"I want to switch superannuation funds, how do I find the best fund for me and what things do I need to look out for, I have no idea where to start?"

-Question from Janelle in Kingaroy, QLD

Top answer provided by:

Stevie-Jade Turner

Hi Janelle,

Your question is very common, one that comes up for people who are interested in taking control of their finances.

I’d like to go back a few steps to help you understand a good place to start before you choose the fund that is right for you.

What are you trying to achieve in switching?

Or another way to phrase this question, what is the problem with your current Super fund? Is it that you feel or know it to be expensive in comparison to other funds? Is it that you think or know it hasn’t performed comparably? Or is it that you are interested to have more control over the way your Super is invested, such as with an emphasis on Ethical investments or you prefer Index style funds, or ETFs or shares?

There are so many Super funds out there and any one of them could be right for you depending on your answer to the above questions. If it is cost that is the driver for you, you’ll want to narrow your focus to low-cost funds, you might already know that Industry Super funds are commonly advertised as lower cost, with their administrative costs usually among the lowest, however, you also need to consider Investment costs as well. I have seen other Super funds (referred to as Wrap accounts or Master Trusts) where the preference to invest in Index funds means that the total cost of this approach is lower than the total cost of the industry fund. The point I’m trying to make here is that not all Super funds are equal.

Types of Super funds

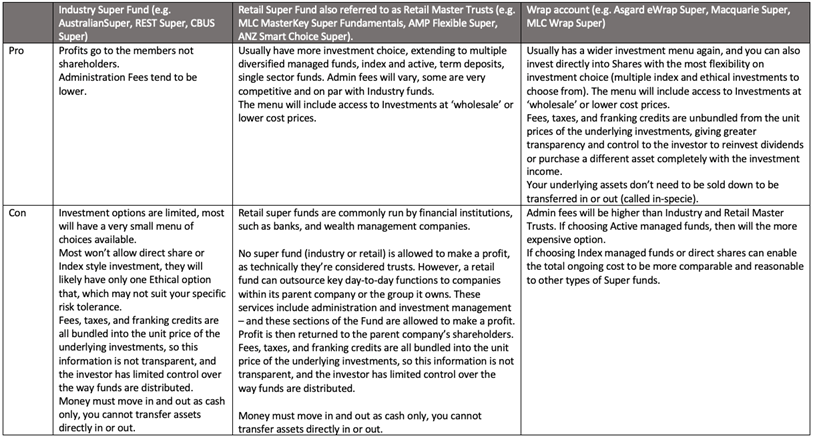

I’ll try to help you discern the different types of Super funds that are out there and what pros and cons they each have so that you can work out if one is starting to tick all of your boxes.

^ Because the question is about switching super, I have only included in the above funds that most people will have access to choose, there are some specialist funds called Public Sector Super funds, where only people who have worked in Public Service can be members.

Something you should consider is the kind of fund you already have and if you will be able to go back to it after moving away from it. For example, the Public Sector Super fund type mentioned above, you may not have access to again if you left Public Service, there are also special type of Super funds called Defined Benefit funds that you should really seek advice on before you make decisions on whether to move away from that type of fund as you might be losing very specific benefits that could put you in a worse position.

Employer/corporate Super Funds, such as Plum Super, Telstra Super or AMP Signature Super, as examples, are essentially the same as Retail Master Trusts, however, the employer has negotiated more favourable fees and insurances for their employees as members of the selected fund. If you leave the employer, you will likely be moved to a Personal Division of the fund automatically, usually resulting in loss of the benefits the employer negotiated for you, so you might have an expensive fund now and may have lost the insurances when your employment ceased. This is an important factor in moving Supers, if you are still with the employer and part of the Corporate Division it may not be wise to move away from that fund until your employment situation changes.Something you should consider is the kind of fund you already have and if you will be able to go back to it after moving away from it. For example, the Public Sector Super fund type mentioned above, you may not have access to again if you left Public Service, there are also special type of Super funds called Defined Benefit funds that you should really seek advice on before you make decisions on whether to move away from that type of fund as you might be losing very specific benefits that could put you in a worse position.

What to do from here?

An adviser can help you discern if you are already in a good fund or one that meets your needs or if it might be advantageous to move.

There is also a website you can look at https://www.chantwest.com.au/fund-ratings/super Chant West is an independent research, data and analytics firm and provides ‘apples for apples’ comparison on Super and Pension funds available in the market place. They give a rating out of 5 apples to help you work out if the fund you are currently with is considered a high-quality fund. You can have a look for your current fund, and the website also tells you what type of fund you have (wrap account, industry or retail/corporate master trust as per table above).

You may see comparisons in the media of ‘top performing upper funds’ however it’s important to note, these usually exclude wrap accounts (they usually focus on comparing industry funds and retail or corporate super funds that have an investment option called ‘MySuper’, which wrap accounts don’t have because of the wide investment menu and the control that the investor has to choose their underlying investments). It’s also important to remember they will be comparing a chosen underlying investment (for example, AustralianSuper Balanced with VicSuper Growth, which have a similar asset allocation of 70% growth assets and 30% defensive assets). If you are an investor who doesn’t suit that mix of growth and defensive assets, then you are looking at a comparison that it useless to your decision making. You will need to compare performance based on your specific Risk Tolerance, which you may or may not currently know. Again, an adviser can help you to understand your tolerance for investment risk and how you specifically should be invested within your Super.

I hope that helps in some way. It makes sense that you weren’t sure where to start, it’s not always as straight forward as people think, there are lots of moving parts and so much information out there now that it can feel noisy at times for people to figure out what’s right for them.

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0