"I am in my mid 40's and I'm thinking of starting a Self-managed super fund. How much do I need in my Super to start this process? Is there lots of upfront costs?"

-From Danny in Perth.

Top answer provided by:

Lisa Scott

Hi Danny,

Thank you for your question. Please note that my answer is of general nature only as I know too little about you and your circumstances. You would probably benefit from seeing a financial planner and an accountant who specialise in Self-Managed Super Funds (SMSFs) for advice that would be tailored to your specific situation.

By way of introduction, most super funds (retail and industry) are regulated by the Australian Prudential Regulation Authority (APRA), however, SMSFs are regulated by the Australian Tax Office (ATO). APRA-regulated funds have professional trustees managing the funds and being held responsible for the way the super funds are run to APRA. With the SMSF, you as an individual trustee or a director of a corporate trustee are ultimately responsible for everything that happens to your super fund, regardless of how much support you have.

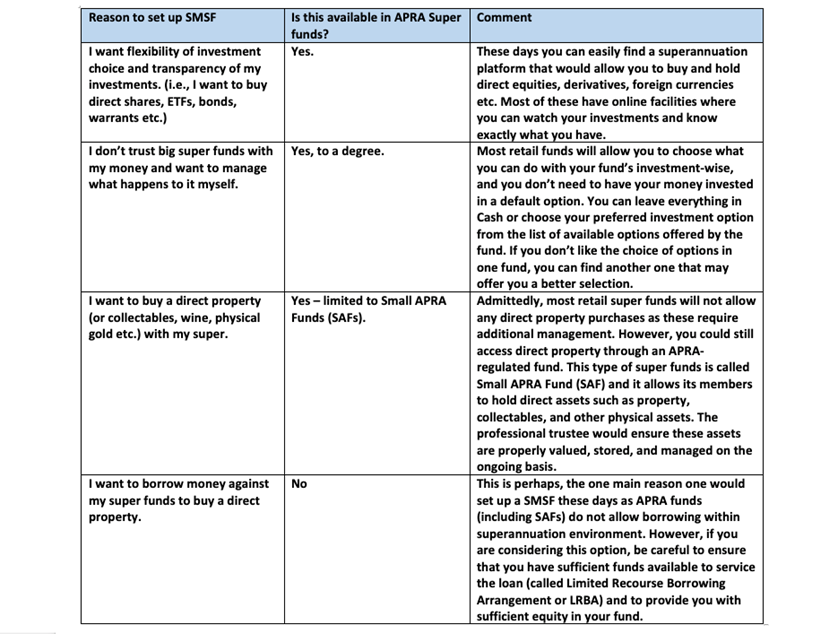

SMSFs have been popular over the years due to the perceived freedom and sense of control they provide to their owners. However, a lot has changed in the superannuation world over the last couple of decades and it is worthwhile to take some time to consider whether this structure would be appropriate for your retirement savings needs. I have put together a little table with some of the most common reasons one would consider setting up an SMSF and some commentary around those.

So as you can see, a lot can be achieved through an APRA-regulated fund without the need to set up an SMSF. However, if you are still keen to go down the SMSF path, you also need to consider the following:

Cost

With regards to costs of setting up an SMSF, these range from a couple of thousand dollars to tens of thousands depending on who sets it up and how complex it is. The same goes for ongoing costs. Some of the costs you are likely to incur would be:

- Legal costs (advice, trust and company set up, drafting of a trust deed etc.)

- Accounting costs (administration, tax returns, member reporting etc)

- Financial advice costs (you must have an investment strategy for your SMSF as a rule)

- Lending costs (if borrowing inside super) – i.e. valuations, loan fees

- Banking costs (SMSFs need their own bank accounts)

- Auditing costs (a separate Auditor must be assigned to your fund)

- Property (collectables etc.) management costs

- Actuarial certificate costs

- Insurance costs

- Underlying investment costs (managed fund cost ratios etc.)

Unlike within most APRA-regulated funds, SMSF costs are not usually based on percentages and may become quite significant regardless of how big or small your SMSF balance is.

Minimum Balance

The starting balance of an SMSF is a critical consideration in determining the cost-effectiveness and thus appropriateness of the SMSF for you. As stated by ASIC:

“If it is not cost-effective, it is very unlikely to be in the client’s best interests”

ASIC Information Sheet 206 (Advice on SMSF: Disclosure and Costs).

ASIC has further stipulated that a minimum starting balance of $200,000 is most likely to provide such cost-effectiveness when taking into account the cost of establishing and maintaining an SMSF. Balances below this threshold will attract attention from ASIC.

In practice, most advisers would not consider any balance under $500,000 as sufficient to start an SMSF. ASIC’s information sheet (INFO 206) stated that “On average, SMSFs with balances below $500,000 have lower returns after expenses and tax than funds regulated by Australian Prudential Regulation Authority (APRA)”.

Trustee Responsibilities

There is a long list of trustee duties and responsibilities you would need to know, understand and comply with if you want your SMSF to be and stay compliant and to avoid unnecessary penalties (some of which can be issued to you personally).

I would like to direct you to the ATO website for videos and simple explanations of the rules associated with this structure. I also highly recommend that anyone considering setting up an SMSF completes one of the ATO approved free online courses to ensure they are aware of the responsibilities of trustees.

Unfortunately, even if you have a whole team of professionals supporting you (Accountants, Advisers, Lawyers etc.), the responsibility for managing your SMSF always lies with you.

The ATO trustee declaration that you would have to sign at the time of your SMSF being established, states:

“I must keep myself informed of changes to the legislation relevant to the operation of my fund and ensure the trust deed is kept up to date in accordance with the law and the needs of the members”

Furthermore, if you are not going to be a sole Trustee/sole Director of a Corporate Trustee, you must ensure that all trustees/directors are equally aware of the rules and their duties. The ATO has been known to conduct trustee audits (they are sometimes called “zombie trustee” audits) where they would phone SMSF trustees and test their knowledge of current SMSF rules and requirements to ensure that trustees are qualified to manage the super fund. Trustees who do not comply with the ATO rules may be penalised by personal fines, disqualification, the appointment of an administrator or a freeze of SMSF assets. In addition, non-complying super funds pay the highest tax rate on any income/growth they earn. You can read more about how the ATO deals with non-compliance here.

Danny, I hope this general information has been somewhat helpful to you. However, this is a highly specialised and complex area of expertise and it would be beneficial for you to seek specialist advice before you make your decision.

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0