When it comes to biases we are well aware of others’ but may not be so sure not our own, or even think we don’t have any (spoiler alert – everyone has them!). The classic example of overconfidence bias is revealed through the illusory superiority that most people display when it comes to answering questions like ‘do you think you are a better than average driver?’ In a study 93% of American and 69% of Swedish people believed that they themselves were in the top 50%!

The point is that such biases arise almost everywhere you look!

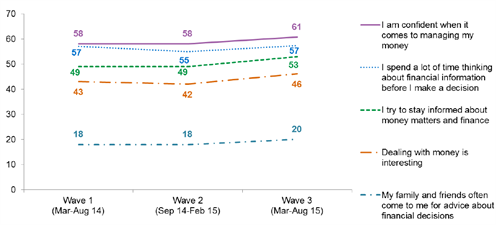

Ernst & Young (one of the top four accounting firms in the world) produced a financial literacy report for ASIC detailing that 60% of people surveyed are “confident” in managing their money. We can then couple this with Mortgage House Australia’s survey results suggesting “far more people believe they are above average than below average - both in knowledge (understanding everyday financial products) and in behaviour (making good financial decisions)”.

Figure 1 Source: ASIC / EY Sweeney

This doesn’t mean that you, me and your neighbour may be overvaluing our understanding of finance, but it should give us pause for thought.

Another interesting finding from ASIC’s report reveals perhaps an overconfidence in men and/or a lack of confidence in women regarding finances. Women were more likely to agree with the statement that ‘dealing with money is stressful and overwhelming’. Below you can see that approximately 35% of women believe so through the three survey rounds.

Figure 2 Source: ASIC / EY Sweeney

We can combine the myriad of tips provided by ASIC and Mortgage House Australia to two key points:

- We should attempt to develop a budget. Even though only 50% of people “mostly” stick to their budget it certainly helps to define your goals and what you’re spending your money on. 20% of people use some sort of spreadsheet to help manage their finances.

- Try to be realistic with your financial skills, if you need to ask some questions do so whether it be through a financial adviser or equivalent expert. Don’t be a disheartened, three in ten people have openly reported that they find dealing with money stressful.

Ultimately the theme of the story is that if you think you may not be on top of your financial future, it is much better to ask for help sooner rather than later. Being able to recognise your biases is not a fault, rather an enormously useful skill in avoiding common pitfalls.

by Raja Grewal, Adviser Ratings

Article by:

Comments2

"Baz - it was the men who caused the crisis back in 2008. Yes - too much testosterone = too much risk = not enough women in positions of power"

My Female Gripe 16:12 on 29 Jan 16

"Haha - great article....the over-confidence in us testosterone-laden humans!"

Baz 16:10 on 29 Jan 16