My Husband is 66. I am 65. He stopped work and I still work. If he gets a small Pension and a Concession Card, do I also get a card? How do you qualify for a card?

Jenny in Sunshine Coast, Qld

Top answer provided by:

Pedro Marin Ramirez

Hi Jenny,

This is a fantastic question! Hopefully, my answer can help you and others navigate across this sea of complexity. I have listed below five things I want you to read and consider, but please be aware that you both are treated as a unit so therefore once you have met the below criteria (age) you may mirror your husbands’ entitlements.

(Please be aware that my answer is general in kind and that you should seek professional and tailored financial advice before heading in any direction as I have made several assumptions which may not be accurate in your case).

1. Your Age:

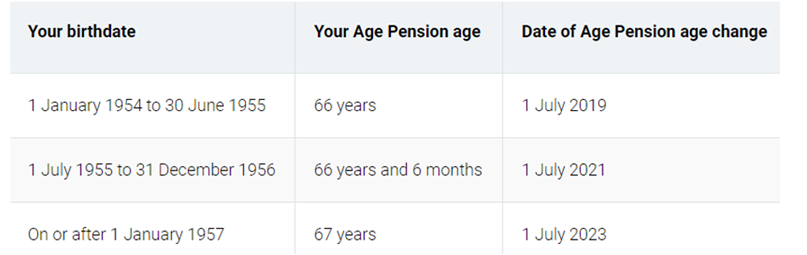

This is the first gatekeeper for Australians looking to attain age pension entitlements (Pension and a concession card), as once you have attained that magical age called ‘Age Pension age’ you can then be assessed for these entitlements.

I have included a table below that will hopefully allow you to accurately find your age pension age.

2. The value of assets you hold, and income you receive:

Once you have reached your age pension age, there are two ‘tests’ that you need to ‘pass’ so you can be eligible for any age pension entitlements.

These two tests are in the form of:

a)How much certain assets are worth (asset test)

b)How much income you both receive and/or how much income you are deemed to be received by your assets (income test)

Please be aware that these tests are there to indicate the amount you will be receiving in entitlements and if you qualify (as a couple) to concession cards.

These tests are driven by limits on how much assets you can both own and income you can be receiving as a couple. Whichever test deems you to receive fewer benefits or exclude you from having a concession card, that will be the test that you will be assessed on.

Depending on your situation, these limits are different (e.g. if you are a homeowner or not) and therefore, I would encourage you to click on the links below to look at what limits may apply to you, to further guide you in this process.

Income test for Pensioners link

Age Pension-Assets link

3. Gifting rules:

These rules are set so Australians cannot ‘get rid’ or ‘gift’ assets in order to rot the system or manipulate their finances to access higher benefits.

You can honestly gift up to $10,000 per financial year for a maximum of $30,000 in a five-year period if you gift more than this, the excess will be considered to be in your possession for at least five years since the day of gifting. For example, you gift $30,000 in one year, you are deemed to still own $20,000 of that gift until five years have passed.

Please see this link to read more about these rules so you’re clear on how you might be assessed.

4. Residency rules:

This might not affect you, but for others who are reading this, it might be something to consider if they are new to the country or are being brought overseas by their children/spouse to reside in Australia.

To be eligible for Age Pension entitlements you also need to have been an Australian resident (or citizen) for at least ten years in total. Five of these years, you must have not broken your residence.

5. Commonwealth Seniors Health Card:

If by any chance you are not entitled to an age pension card, please come back to this article and click on the below link or contact 132 300 and further discuss with a Financial Service Officer about your eligibility for a Commonwealth Seniors Health Card.

This card does not provide as many benefits as the card your husband currently has (age pension card), but it has benefits that may help you reduce your cost of living in some form. The criteria to access this card is less strict but there are still limits.

Conclusion

Jenny, I would highly recommend you click and read the above-provided links and/or phone 132 300 and contact a Financial Service Officer (Australian Government Services Australia), as you are getting closer to your age pension age and this process can take a while from beginning to end.

In your particular case, you may also have assets that have not been assessed in your husband’s situation because of your age (if your superannuation balance was in accumulation phase this is exempt from his assessment). Therefore, once you reach age pension age, your super balance (whichever phase it is on – accumulation or pension) will be part of the equation and may diminish or cancel his and your entitlements/pension card.

Hopefully, I was able to somewhat guide you with my answer, but we are always here to help. I believe that your case should be assessed in detail by a professional as there are many opportunities that you may not be aware of in order to maximise you age pension entitlements or to ensure you and your husband are in the best position possible going forward.

Warm regards,

Pedro Marin Ramirez CFP®

While the Adviser Ratings Website facilitates the question and answer functionality, all such communications are between users and authorised financial advisers, of which Adviser Ratings has no affiliation. Adviser Ratings is not the advice provider and does not provide financial product advice and only provides information that is general in nature.

Article by:

Comments0