To survive long-term and to service the growing demand from consumers, the advice industry needs to stop this ongoing talent drain and build increased capacity. With the current ratio of leavers to joiners typically 100:1, the disparity is stark and should be raising alarm bells with government and regulators. Certainly, the industry itself needs no reminder.

The capacity building may come from: changing regulation including relaxing rules for accountants and other specialists; encouraging job changers from other industries; drawing from the talented pool of paraplanners and associates working behind the scenes; and growing the supply of talent from tertiary institutions. This special feature looks at what is happening with financial planning students at universities and the challenges confronting them as they on-board to a financial planning career.

The Student Pipeline

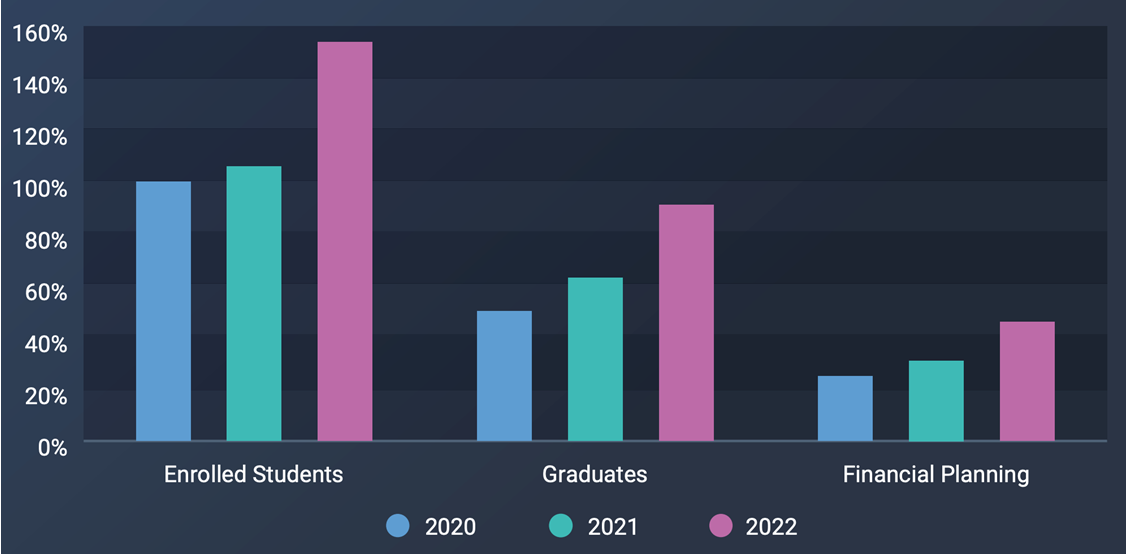

We understand from industry reports that there are approximately 900 students enrolled in tertiary financial planning courses nationally. These include students at all stages of a traditional three-year undergraduate degree. Adviser Ratings conducted a survey in early August of academics from 24 universities offering financial planning courses. The following results are from the first nine respondents representing institutions in every state except Western Australia. Importantly, they do not include responses from two institutions that dominate student numbers, namely Deakin and Griffiths. This survey also excludes Kaplan that focuses almost exclusively on existing advisers. From our first Chart, it is firstly encouraging to see substantial increases of up to 50% in the number of students anticipated to enrol, graduate and then enter the financial planning industry, although admittedly these are off a low base given the respondents’ relatively small market share.

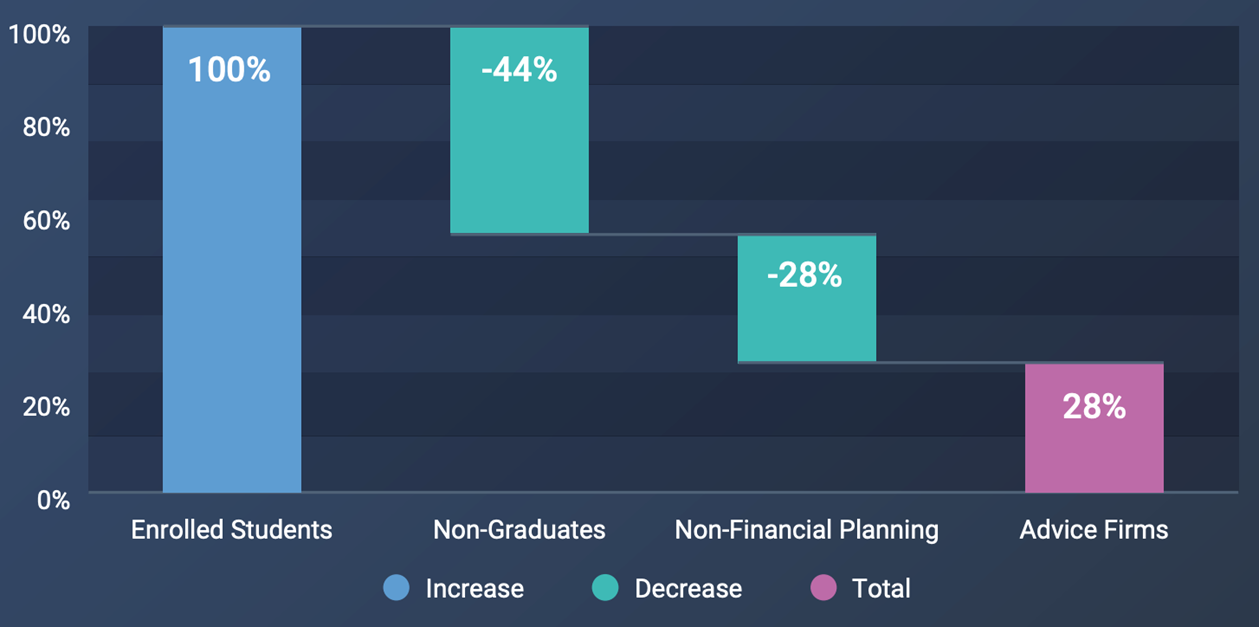

The following results are from the first nine respondents representing institutions in every state except Western Australia. Importantly, they do not include responses from two institutions that dominate student numbers, namely Deakin and Griffiths. This survey also excludes Kaplan that focuses almost exclusively on existing advisers. From our first Chart, it is firstly encouraging to see substantial increases of up to 50% in the number of students anticipated to enrol, graduate and then enter the financial planning industry, although admittedly these are off a low base given the respondents’ relatively small market share.  However, from our second chart, what is disconcerting is the high drop-off rate of students actually making it into their chosen profession, with only 28% of enrolled students eventually working for a financial planning firm. Of further concern is the 44% drop-out rate of students not completing the degree

However, from our second chart, what is disconcerting is the high drop-off rate of students actually making it into their chosen profession, with only 28% of enrolled students eventually working for a financial planning firm. Of further concern is the 44% drop-out rate of students not completing the degree

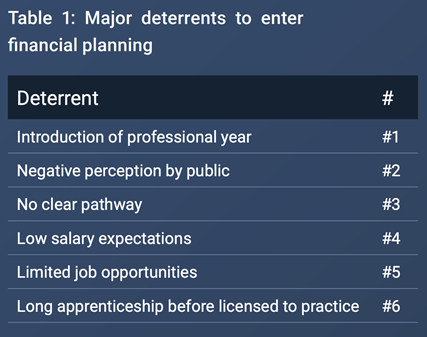

Table 1 lists the key deterrents for students as perceived by their academic leaders, with the greatest concern being the introduction by FASEA of the professional year. The second greatest concern, being negative perception by the public, is likely reflective of the terrible press the industry has received, particularly from the Royal Commission. While the FASEA changes around onboarding new advisers are cast in stone, arguably the industry itself has not done itself any favours in promoting the benefits of advice to the general public in order to change perceptions. Nor has the industry done a great job marketing into the universities to promote interest and win more students across from other courses. As an example, there are approximately 100,000 accounting students enrolled nationally that represent a huge pool of talent that should be targeted for conversion.

The second greatest concern, being negative perception by the public, is likely reflective of the terrible press the industry has received, particularly from the Royal Commission. While the FASEA changes around onboarding new advisers are cast in stone, arguably the industry itself has not done itself any favours in promoting the benefits of advice to the general public in order to change perceptions. Nor has the industry done a great job marketing into the universities to promote interest and win more students across from other courses. As an example, there are approximately 100,000 accounting students enrolled nationally that represent a huge pool of talent that should be targeted for conversion.

One business making a difference is Striver, previously known as Grad Mentor, that has placed hundreds of students in the financial planning and accounting professions since 2013. The Striver platform takes students through a comprehensive screening process of tests and interviews to not only help in the skills matching with potential employers, but increasingly to help with selection requirements around the softer elements of culture and ethical behaviour. It expects to place 120 students into financial planning firms over the next 12 months, although primarily into administration, client services and paraplanning roles. Striver acknowledges that the transition for graduates into financial planning is not a linear process and that it can take a few years after graduation to become sufficiently experienced to work as a financial planner.

Onboarding Graduates

The professional year requires participants to complete 1,600 hours of work and training (the equivalent of one year), including 100 hours of structured education and training and 1,500 hours of work and supervised experience. Completion of the many “specified activities” and “key competencies”, including technical competence, client care and practice, regulatory compliance and consumer protection, all need to be documented by the individual and validated by their nominated supervisor and by the licensee.

However, there appears to a disparity of views amongst advice firms about exactly what is required, perpetuated by inconsistent guidance from FASEA and different approaches taken by licensees according to how they view their role and the risk attached to their responsibility for the new entrant.

Maybe it is to be expected that the first tranche of new advisers entering the industry would come up against some teething problems. With relatively few advisers taking part in this process (there are only 16 advisers listed as “provisional” at the moment) these participants form the vanguard that will potentially smooth the progression of the transition into advice for those that follow. We would expect the method and administration of the process will become somewhat smoother over time

Article by:

Comments4

"In 4 or 5 years' time, I'm betting that the figures in Graph 2 will be the same for the current pool of existing advisers who would have left the industry, 28% remaining.... except the ones who have gone would have made their decision based on the same reasons in Table 1 which they had personally experienced while they were practicing, deciding that not only is it not worth it, but there was no way they could possibly spend the time for a degree nor find the money to pay for one. "

Old Lifey 11:02 on 03 Sep 20

"Agree with you R a very well written comment about the costs of staying in this industry and how to improve it."

FPAccountant 07:47 on 03 Sep 20

"As a self employed financial planning practice/owner, there is no financial reason to take on a graduate and 'grow' your practice. The labour/educational costs are appalling, and the licensee costs are outrageous, I'd comfortably estimate ~$30,000+ pa (licensing, TPB, AFA/FPA, PI, FP software etc etc) before you even pay their wage. Without the big 4 banks, AMP Horizons and the other big players, doing the heavy educational lifting, how are people supposed to enter? When you have very experienced and long term advisors, say enough and leave - what does that say about the requirements, the prospects for new entrants (if any) and future of the industry? The only good news, is that the government/FASEA et al are wiping out my competitors.... "

Michael 15:32 on 02 Sep 20

"The educational requirement (have a degree in financial planning to be a financial planner, or a grad dip in FP if you have a relevant degree in a related field) is a positive and will eventually make FP a 'profession' rather than an 'industry'. The 'professional year' is also a good requirement for freshly minted grads, but should be a bit more flexible for those with years of other relevant exerience (eg financial services employment, being an accountant, etc) - I finished off my DFP just before the new rules came into effect just so I could be an 'existing adviser' and avoid having to do a professional year (which didn't suit me as a career changer wanting to setup as a financial planner). The biggest problem I see is that cost and red-tape that is involved in being able to provide financial planning services - having to be a 'rep' of an AFSL and gain access to PI insurance costs me around $1,500 /month even though I'm just starting up and have no clients. A move to individual licensing and a centralised provision of affordable PI and having ASIC fees charged per SOA/ROA plan (rather than a flat annual 'per advisor' fee) would do a lot to make graduates able to start working as a financial planner after doing their 'professional year', rather than having to work via a 'firm'. If ASIC could take over creation of a centralised 'approved products' vetting/listing process, rather than leaving it to each AFSL to create/maintain their own 'approved product' list (often driven by revenue concerns rather than quality and value) that would also make it a lot easier for professional, uni qualified financial planners to go out and start providing financial planning services to clients. The current system is basically a cumbersome regulation/review system loaded on top of an out-dated, commission based system that was based on 'salesmen' rather than 'professionals'. There's nothing wrong with large numbers of planners leaving the 'industry' if they can't/won't upgrade to a degree-level qualification in FP, but the current system makes it too hard for a person with a financial planning degree to actually do work as a financial planner. You don't see this sort of ridiculous cost burden on other professionally qualified graduates."

R 15:13 on 02 Sep 20