24 Jul 19