My Husband is 66. I am 65. He stopped work and I still work. If he gets a small Pension and a Concession Card, do I also get a card? How do you qualify for a card?

Jenny in Sunshine Coast, Qld

Top answer provided by:

Craig Holly

Hi Jenny,

Thanks for your question!

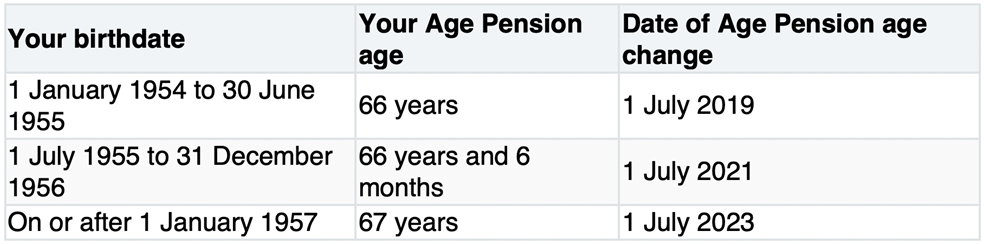

I’m assuming you fall into either the 66 or 66.5 ‘Age Pension Age’ category (please see table at the bottom), and are asking about the Pensioner Concession Card.

If so, then unfortunately you won’t be eligible for a Card, well not yet anyway!

This is because you need to be ‘Age Pension Age’ and receiving the Age Pension to receive a Pensioner Concession Card.

Age Pension & Pensioner Concession Card

As soon as you reach Age Pension Age, and your combined income/assets are under the Age Pension thresholds, then you can apply for the Age Pension & the Card.

It’s important to note that you don’t need to apply for the Card itself, because it’s part of the Age Pension application process. Centrelink will simply send you a card once you’re eligible for the Age Pension.

The easiest way to claim for the Age Pension (which your husband has probably just gone through) is online with Centrelink. But… you’ll need to have your MyGov account set up first (you do this online too).

Commonwealth Seniors Health Card (CSHC)

As an extension to your question Jenny (sorry if this isn’t relevant for you), I’ve included some further info regarding another Card that we often get asked about, the Commonwealth Seniors Health Card (CSHC).

This one’s a little different, because it’s only available when you’re not eligible for the Age Pension (asset level or income is too high).

The CSHC doesn’t use an asset test, just an income test. As long as your combined income is below the $89,290 threshold, then you should be eligible for the CSHC.

Centrelink assess any income from work, plus they ‘deem’ your financial assets (eg cash, investments & most super funds). This just means they assume (based on their rates) that your financial assets are generating an income for you.

As an example, a couple has their first $88,000 of financial assets ‘deemed’ at 0.25% pa, then over $88,000 is ‘deemed’ at 2.25% pa. So let’s say if you had $176,000 in financial assets, Centrelink would then include $2,200 pa into your ‘income’ test ($88k x 0.25% + $88k x 2.25% = $2,200)*.

It doesn’t matter what you actually earn from your financial assets, as Centrelink will simply use the above percentages to calculate your assessed ‘income’.

Comparison of the two Cards

Both the Pensioner Concession Card and the CSHC provide great benefits such as cheaper medicine, bulk bill doctors, bigger refunds for large medical costs, and possibly some utility discounts (may differ state-to-state).

However, the Pensioner Concession Card has a few extra benefits associated with it, such as public transport fare assistance (may differ state-to-state), and help with hearing services.

If you need help

FIS Officers at Centrelink can be very helpful if you need assistance throughout the application process.

Or for a more personalised and comprehensive perspective, a Financial Planner who specializes in assessing and maximizing Centrelink entitlements can be very helpful too.

Good luck with everything Jenny, I hope it all goes well for you, cheers!

Craig Holly (Financial Planner – Adelaide)

*Deeming rates current as at 22nd Sept 2020 & subject to change

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments1

"I thought that if Jenny's husband qualifies for a part Age Pension and gets a Concession Card then Jenny is also named as a spouse on his Concession Card. So she gets the medical benefits just no monetary payment. This has been my experience."

darren johns 09:59 on 24 Sep 20