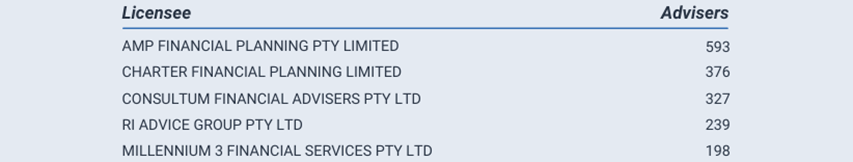

One of the biggest reactions to the Hayne Royal Commission and professional standards was the swift collapse of the vertical integration model. In 2017, most advisers were licensed by one of the Big Four banks or AMP. Today, the banks are virtually non-existent in the market. In fact, National Australia Bank (NAB) – which has the largest presence – has only 99 licensed advisers. AMP Financial Planning has fewer than 600 advisers on its licence, and the number dwindles every quarter. In the past year, the scandal-ridden corporate has lost 27 per cent of its adviser base.

Table 1: Top bank licensee

Source: ARdata

Table 2: Top diversified licensees

Source: ARdata

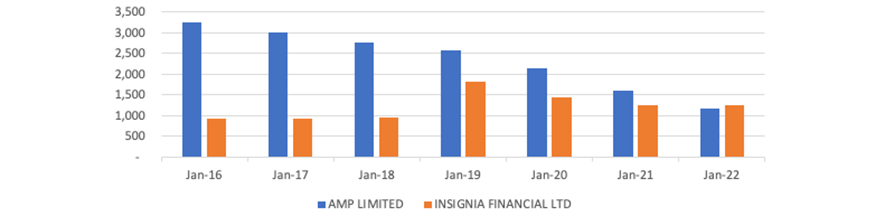

It’s a similar story elsewhere at the top end of town, where big licensees have reassessed the value in licensing advisers. In the past year, we’ve seen many of the heavyweights enter takeover arrangements or exit the market completely, which has shifted advisers to a spectrum of new licensees. For example, the IOOF acquisition of NAB/MLC dislodged 411 advisers from MLC-aligned GWM Financial Services in 2021. Last year, we also saw the closure of Financial Services Partners, which displaced 125 advisers, and GLP Limited, which left 77 needing new licensees.

Figure 1: AMP and IOOF/Insignia Financial – 2016-2022

Source: ARdata

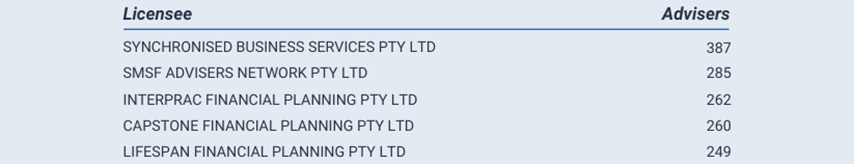

Other licensees that have stuck around haven’t been immune to advisers’ desire for change. Exiting accountants saw the SMSF Advisers Network’s adviser numbers fall 66 per cent – or a 545 headcount – in calendar year 2021. Synchron, meanwhile, lost a quarter of its advisers, or 128 in total, over the course of the year, while Merit Wealth lost 115.

Table 3: Top privately-owned (100+) licensees

Source ARdata

Where the gains are

At the same time, there are a few mid-sized to large outliers that have managed to keep strong headcounts amid the general industry decline. Examples include Morgans Financial, which lost just 9 per cent of its 492 advisers in 2021; Capstone, which saw just one adviser from its 261 depart; and Fortnum Private Wealth, which lost six advisers (from 207).

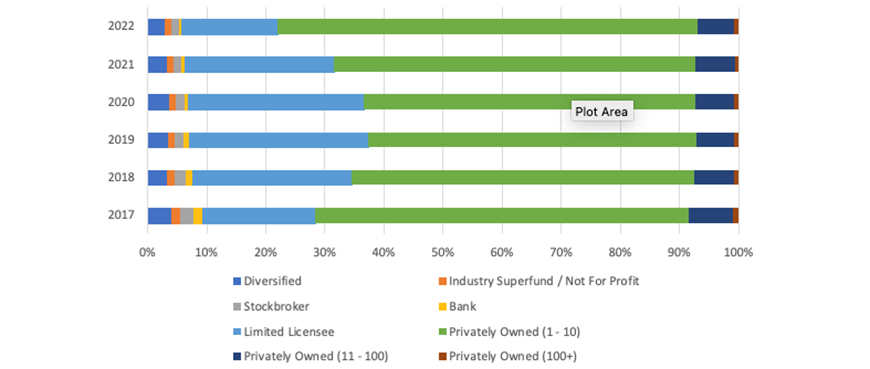

So, where are the other, remaining advisers ending up? Among those who’ve stayed, formerly bank-licensed advisers have now primarily fractured off to privately-owned licensees, with a particular preference for boutiques. Since 2017, the small, private licensee, with one to 10 advisers, is the only segment to have grown amid the mass exodus. There are now more than 700 more advisers licensed in this space than there were five years ago. Advisers tell us they don’t miss being tied to limited product lists; the main teething problems listed have been around access to some of the traditional technology and support services that big licensees could provide at low cost.

Figure 2: Licensee Distribution per Segment, 2017-2022

Article by:

Comments1

"Looks like mass destruction to me. Reduction in adviser numbers and increase in boutiques. Licences(ASIC/AFCA) certainly will be hard pressed to administer without further increasing licencing costs. Then there's all the other costs to cover dwindling numbers, PI insurance for example. And the mandate was to look after the consumer and reduce costs. What more proof does the regulator need when advice now only can be accessed essentially by the middle class and higher due to the increasing costs to serve and the onerous compliance burdens and increasing education standards!"

James Herman 15:30 on 10 Feb 22