The Royal Commission has recommended that mortgage brokers should be required to adopt the same obligations as financial advisers as they are deemed to provide personal financial advice. As such, mortgage brokers would fall under the best interests’ provisions, commissions would be banned, they would have to registered on a central registry. In a headline grabbing change the borrower, not the lender, would pay the mortgage broker a fee for acting in connection with home lending. The impact of these changes would be manifold and far reaching. Here, we look at the potential move to fee for service for brokers and what they might gain from looking at the experience of financial advisers and other service providers, to see what the future might hold.

In the RC final report, commissioner Hayne referred to the differences in roles and remuneration between financial advisers and mortgage brokers and explicitly referred to the fee difference as being “striking”:

“Internal papers prepared by CBA when the Sedgwick Review was considering broker and other remuneration compared the fees received by a mortgage broker with the fees charged by a financial adviser for personal financial advice to a retail client. The fees charged by a broker were said to be higher than the fees charged for financial advice (the figures quoted were about $6,600 compared with $2,300). No doubt the two tasks differ. The financial adviser must reduce the advice to writing, as a Statement of Advice; the broker need not. The broker will take the information provided by the client and turn that into a loan application that the broker will submit. But the difference between the fees is striking. And it is all the more striking when it is recalled, as it must be, that home loans are not complicated financial products.”

It would appear the inference is that mortgage brokers are overpaid for what they do – at least when compared to financial advisers. The banning of commissions for brokers would mean they move to fee for service (FFS), combining this with the other recommendations – would that mean that brokers would effectively become "financial advisers" in the mortgage space? It's a massive change to the landscape. Business models will need to evolve. The impacts will be many. What will FFS pricing look like for brokers? How do aggregators survive? Will comparison sites morph into B2B propositions? Currently home loan approval rates are at 50%, so what happens to the up-front fee if a loan is not approved? Will specialist brokers be housed solely in financial advice firms or banks? Would brokers have to conform to FASEA requirements?

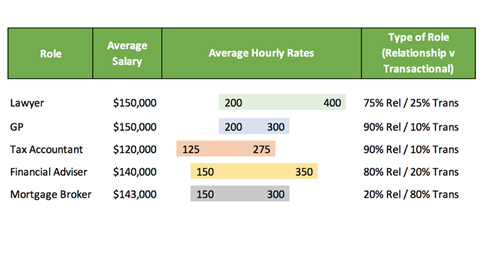

There are many questions and much to work through, but here we’ll look only at mortgage brokers potential change to FFS. Pressure to drop all commissions for financial advisers has been mounting for some time and many advisers have been grappling with amending their business models to rely more on FFS as a result. A key question is - how does the mostly transactional nature of mortgages play against other industries, including financial advice, that have a heavier relationship focus - and hence maybe more justification for FFS? We’ve mocked up a table as a basis to start thinking about this point.

First a note on the graphic - trying to find comparative metrics for financial modelling purposes is fraught with assumptions. The figures in the graphic were compiled from a range of sources and are not meant to be a definitive indicator, rather an estimation and starting point for discussion.

Undoubtedly there are differences in the nature of the occupations listed and different business demands. For example, established GP’s would do little marketing, and the level of resources spent on prospecting for new clients by different firms would differ depending on the types of service offered and the maturity of the practice.

Type of B2C Role

The key point of comparison is the “type of role” played between the service provider and client, and how much of the role is “transactional” versus “relationship” based. Financial advisers offering full service spend a lot of time in the discovery of detailed information about their clients – not only in what their current finances look like, but also regarding what their hopes and goals are and setting up comprehensive plans on how to achieve their ambitions. By contrast, a mortgage broker is more concerned with the specific issue of obtaining a mortgage for their client.

Psychology of Consumers

Another thing that plays out when thinking about these changes is consumer psychology. Will consumers pay up front for something that they have been getting for “free”? Of course, there’s no such thing as a “free lunch” - banks absorb the commissions they pay into their cost base and it is ultimately paid for by the revenue they earn from the customer. This up-front versus commission dynamic echoes a similar argument for commissions paid for life insurance. Australians are chronically underinsured and consumers are simply more inclined to get cover if it is paid for in a way that’s not “direct”. An important consideration here is how consumers value a service and what their “need” for the service is?

Need For A Service

When it comes to paying for a product or service, there must be a strong perception of need from the consumer for them to justify parting with their cash. The business services listed above have varying degrees of “need” for consumers. People may not perceive the need for life insurance (even though it might be against their best interests), but if they want to buy a house, they will invariably need a mortgage. Generally, you only need a tax adviser at that time of the year, good health checking regimes aside, sometimes the need for a GP is out of your control and as such, payment is not a choice. Mortgage brokers are only of use in a particular situation. As for financial advisers, while the need to have proper financial planning is widely agreed, the challenge advisers face is making a compelling case for people to recognise that need, and to seek (and pay) for help. Regarding commissions – as financial advisers know too well, there are many consumers who simply can't afford to pay several thousand dollars up front for a life adviser to do 10+hrs work getting a proposal across the line. Depending on complexity, it may be similar for a mortgage broker.

Tech Advances

Another factor for consideration is technological change. Will it be another nail in the coffin of brokers regardless of the RC’s recommendations? As one commentator puts it, “the fundamental issue that needs to be clarified is what does/can a basic mortgage broker do to add real value in a way that is difficult to automate, presumably because it requires specialised knowledge and experience. If some mortgage brokers’ key value proposition is finding a better rate and completing application forms, then there is little value, other than saving the banking system a fortune in lead generation and sales conversions. Comparison sites and standardised application forms (or open banking) will replace the basic broker.”

If this is the case, the relational (rather than transactional) aspect of the business becomes the key differentiation point for service providers. The intangible nature of this interaction is not something that is easily automated. Client service become an even more significant aspect in the provision of service.

These changes to the regulatory provisions for mortgage brokers continues the blurring of the lines between the various professional advisers helping consumers with their overall personal financial needs. Financial advice businesses are evolving into multi-disciplinary practices or practice “syndicates”, in many instances combining experts providing financial advice, lending, accounting, property advisory, and legal assistance. Those business that can best combine the related service offerings and which are based on compelling and sound relationships look to be more likely to succeed by weathering the regulatory and technological disruption currently besetting the industry.

This article is based on a Linkedin discussion kicked off by Adviser Ratings MD Angus Woods.

Article by:

Comments6

"Saying that mortgages are not a complex financial product is rather startling. (Has anyone involved with handing out this opinion tried dealing with the back offices of lenders, where even the simple aspects are often mishandled and made complicated)! Stating that mortgage brokers are rate comparitors and form fillers is also just not correct. I am both a financial planner and a mortgage broker. (I have never had an insurance, superannuation or fund manager’s back office have me in tears of frustration trying to deal with them. I cannot say the same about dealing with lenders - especially the four big banks). From my own experience and talking to other mortgage brokers, about 10% of mortgages are those nice easy, form filling exercises. The majority involve such complications due to the client’s circumstances that just getting those applications in place takes hours and hours, not covered by current upfronts at all. Only the knowledge of knowing one will be compensated over the following years through trails makes the stress and time involved worthwhile. "

Anna-Louise Brown 09:52 on 21 Feb 19

"The point of this exercise is NOT about the value of brokers' businesses, it's about getting rid of conflicts and oroviding better, transparent services to consumers..."

Philip 18:12 on 20 Feb 19

"Selling property and loans are not products that require a licence to sell or real estate agents would go out of business. Forcing mortgage brokers to do the same level of research and documentation that advisers do will mean that they will have to become AR's? Seriously. "

Philippa Hunt 15:24 on 20 Feb 19

"Why would you base your judgement on Big Banks figures of costs , not the Productivity Commission , & 2 other enquires,.. just look at customer satisfaction and channel usage .. It's Driving the bus to the Big Boys.. Competition will again back in the hands of a few...it seems the experience , process and availability that the customer prefers here, somehow has been forgotten or just doesn't count ... Ask the Online lenders and larger 2nd Tier Banks who introduces most of their business and who they direct the customer to for service as they don't have provision to see clients.. What about prevention of fraud , seems to me that face to face lending is a requirement of most lenders.. TO verify Documents etc the old 4 C's of Lending... #babyoutwiththebathwater "

Craig 15:20 on 20 Feb 19

"Up front fees do not work for Risk Advisers the average Mum and Dad cannot afford this. Australia has a massive under insurance problem and taking away up-fronts will only exacerbate this."

Warren 15:12 on 20 Feb 19

"Up front fees would also wipe out the value of brokers business as a going concern. No book to sell, no value. Leaving aside whether a stand alone FFS model would be viable in the first place which I doubt."

Drake 14:54 on 20 Feb 19