I am now self-employed and work from home 2 days a week-what can I claim through my business with regards to the home office?

Top answer provided by:

Paul Giordano

Firstly congratulations on starting your own business, this is no easy task and whilst there is going to be hard work, long hours, frustration and second guessing yourself along the way. If you follow you plan, manage your expenses well and efficiently solve your customers problems while providing amazing customer service, you should be on your way to a happy and prosperous future.

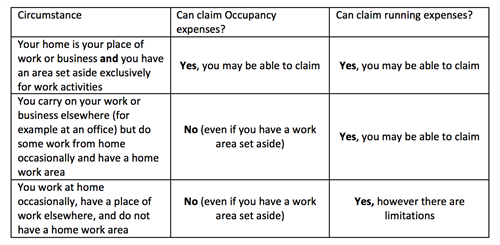

To answer your question, first it is important to understand that there are two main categories for home office expenses, they are, occupancy expenses and running expenses. Depending on your actual situation (which would need to be clarified further) being able to claim expenses from these two categories depends on whether your home is your place of work or business and if you have an area set aside exclusively for work activities.

Let’s first look at the type of expenses that fall into each category and then look at in which situation these can be claimed:

Occupancy expenses: (not necessarily limited to)

- Rates

- land taxes

- rent

- interest on the home loan

- insurance premiums

Running expenses: (not necessarily limited to)

- Repairs and maintenance to home office furniture and fittings

- Air-conditioning and lighting

- Telephone expenses related to work (including mobile)

- Internet

- Cleaning

In what situations can I claim expenses from these categories?

How do you calculate the home office deductions?

1. Log the actual running expenses

Keep a log/diary to work out how much of your running expenses relate to doing work in your home office. The log needs to detail the time you spend in the home office compared with other users of the home office. You should keep this diary for a four-week period, this can then represent the entire financial year.

2. Use the ATO’s rate per hour method

You can use a fixed rate of 45 cents per hour for home office expenses for heating, cooling, lighting and the decline in value of furniture instead of keeping details of actual costs. You just need to keep a record of the number of hours you use the home office and multiply that by 45 cents per hour. Under this method you can also include the decline in value of office equipment (i.e. computers, faxes, etc).

This should provide you with an overview of what can be claimed and how, however we strongly suggest you seek individual tax advice. We recommend that you seek out a tax adviser that has experience or even specialises in dealing with small businesses and businesses who are in start-up phase. You should arrange to meet with a few and ask lots of questions that relate to their experience with similar types of businesses to you and in similar phases.

You may at this stage of your business get great benefit from working with an adviser to help set your goals and targets, who can then keep you accountable. It’s easy as a business owner with no partners to let your goals or targets slide.

I wish you success in your new venture.

Kind regards,

Paul Giordano

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0