A recent report prepared by Per Capita (an independent progressive think tank) in conjunction with the Australian Services Union (ASU), lead to headlines about how our superannuation system is selling women short and claims that super is biased against women. We take a look at the issue – and we’ll try to be dispassionate and not throw any petrol on the gender war fire...

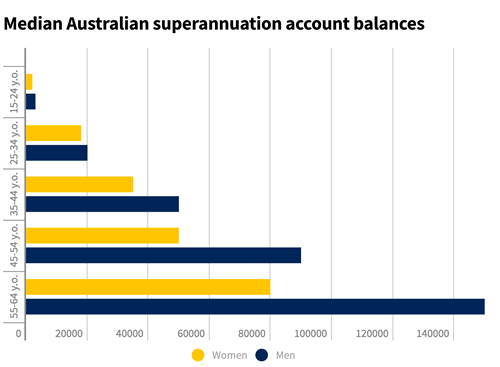

The report surveyed over 4000 workers and found that on average Women’s superannuation balances at retirement are 47% lower than men’s. It analyses the reasons for this discrepancy and presents a list of recommendations to address the problems. The divergence in super balances mean that women are far more likely to experience poverty in retirement in their old age. The report concludes that superannuation is failing women.

Source: ABS Series 6523.0, Household Income and Wealth, Australia, 2013–14

Source: ABS Series 6523.0, Household Income and Wealth, Australia, 2013–14

Reasons for The Gap in Super Balances Between Men and Women

Type of work

Superannuation is predicated on the fact that every worker is an employee. But the rise of non-standard work means that almost a quarter of female workers (23%) aren’t in a traditional permanent employment arrangement. Instead, they are casuals, contractors, subcontractors, labour-hire workers, self-employed or on zero hours contracts. In all of these arrangements, superannuation is less likely to be paid. Women are overrepresented in the industries where these forms of precarious work are most common, with the result that the growth of these forms of work hits women’s retirement incomes hardest.

The most recent data from the Australian Bureau of Statistics (ABS) indicates that women’s pay rates for equivalent work are 10% lower than men’s, and women’s total pay across the workforce (adjusted for fewer hours worked) is 31% lower

Time out of the workforce

Amongst the survey respondents, over 55% of women had experienced periods out of the workforce in order to care for family members. By contrast, less than 12% of men had taken time off for similar reasons.

Not only do far more women take periods out of work to care, but they are away from the workforce for far longer when they do. Two-thirds of men who take time out are away from work for less than one year, but only one-fifth of women take so little time away. Almost 45% of men are away from work for fewer than three months. By contrast, over a quarter of women are out of the workforce for more than six years. This has a dramatic effect on these women’s capacity to contribute to their superannuation accounts.

The gender pay gap

Because most people’s superannuation balances are almost entirely determined by their compulsory contributions based on a percentage of their salary, the superannuation gap is, largely, the result of the gender pay gap.

The gender pay gap takes multiple forms: women are paid less than men for doing the same work; women are less likely to be in high level (and therefore highly paid) positions than men in many industries and occupations; and women are more likely to work part-time than men.

Many more women are part-time workers, including both casual and permanent part-time than men and, as discussed above, more women take time out from working and take longer breaks from employment than men. These factors combine with lower rates of pay and the overrepresentation of women in lower paying jobs to explain a large proportion of the superannuation gender gap.

Poor understanding of the Superannuation System

The report found no evidence that women’s understanding of our super system is worse than men’s: the system changes so often that it is impossible for any lay person to keep up with all the details. However, women did attest that they lack basic understanding of the retirement income system and are sorely in need of education and advice. The women in the survey said that they realise they can’t rely on others, but they don’t know where to go for assistance and advice. As a result, there is an overwhelming demand for better financial literacy education for women, at all stages of the lifecycle.

Is Super biased against women?

The headline – “Super is biased against women” is certain to attract a lot of attention in our societies current milieu which highlights rights issues like the gender pay gap.

But as Noel Whittakar pointed out in his newspaper column:

“superannuation is nothing more than a structure that lets people build assets in a low-tax environment. Obviously, people in low-paid jobs or irregular jobs will not end up with as much superannuation as people in higher paid jobs, who contribute more.”

It's that simple really.

The compulsory superannuation system was predicated on making an ageing population self-secure in retirement and ease the reliance on the government paid pension. But the system in failing low-income workers. Changes in the way we work (eg. increasing casualisation and non-standard work) account for some of this systemic failure. There are now more low income earners and the current structure of super not doing what it was designed to do for these people. It also happens that in our society, women make up a higher proportion of low income workers than men for the reasons discussed above.

Although the structure of the superannuation system itself has not kept pace with changes in our work structures, the other problem rests with the undeniable fact that women get paid less than men (the gender pay gap).

So it is the case that our Super System is biased against women?

Well yes, but that is a function of (as far as remuneration goes) – our society being biased against women. You might as well ask is being paid for work biased against women – the facts bare it out, the answer is yes.

Many do not want to admit it, but this is a result of our society valuing (in monetary terms – for reasons that are manifold) women’s contributions less than men’s. Taking time off work to care for family members is a role dis-proportionally filled by women. This role is actually of paramount importance in anyones life – but society dictates it receives little monetary recompense.

If we look at the bigger picture that sees compulsory superannuation as just one part of our societies “remuneration mix” - from the start, it did not take into account unpaid working roles that are dominated by women. These types of roles, unfortunately fall into the “intangible” category, and aren’t priced appropriately by our remuneration market. In societal terms, this is a monumental market failure.

To fix this, we need to recognise two things and respond appropriately:

- The gender pay gap exists and needs to be closed.

- Unpaid work that is beneficial to families (and society as a whole) needs to be further recognised by our social systems and added to current, or embedded into any future remuneration and market structures (such as for example – compulsory superannuation)

Article by:

Comments10

"Keith, Richard, Peter and others - the way I read this article is that it is saying the super system was designed a particular way (preferencing major breadwinners for example). No one is disputing the basic facts that if you put more in, you get more out. How about framing it this way. Super was not designed to benefit low income earners - in effect, it's structure is biased against low income earners. The majority of low income earners happen to be women. 1. The Super system is biased against low income earners 2. More women are low income earners than men 3. ipso facto - The super system is biased against women If you haven't got a problem saying the super system is biased against low income earners, then you shouldn't have a problem saying it's biased against women. Look at the facts and don't just on the gender argument - it is just stating a fact and it obviously get people interested. Maybe for the wrong reasons!"

A Man 16:09 on 17 Aug 17

"I'm a stay-at-home Dad looking after primary school aged kids while my wife works earning good money. Our house is also in her name. If we were to separate, the house and her larger super and savings account balances become joint assets to be divided. I might then have to go back to work and would become gradually worse off if earning less and spending capital rather than saving it. It would be stupid to say that the car industry is biased because the major bread winner might drive a more expensive car. It would be idiotic to claim that bank accounts are biased against the minor bread winner because they have lower balances. Bank accounts, cars, super accounts and the kitchen fridge are inanimate objects - they don't give a stuff! The idea that the superannuation system is biased against women is nonsense. Of course, if you put in less, you will have less. That is true for lower paid men and women. Many men would love to be in my position to be the 'homemaker' but they can't afford to stop working. The expectation that men will go to work and that women will stay home to look after the kids is arguably biased against men if you value family life above money. Victims unite against the tyranny of something-or-other but remember - Equality of opportunity is the best for which we can strive but this will never result in equality of outcomes. It isn't always the Government's fault! "

Peter Dev 12:34 on 08 Aug 17

"To Richard Moore. The acticle states plainly that research indicates women get paid on average 10% less than men. They are ABS facts! That your anecdotal evidence doesn't match means nothing. We have to recognise that FACTS as they are and then redress the situation. Your thinking is part of the problem. Median is average, of course it doesn't mean EVERY woman in retirement. "

Robert 15:11 on 05 Aug 17

"From the comments above, it seems that there is an assumption that a woman's wealth will be somehow tied to a man's at all stages in life (eg. As dependent child, marriage, divorce, death).. and that some kind of wealth equalisation occurs during these processes. I don't know if this assumption has really been tested properly. Nor that the assumption is going to hold true in future. It seems to rely on wealth generated in the 'family unit' as an economic unit rather than the individual. This is a bit concerning given that our culture seems to be becoming more and more individualistic. I don't think I would be advising women to have this much faith in the family unit system when thinking about their financial future. "

Clare 12:01 on 05 Aug 17

"I can't help being sceptical of paid for research sponsored by a union. What is the union's motivation? Surely they wouldn't waste their members' money for no reason. Sorry, that was a twitch, not a wink. I would like to see more research with no agenda. I am dubious that can happen. What is the situation when there is a divorce these days? Do women tend to get the family home and men the super? Who is most likely to benefit on the death of a partner, bearing in mind that on average women marry older men? When there is a death what happens to the deceased's superannuation - does it tend to exit the superannuation system and the assets be held personally? Single women with children will generally struggle to accumulate wealth in any form. I do not believe the superannuation system was designed to redress that situation. There is a safety net in the form of the welfare system. I see no advantage in setting up a second safety net by way of superannuation. As a result I find it difficult to address this issue without coming over as biased myself."

Graeme Bennett 18:14 on 04 Aug 17

"Are we not really talking about single women in retirement? I don't have a single "client couple" who live separate financial lives in retirement, just as most share financial resources in their working lives. I also find almost every woman I deal with doing equal work to a man gets the same pay - due to awards, enterprise agreements etc. blanket statements need to be broken down a little to see how many are really affected - somewhat less than every woman in retirement!"

Richard Moore 17:20 on 04 Aug 17

"Are we not really talking about single women in retirement? I don't have a single "client couple" who live separate financial lives in retirement, just as most share financial resources in their working lives. I also find almost every woman I deal with doing equal work to a man gets the same pay - due to awards, enterprise agreements etc. blanket statements need to be broken down a little to see how many are really affected - somewhat less than every woman in retirement!"

Richard Moore 17:20 on 04 Aug 17

"Superannuation is not biased against women; Noel Whittakar got it right. The structure of society and biology has resulted in women not being able to utilise the investment structure of superannuation as effectively as their male counterparts. However, I detect a reluctant and clumsy unwitting redressing of the situation with women becoming more attuned to the need for superannuation plus family law court splitting of super and other assets in the increasing incidence of marriage and relationship break-ups. As much as those in the financial planning industry bemoaned the introduction of low contribution caps and maximum retirement savings account values, these two factors along with the abolition of the work test for people over 65 will lead to changes in the current male/female superannuation savings ratio. It is an inescapable fact that biologically the majority of caring duties of parenthood will fall on upon women. This is being influenced by the availability of paternity leave and government subsidised access to child care facilities. From a personal perspective, I also notice an increasing incidence of fathers becoming more involved in parenting activities, some reducing their working week to enable their partners a break from child minding and take on a part time job. I suggest that some tweaking of the spouse contribution tax concession is a non gender issue which could assist in redressing the current imbalance. However, it is an issue that needs better than accidental and incidental correction and I suggest also that our legislation makers should plan a pathway to correcting the problem. "

Keith Lello 16:09 on 04 Aug 17

"It's true though. It doesn't have to be framed as a gender thing though. If we said that about 50% of the population were disadvantaged by a structure set up by society, we'd change to accomodate it"

Sam 15:14 on 04 Aug 17

"Plenty of petrol thrown on that gender fire now..."

Mal 15:11 on 04 Aug 17