Can I set up a pension fund for my retirement? I am getting a voluntary redundancy payment and would like to know if putting it in a pension fund or adding it to my super fund is best for tax purposes. I am 58 and I don't plan to fully retire after I am made redundant.

Andrew - Keilor, Vic

Top answer provided by:

Martin Cossettini

Andrew - great question and thanks for asking.

Allow me to answer your question in a generalised sense, as I clearly don’t know you or your personal situation or circumstances.

You can’t actually go out and open up a Pension fund, as the only way to establish a Pension fund, is by transferring money from your Superannuation fund over to start a new Pension fund (Super=>Pension). This process if often call one of the following terms - (Switch, Commutation, Rollover, Transfer)

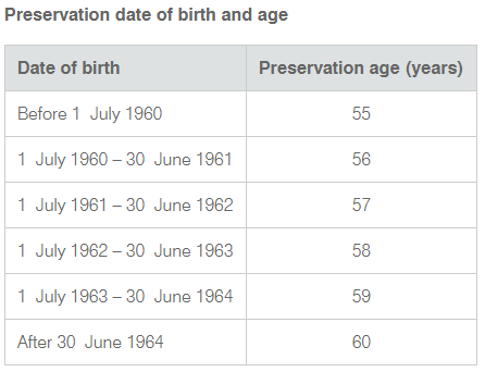

Most of the money/investments held in your Super fund are likely to be considered preserved benefits. But as you have already reached your preservation age (see table below), you have an option to transfer some or all of your Super Funds (up to $1.6M) into a Pension fund and start drawing an income.

As it appears you may not need the money (don’t plan to retire) than it may be best to wait at least after reaching age 60, as all income, that you draw from your Pension fund will be tax free after obtaining 60 years of age, whereas some tax is payable (taxable portion) if you draw a Pension income stream before age 60.

When the time is right for you to start drawing an income or lump sum from your Pension fund, be aware that you need to draw (at least) a minimum of 4% of your respective Pension fund balance per annum. (Currently reduced by ½ e.g. 2% min due to COVID-19 support measures – FY20/21)

Contributing some or all of your redundancy money, will mostly likely be a wise decision, as for up to <$25,000 of a personal Super contribution, you may be in a position to claim a tax deduction for some of this contribution. Be aware that you only have an annual Concessional Contributions Cap of $25,000, and any employer Super Guarantee (SG) 9.5% forms part of this annual cap.

You may also be in a position where you have some unused Concessional Cap, where you can look to utilise some of the previous financial year unused Concessional Cap. (A recent legislation was introduced allowing a provision to catchup on previous unused Concessional Contributions – with last FY 18/19 being the first FY to be used as a catch-up year)

The greatest long-term advantage of contributing funds to the Superannuation environment, is that when you retire after age >60y or cease an employment arrangement after >60y, up to <$1.6M of your Superannuation funds can be transferred over to Pension phase, with all future income and capital gains will be received “tax free” for the rest of your life or while funds remain in the Pension fund.

All individuals currently have a $1.6M transfer balance cap, which is the current maximum that can be transferred to start a Pension fund. If your Super balance is greater than the $1.6M transfer balance cap amount, it can remain in Superannuation where a maximum tax rate of 15% is applied.

A very important and often over looked feature in having the majority of your investment assets held inside the Pension environment, is that all investment assets will be considered tax free assets whereas assets held outside the Pension environment excluding the family home continue to be taxable assets (income/capital gains)

A great way to think about a Pension fund is that its an effective legal “Tax Haven”, no need to hide money off-shore when you have money held inside a tax effective structure.

To recap, if you don’t need the money to cover current living expenses, its most likely your best option to contribution funds to Superannuation and potentially claim a tax deduction for doing so, and when you need to start drawing a Pension income steam (Pension Phase from >60y), all income you received, and income earned by the Pension fund and future Capital Gains will be tax free, while funds remain in the Pension fund.

Andrew - Best of luck, seek some expert financial advice to help you decide the best course of action to match your chosen path “Yellow Brick Rd”

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0