Cosmic snowballs of dust, rock and gas have hurtled towards the life insurance industry for a good part of the last decade. And much like the movie Greenland, there needs to be a massive reset that is likely to have potential casualties along the way.

The Australian life insurance industry appears to face structural and legislative changes year after year. A wave of regulatory reform, with the Life Insurance Framework, Code of Practice, claims reviews and the Financial Adviser Standards and Ethics Authority, a swathe of Royal Commission recommendations and a pandemic that has effectively thwarted any “comeback”.

In Australia and globally, insurers and reinsurers have relied on very strong capital adequacy, but the massive increase in claims, investment volatility and perpetually low-interest rate environment has effectively eroded any buffers. Whilst they continue to dodge such cosmic snowballs, their capital is now fully exposed to any and all risks. Meanwhile, the Australian insurance market is diminishing at a rapid rate, with 2020 inflows down drastically.

None of this is new, it has been highlighted by insurance researchers across the globe, from Oliver Wyman to NMG Consulting to the Big Four and most importantly, APRA itself (that is more nervous than ever).

In this year’s Adviser Ratings’ Landscape report into the retail life insurance industry, there is significant detail:

1. on the potential ruin that may be laid bare with the massive exodus of advisers, and which insurers are likely to be impacted most.

2. the significant shift in sentiment amongst advisers and licensees and how they “feel” they have been treated by insurers

3. the willingness to shift loyalties based on a new range of criteria

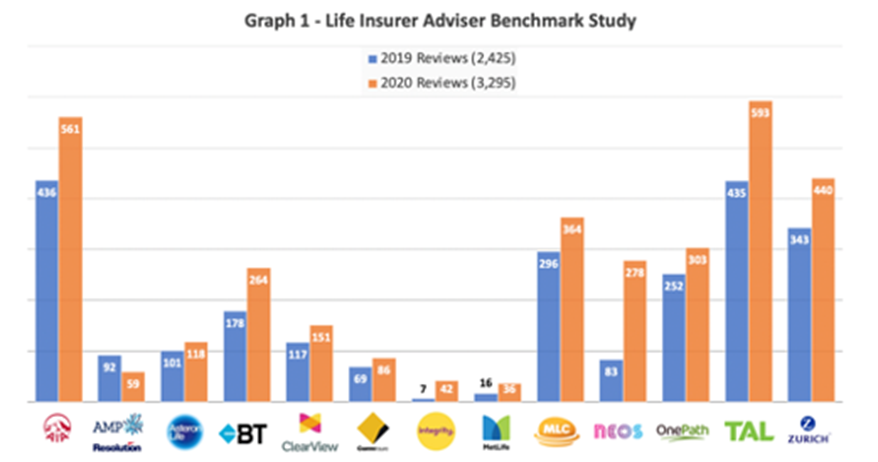

This year we had the most comprehensive feedback of any other advice category and it was sobering reading for life insurers. 1,527 advisers left close to 3,300 detailed comments and reviews on all the life insurers in Australia. To put this in context, it represents 10% of the active adviser market, but given the total number of practices answering the survey, it’s more representative of ~40% of advisers.

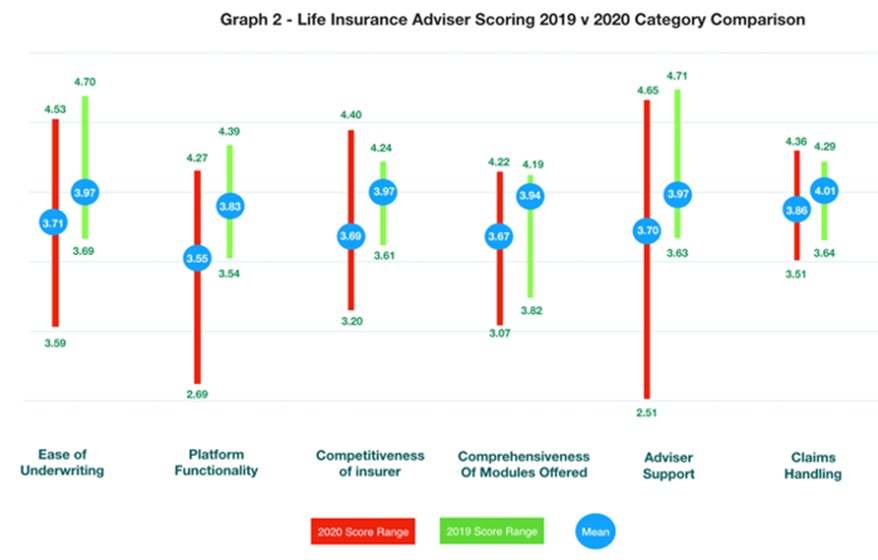

Graph 2 below, illustrates quantitatively the decline in sentiment across the board effectively for the entire life insurance industry. There are sparks of support and willingness for both new insurers and some incumbents, given some of the market conditions are not of the insurers’ doing.

But given mispricing, lack of investment in technology and data, and a perpetual race for market share, there has been little forgiveness by advisers or, more recently the regulator. It has taken an event like the pandemic for structural change to happen. And if any catastrophe happens…..well…..mmmm.

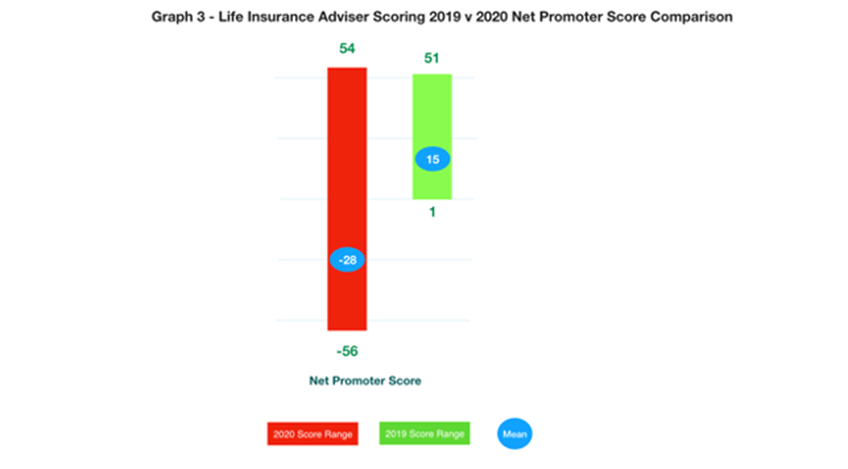

Life insurers have always been perceived as quite a commoditised solution. As one Life Insurer CEO so aptly put in conversation with me recently, if you get your pricing right we are now effectively in the “service” business, not the insurance business. Net promoter scores for retail life insurers in general have always been relatively positive, unlike other advice stakeholders in the battle for the adviser. 2020 changed all that!

Life insurers have a significant economic and social role to play, so the existential threats they are facing can only be described as troublesome.

This is a time for the industry to come together as a collective (not unlike the industry funds did so successfully well over the last decade) to ensure more Australians are seeking retail life insurance. The top of the funnel needs to be filled – from there, insurers need to foster a culture of innovation built on data and understanding of the end client/adviser.

Whilst product design, technology and pricing will be at the core of many insurers’ strategies in 2021 with BDMs having to painfully justify premium increases to advisers, a core component for insurers will be combining data and EQ. Winning back advisers’ hearts and sentiments and understanding which advisers are switching their insurer allegiances or exiting the advice industry entirely will make strategies far more complex. Our unique data delves into this in our upcoming Landscape report.

Unfortunately, 2021 is likely to inflict more pain on life insurers – with no Gerard Butler in sight for a Hollywood “happy” ending.

PS I’m trying to bookend the “Greenland” movie reference ;-)

Article by:

Comments9

"For new insurance it is my understanding that clients are also going to have to sign an annual fee agreement for the adviser to receive the ongoing commissions each year. This being the case it is not only the 60% upfront which makes smaller clients unprofitable but the cost of pursuing and tracking annual commitments from all clients will radically increase again the minimum premium that advisers will require to make doing insurance business worthwhile. So while insurers and advisers may think the bottom is near it seems more likely that things are going to get considerably worse for the life insurance industry in the coming years. "

Greig 09:23 on 22 Feb 21

"The solution is easy. The hardest part is convincing the Government, the Regulators and the Life Insurers that this is not a problem, it is a disaster of their own making. It is a simple 7 step process where the retail advised Life Insurance Industry can be saved and rebuilt. All we need is for the Government to listen to ACTUAL experts who totally understand the issues and who have the solution. What we have today is a collective of Self serving Interest groups who have little understanding, or care of the BIG picture and the dire situation Australia is in, right now. I challenge anyone to debate with me or try to argue against my 7 steps, which will save the Industry. Stabilising adviser exits, is not a solution. We need 10 times the current amount of Risk specialists that are struggling to survive today, to bring the Life Insurance Industry to it's full potential and allow the economic safety net, that is Insurance, to do it's job as a vital service Industry to all Australians and the economy."

Jeremy Wright 12:24 on 18 Feb 21

"Not to mention that it isn't a level playing field. To be compliant, I must spend up to 10 hours per client researching 6+ insurers to ensure the policy is in the best interest of the client. How/Why are online and call centre insurers that advertise on TV daily excused from this obligation to their client? How are they allowed to sell their own insurance products and not consider if it is in the best interest of the client?"

D 11:06 on 18 Feb 21

"Insurers with bells and whistle policies , underwriters with no sense of the likely incidence of mental health issues, regulators who have never sold a Lolly in their lives and Fasea who insist on their version of life forcing an exam on life agents , what on earth is going on ...... and all the while the government pleads its case that they want low cost advice for all Ozzies. Perhaps there is a tech course at nite they can go to, to learn the basics."

John 22:25 on 17 Feb 21

"Sadly the compliance required to be done to get such a small amount of earnings in the Life Insurance side of financial planning is so high, it is no longer financially viable to advise on insurance. So much so that advisers have resorted to conserving their client business rather than take on new clients, which might conserve premiums for insurance companies, but does absolutely nothing to bring in new clients to help with any revival. We're not even at the end of the term for FASEA requirements, and if a mass exodus of advisers at the end of the year does not bury the risk industry, additional poorly constructed and untested Hayne legislation, or the increasing cost of PI cover or ASIC adviser fees will soon after. This industry should be vibrant and alive with activity, but it is all but dead and personally, I cannot see how it can possibly survive."

Tony 17:21 on 17 Feb 21

"Whilst 50% increases are horrific, 100% increases are worse per recent experiences with Resolution Life (another AMP disaster)... Many clients are in a no win situation and have to cut covers to meaningless amounts or consider underwriting in their late 50s / 60s for substandard alternatives having paid level premiums for 20 plus years - not an ideal scenario. The games insurers are playing are unconscionable and nasty - e.g. AMP Elevate are not allowing older in force agreed value policies to be altered to indemnity - instead they need to be cancelled (losing valuable level premium status) and re-written (with underwriting) to a new sub-standard policy, this never used to be the process. Advisers have an important yet perilous role to play in this mess - In one breath they need to calm clients and reassure them of the importance of their insurance plan, in the next they themselves are questioning their belief in level premiums or insurance at all. This goes on in an environment where compliance and ASIC is ready to pulverise any adviser who might suggest a move to an alternative plan god forbid they receive a commission - which incidentally, nowadays doesn't cover the work required to satisfy "best interest duty". In most instances replacement covers are substandard (terms and definitions) or just not available (e.g. agreed value) - The advice process then becomes a very delicate balancing act of weighing up expensive cover that is high quality versus cheaper cover (not cheap though!) that is mediocre (at best)."

LJ 17:10 on 17 Feb 21

"The one thing that remains constant is that people from all walks of life need advice about their personal insurance needs. The other thing that remains constant is change in our industry. We have been rolling with the punches for years now, but the biggest blow is the pressure of having to pass an exam to keep doing what we have been successfully doing for decades. To add insult to injury, the subject matter of the exam has precious little to do with what a risk insurance specialist does on a day to day basis, and proves absolutely nothing about the competence, honesty and integrity of an adviser. "

deputy 15:46 on 17 Feb 21

"I have been a Riskie for 18 years. In recent times I have had to inform clients their premiums have increased up to and over 50% in one (1) year ! Obviously the client is horrified, as am I. And then if I wish to change the client to a cheaper more appropriate policy we are under the harsh scrutiny of Compliance and ASIC. I love helping people but this current state of industry is very sad and frustrating. And as per the article says, I think 2021 will be no better than 2020."

Steve 15:37 on 17 Feb 21

"Need to show which insurers are dragging down that score. Like any industry there are a few that are awful but are others who are brilliant"

Chris 15:22 on 17 Feb 21