In the past week, Commonwealth Financial Planning has become the latest major player to call time on its advice business, echoing the recent trend of institutional exits from the market they once dominated.

Earlier in the year, it was announced the Big Four bank’s advice arm had entered a strategic referral relationship with insurer AIA.

The move continues the shift away from wealth management that the Big Four and AMP began three years ago after the damning revelations from the Hayne Royal Commission and preceding scandals at many of the large institutions.

Not long ago, NAB completed its deal to sell MLC Wealth to IOOF, which sent hundreds of former NAB/MLC-licensed advisers to either IOOF or new licensees.

Given these recent actions, we thought it would be timely to re-examine how the licensee universe has changed in the last few years.

Bank and AMP losses

It’ll be no surprise to any adviser that licensees are getting smaller. In fact, the average number of advisers per licensee has fallen by 25 per cent since 2018. The largest licensees from three years ago have lost thousands of advisers through resignations or retirement, lateral moves to other licensees or downsizing of their financial advice presence.

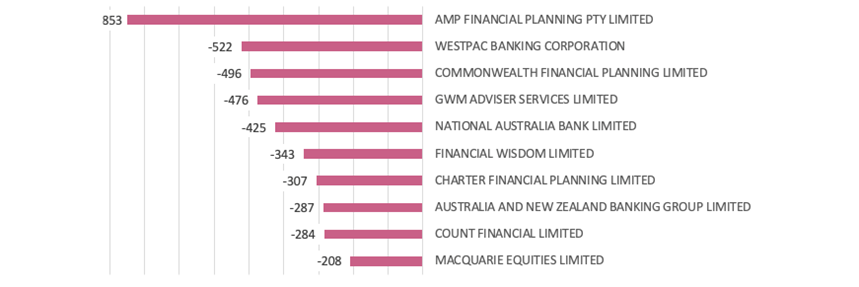

Our analysis shows the AMP licensee (as opposed to AMP Group) has experienced the most prominent loss, with 853 adviser exits, which represents 57 per cent of the licensee’s adviser universe in under three years.

Figure 1: Licensees’ adviser losses between 2018 and now

Source: ARdata. Note: Westpac Banking Corporation is no longer active in financial advice. Figures above are net numbers.

Meanwhile, the Big Bank licensees – Westpac, NAB, Commonwealth Bank and ANZ – have collectively lost 1730 advisers. In today’s universe, this would represent more than 9 per cent of the advice industry.

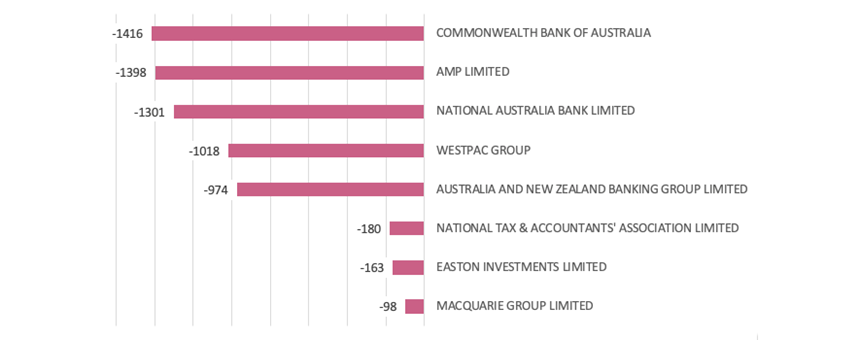

Figure 2: Adviser losses by licensee owner, 2018 to now

Source: ARdata. Note: Westpac Group no longer active.

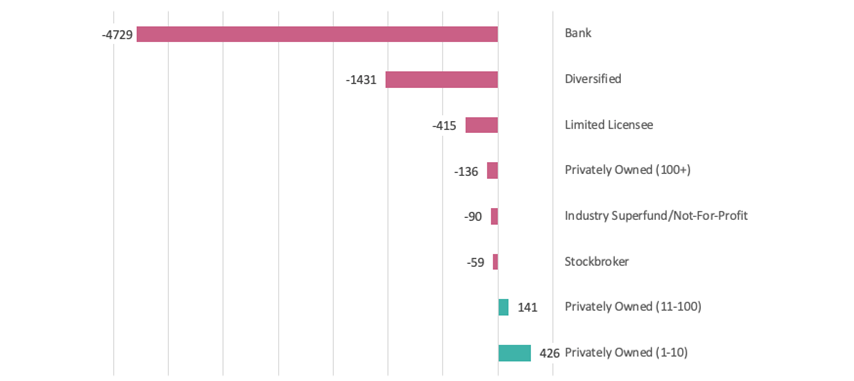

The biggest shake up is at the licensee owner level. The same Big Four banks have lost more than 4700 advisers from their networks of licensees. It’s worth stating these numbers capture licensees like Millennium3 and RI Advice Group, which have switched licensee type from ‘bank’ to ‘diversified’. However, diversified licensees have also experienced significant losses, with total departures exceeding 1400 between 2018 and last week.

Figure 3: Adviser losses by licensee type between 2018 and now

Source: ARdata.

All these losses have left ANZ and the Commonwealth Bank Group without much of a remaining presence. ANZ has lost 89 per cent of its adviser base in three years, while the Commonwealth Bank has lost 87 per cent.

Adviser Ratings is aware there are whispers in the market of banks re-entering wealth, but decisive moves are yet to materialise. One thing we cannot be left in doubt about is that the numbers don’t lie: the once-dominant presence of the banks and AMP in wealth is now just a shadow.

Article by:

Comments0