"With house prices going through the roof, should I keep saving and invest in property? Or should I start looking at investing in shares?"

-Barry in Coolum, Sunshine Coast, QLD

Top answer provided by:

John Forwood

Hi Barry,

This is a great question and one that many people are asking themselves at the moment (even real estate agents).

I have made the assumption that you are looking at investing in a house as an investment property. If the property you are looking at is to live in, then it is less of an investment decision and more of a lifestyle question.

As a lifestyle decision, the questions become heavily linked to affordability, desirability, and the length of time you expect to live in the property. The decision does have some linkages to property growth, but none to property income.

If this decision is about a home to live in, I am a big advocate of doing this, and doing it early. Australians as a rule save far more money by paying a mortgage than they are able to if left to their own devices.

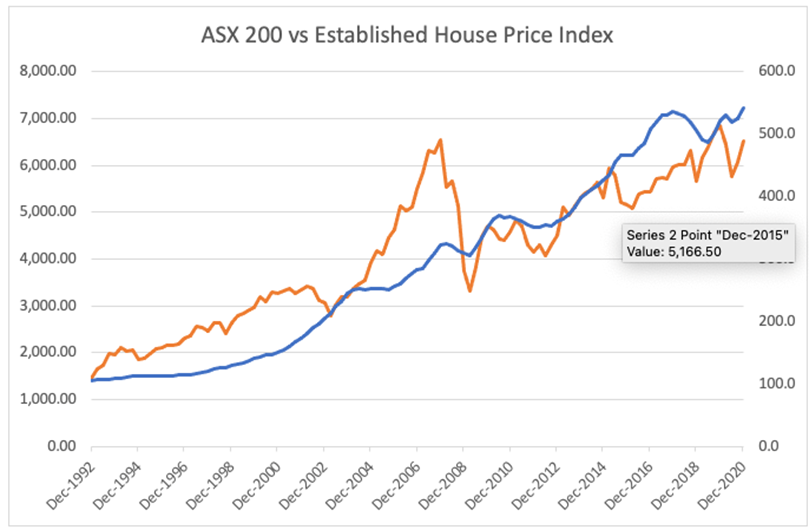

As you can see from the chart below, Established Houses have slightly outperformed the share market (Dec 1992 – Dec 2020). However, since the end of this graph Australian shares have risen above 7000.

For these two lines to be so close together, over 28 years means that the investment decision is not really about the long term growth of the 2 types of investment.

Note: The date range on the chart was chosen for 2 reasons:

- The ASX 200 index started in 1992. Data supplied by Yahoo Finance (Left Axis)

- The latest Established House Price Index from the Australian Bureau of Statistics was December 2020. Data Supplied by ABS (Right Axis)

With my clients I would break this decision into the following areas:

- What is the purpose of the investment?

- What structure suits that purpose

- Do you need to borrow for this investment?

- What level of involvement do you want?

Purpose of the investment

The purpose is your personal reason for making this money work for you. It could be saving for a holiday, a new lifestyle asset, or to provide income for you in your retirement. The purpose will dictate the timeframe that you are prepared to have these funds invested, and when they will need to be liquidated.

What Structure?

The purpose will help determine the structure, but other factors need to be considered. Is this asset best purchased inside superannuation? Does your job or business leave you potentially exposed to litigation? What is your personal tax rate, and what is that of your partner?

Borrowing

Borrowing most of all differentiates residential property from share investments. Borrowing to purchase property is easier to obtain and is cheaper than borrowing for shares. Property lending also comes with a very low chance of a margin call.

Borrowing magnifies your gains… and your losses. A simple example: If I have $100,000 and borrow $100,000 to make a $200,000 investment and that investment then goes up by 10%, my equity is then $120,000 and I owe the bank $100,000. An effective 20% gain in my money. Vice versa if that same investment goes down 10%, my equity is $80,000 and I owe the bank $100,000. An effective loss of 20%. The more you borrow, the more the up and downside of can be.

Borrowing also adds to your costs of the investment. If the growth rate isn’t matching the costs of the borrowing, then you are slowly going backwards. Negative gearing (cost of borrowing is greater than the rent or income generated) is only beneficial if the growth rate makes up the difference.

Involvement

Investment properties are a pain in the you-know-what, if you don’t want to be involved. Even with an excellent agent, there is always decisions about paying for a plumber, or electrician etc etc.

Now What?...

Once you have answered a whole heap of questions above, the question is do you buy now? No one has a crystal ball, but it is important to try and understand what drives the prices in each sector.

Share Market

Long term and even medium-term drivers of share market return are heavily linked to the economy, both domestically and around the world. Fundamentally the share market is made of thousands of businesses, and the better the economy is doing, the more sales those businesses make, the more they earn and the more they are worth.

Houses

The key drivers for house prices are supply and demand.

For a long time in Australia supply has been an issue. Simply put, there is not enough new dwellings being built. This is largely in the hands of State Governments, and councils for land releases and approvals. This situation is unlikely to markedly change in the near future.

On the demand side of the equation, there are a number of short term factors affecting house prices at the moment.

Demand Positives

- Since the beginning of COVID, in excess of 400,000 ex-pat Australian’s have returned home. This has put additional pressure on the demand side of the equation.

- Cheap interest rates have allowed home buyers to borrow more, and therefore bid up dwelling prices.

- In some states, such as Queensland, there has been substantial inter-state migration.

Demand Negatives

- Normal immigration has all but stopped since the beginning of COVID.

- Affordability is becoming an issue for lower and middle-income earners.

- In some states such as Victoria and Queensland there has been substantial inter-state migration out of those states.

When looking at your decision about where to invest, you would do well to ask what factors are going to continue and what factors are going to stop. Will this be a positive or a negative for each investment?

Lastly, the idea of having investments in both, and even other assets has always been sound if you are investing for the long term. This softens the falls and smooths the rises in your overall portfolio of investments.

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0