I am looking to retire this year, how much would I need in Super to comfortably survive without a pension? Should I leave retiring to post COVID 19?

Sally, in Sydney, NSW

Top answer provided by:

Steve Esnouf

Hi Sally,

Deciding when to retire is one of life’s big decisions and most people are fearful of not having enough superannuation or financial assets to support them in retirement. This is a valid feeling as most people want to maintain their standard of living going in retirement and no one wants to adjust their lifestyle and future expectations to accommodate their financial position.

There are many reasons why you would consider retiring such as age, health, financial position or simply having enough of work! COVID19 adds another level of complexity to your situation, however, I would suggest the former reasons should be the main driving force behind your retirement timing decision.

The question of how much you need in superannuation to live a comfortable life in retirement is somewhat open-ended and my response to your question is that it depends. There are a number of factors that need to be considered such as your age, health, income requirements, other financial assets and level of investment risk you are prepared to take.

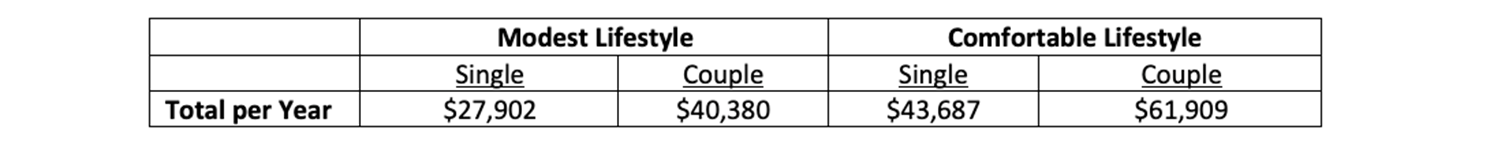

The Association of Superannuation Funds of Australia (ASFA) benchmarks the annual budget needed by Australians to fund either a modest or a comfortable standard of living. For those aged around age 65, AFSA estimates the below income requirements:

Further to the above, a benefit of the Australian retirement system is that we have a financial safety net being the Centrelink Aged Pension. Depending on your year of birth, pension eligibility starts from age 66 and increases to age 67 if you are born after 1 January 1957. I call the Aged Pension a safety as once your assets and income fall below a certain threshold, you will qualify for the full Aged Pension which represents a base level of income for your retirement.

Currently, the full aged pension for a single person is $944.30 per fortnight ($24,552 per annum) or $1,423.60 per fortnight for a couple combined ($37,014 per annum). As I mentioned above, there is an assets and income test to pass in order to qualify which may lead to one of 3 outcomes, full Aged Pension, part Aged Pension or no Aged Pension.

Further to the above, the level of investment risk you are prepared to take with your superannuation plays a large part in how much superannuation you need for retirement. This decision relates to risk and return. Should you want to take no risk and be a cash-based investor, you will need more superannuation capital than someone else who may be a growth-based investor. There are advantages and disadvantages in adopting certain investment strategies and the right approach for you will ultimately be the approach you feel most comfortable with once you are educated about your investment options.

Assuming you are aged 65, single, a homeowner, a balanced investor (assumed net rate of return of 5%) and want to live a comfortable life in retirement ($43,687 per annum for life and indexed to 3% per annum) with no other financial assets, I would expect you to need between $850,000 and $950,000 in superannuation to be able to retire with a level of confidence that your superannuation will last until life expectancy (Age 88). There are many assumptions factored into these calculations and these may not accurately reflect your financial position. Working with a financial planner can help you work through these issues and questions and help you make the most appropriate decision for your current and future circumstances.

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0