It’s probably no surprise that advisers are suffering high levels of burnout and stress. With increasing workloads, compliance and regulation, the public perception post-Hayne Royal Commission and now COVID-19, it has been far from an easy ride for any financial adviser.

It’s reached a point where almost two in five surveyed advisers have said they would consider leaving the industry due to stress, according to a recent study. A further 17 per cent said they were unsure if they will stay in financial advice.

The research from Dr Adam Fraser’s e-lab, Deakin University and AIA surveyed advisers in two parts about their wellbeing and physical and mental health. Scores were then compared to other industries, including mortgage broking, human resources, executive-level roles and school principals.

To complete the research, two studies were done. The first surveyed 43 advisers and asked them to keep a diary over a week. The advisers were also interviewed. The second study asked more than 700 advisers the same survey questions from the first study.

From the second study, most advisers were male, 40+ and working more than 50 hours a week. Most had completed their FASEA exam.

“Concerningly, we found that advisers had the lowest scores in areas of wellbeing, mental and physical health and higher scores in terms of stress, burnout and work overload than any industry we had previously studied,” Dr Fraser said.

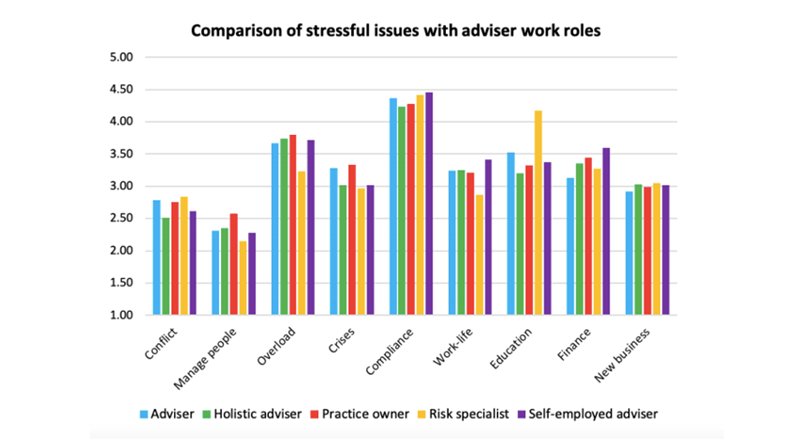

Regulation and compliance were listed as the top concerns among the studied advisers.

Researchers said the findings cast doubt about the sustainability of the advice profession.

Key findings

The research found the following among the sample group:

- 73% of advisers have high levels of work burnout.

- 33% of advisers have sought medical help to manage work-related stress.

- 17% of advisers said they were depressed most or all of the time.

- 42% are considering leaving financial advice as a result of stress.

Source: The E-Lab and Deakin University. 2021. Sponsored by AIA Australia.

Evidence of coping skills

Although the headline figures are alarming, one of the researchers, Dr John Molineux of Deakin University, said there was also evidence of resilience and recovery among the studied advisers.

“There is hope, as pathways for help are becoming available and many of the advisers we interviewed are learning, coping, adapting, recovering and moving away from stress reactions which can prevent us from taking positive action.”

A minority of the surveyed advisers also defied the general trend and showed strong wellbeing, mental health, worklife balance and business growth.

Researchers said while there were no standout demographic characteristics among the group they described as “thrivers”, these advisers made their wellbeing a priority, showed psychological flexibility, optimism or resilience, adaptive performance and an interest in engaging in industry support.

Help and support is available

The study’s authors made the following recommendations for advisers who are struggling.

- Work on specific psychological skills, such as psychological capital (resilience, optimism hope), flexibility and adaptive performance (changing behaviour to suit the changing environment).

- Seek help, including from licensees and associations.

- Participate in associations (as opposed to being an inactive member)

- Get a mentor or coach

- Reduce stress outside of work with exercise, mindfulness, relaxation or hobbies.

You can read the full report here.

If you, a loved one or a colleague needs urgent mental health support, you can always contact Lifeline on 13 11 14.

Article by:

Comments10

"I am thankful that I lived through the glory days of financial planning, when you did a fine job for your clients & had time for leisure, holidays & a balanced lifestyle. All the compliance & paperwork gradually squeezed out the joy, as well as the audits which went from acceptable to more like a slap in the face no matter how much you improved your systems. I was fortunate enough to have invested well without having to rely on the much reduced proceeds of the business sale to fund my early retirement. I wish you advisers well & hope that there is light at the end of the tunnel. In the meanwhile, lots of PMA!"

Dessie 12:00 on 15 Jul 21

"One powerball and I'm outta here!"

Ian 09:23 on 15 Jul 21

"Fully qualified, many years experience and in my prime... and I can't get our fast enough. That being said, love the clients, but the industry is surrounded by bloodsuckers on all sides and the next Labor government has a clearly planned and articulated agenda to finish off most everyone except wholesale client advisers. I recently decided to get out when I realized that I was not willing to invest my time energy or money in growing the business again in view of all the entrenched enemies the planners have and would rather use my skills in other ways. In 2-5 years, the same old institutional players will be selling their products via general advice. All the same old issues around mis-selling, just no pesky "independent" people giving personal advice to keep the product providers honest- well played FSC and FPA...well played."

Mark 20:48 on 14 Jul 21

"I'm young, educated and have a great advice business with amazing staff but I'm done with this industry. Over the past 13 years it's moved way outside my risk profile and interests. While there appear to be green shoots on the horizon, the sum of yearly incremental gains are too easily taken away. We'll have driverless cars before these manufactured problems are solved. I've learned a lot over the journey but I want my nights and weekends back."

Daniel 19:42 on 14 Jul 21

"Hey Imran. Get those surgeons, physicians and car mechanics to complete an SoA before they operate on any new clients and do an RoA when reviewing the results and see how responsive they are to your utopian views ! "

John 17:20 on 14 Jul 21

"Here is what I had to say after that report and having the gauge on general feeling in the industry. 1. Why was there more emphasis on clients' numbers vs relationship building with the clients? 2. Did the professional bodies granted admission to adviser's who had spoon fed their CFPs just because they were in the industry even remotely attached? 3. If the compliance is a burden now, then what wasn't done correctly for the clients over the years? 4. why the financial advisers be feeling any different to constant change vs health industry or other profession? 5. wouldn't a surgeon or physician by feeling the same if they were not up to date with change in their field with new innovations? Or should a car mechanic through tantrums because there are more innovative idea on electric cars? Every industry and profession has been through changes since these first established. The blame has to be with the financial services industry itself where it could not even establish itself as a recognised profession till a few years ago. The industry bodies had to carry the blame where they have failed to weed out advisers with no qualifications at the grassroot level but are designated as CFPs. As the profession evolves we should be broadening our horizon and looking at a client's wider circumstances where intergenerational advice becomes integral part of advice. Then how can as an adviser, one can segment themselves as risk vs investments or single sector based advisers. That is exactly where the financial advice industry has gone wrong; not considering the circumstances and focused on revenue generation rather tailored advice. Advisers who are going to be left post 2021in the industry have braced themselves for 'fee for service'; where the service quality is uncompromised. Sooner the advisers connect with their clients on the basis of 'fee for quality of service' not fee for any service; the better future the industry and individuals hold. "

Imran 15:49 on 14 Jul 21

"Hey wasn't all this regulation, LIF, FOFA, FASEA, Best interest, Opt-in, Opt out, Opt All about, FDS , terms of engagement OFA, consent forms, going to lead to better consumer outcomes and reduced costs to consumers. Then ASIC has the nerve to ask why the cost of Advice has gone up or out of reach for many? Might want to add to this some research into the devastating impact of loss of life due to suicides, the loss of a previously valuable retirement asset as John says, retrenched staff, who worked for advisers as they have their roles moved offshore. But hey lets believe the hype of Jobs and Growth. A compliance regime that has become unworkable, whilst handing back your business to the Corporate's so those small clients can be totally orphaned and ignored. I know where my vote is going this time and it ain't with these Liberal Boys Club Turkeys. Think I need a hit man, not a Therapist or a conflicted association."

Michael 15:42 on 14 Jul 21

"Like most surveys I would like to know more about the sample group. There is a big difference between an owner of a business and a person working in a business. As a planner who is employed I may find it hard to keep up with change but I get paid, as the owner I get paid if I make enough money after bills are paid. Sample group comparison with School Principals and executives who are employees are not in this boat. That is not to belittle any of these people however as a Financial Planner who runs their own business I have the stress of all the changes affecting employed people plus running a business profitably."

allan 15:40 on 14 Jul 21

""With increasing workloads, compliance and regulation, the public perception post-Hayne Royal Commission" Let's not forget the biggest thing; Josh Frydenberg and his great big new taxes. The ASIC tax is a real issue and driving advisers away. Then there is also the Liberal government introduced Tax Practitioners Board tax where we must make payments to the ATO for .... for something, I'm not sure what though. No intelligent person would even entertain the idea of entering this industry. It is dead; the Liberal government has killed it. They have let the bureaucrats at ASIC deliver their socialist utopia and drive small businesses to the wall. "

Chris 15:10 on 14 Jul 21

"You have got to be joking right ? 10 years of a persecutory regime that advisers are supposed to just accept as being ok.? Why wouldn't anyone love to exit this current circus ? Many can't because the financial asset that was supposed to support retirement has been devalued to such an extent not only from a financial income perspective but from such ad hoc regulations allowing 10 year lookbacks and 5 years imprisonment for poor file keeping !"

John 14:38 on 14 Jul 21