What is the investor’s conundrum?

For decades and when interest rates were high, many Australian investors had a substantial portion of their investments in term deposits and savings accounts, generating healthy levels of income virtually risk free.

However, the days when investors could earn a five or six percent yield on a bank term deposit are long gone and they seem unlikely to return any time soon as central banks both here and overseas seem determined to maintain their ultra-low interest rate policies for some time yet. Yields on cash and bonds here in Australia are extremely low and, given the Reserve Bank of Australia’s current cash rate and yield curve control settings, look likely to stay that way for an extended period of time. At the time of writing the yield available on a one-year term deposit from the ‘Big Four’ banks ranged from 0.25 to 0.30%.

Investors are responding to this environment in a variety of ways. Many are hoarding cash at a time of uncertainty, a result of the COVID-19 situation and rolling government-enforced lockdowns. A recent report from Russell Investments pointed to Australian Prudential Regulation Authority data indicating that Australians had increased the amount of cash in their bank accounts by 12% between March 2020 and March 2021, accounting for an additional A$124 billion in deposits.

Some investors are displaying clear signs of “fear of missing out” behaviour, as we’ve seen from the boom in speculative assets like cryptocurrencies, ‘meme’ stocks and the significant growth in online broking accounts. Many investors have also been chasing the soaring prices of trendy but not necessarily profitable ‘concept’ stocks such as ‘buy now pay later’ and technology companies which are trading at extremely inflated valuations.

Many other investors are caught between the need to earn adequate income from their existing accumulated savings but are hesitant to risk their hard-earned capital in more volatile asset classes such as the sharemarket. Additionally, some investors tempted to invest in the sharemarket have concerns about company valuations at this stage in the cycle.

Given all this, there is an opportunity for financial advisers to provide guidance about the risks involved in “staying on the sidelines” in terms of the investor’s ability to achieve their capital growth and income goals, while identifying potential investment opportunities which align these goals with the investor’s risk tolerance. One opportunity could be an investment in a vehicle which is suitable for investors seeking a “middle ground” between cash and the sharemarket, by providing defensive, lower volatility market exposure with a focus on capital preservation and conservative return generation.

How can advisers address the investor’s conundrum?

The Investors Mutual Private Portfolio Fund (the Fund) is one solution which can help address this. The Fund is a defensive investment intended for investors seeking consistent and reasonable returns with a target objective of 3% above the return of the RBA Cash Rate, combined with relative capital stability and lower volatility than that of the sharemarket.

The Private Portfolio Fund combines IML’s skill in fundamental research and prudent stock selection with expertise in tactical portfolio management, and the flexibility to adapt to changing market conditions. The approach to investing draws on IML’s long-established focus on sound value and quality stocks that are conservatively valued and offer good return potential over time.

It is a very interesting time in the sharemarket, in our opinion, with some sectors being significantly overvalued, while other companies with a sound track record of earnings and dividends appear substantially undervalued.

To be defensive yet also opportunistic, IML’s Private Portfolio Fund employs three diversified strategies to generate positive returns across different market conditions – relative value, income and events (taking advantage of opportunities such as capital raisings).

The Fund is managed with a very strong focus on risk management and capital preservation as we are aware that investors in this Fund are extremely sensitive to negative returns and hence the Fund employs various prudent market risk management overlays.

The result is a Fund with the aim of generating a track record of conservative and consistent positive monthly returns and avoiding too many negative ones - which the Fund has successfully achieved to date.

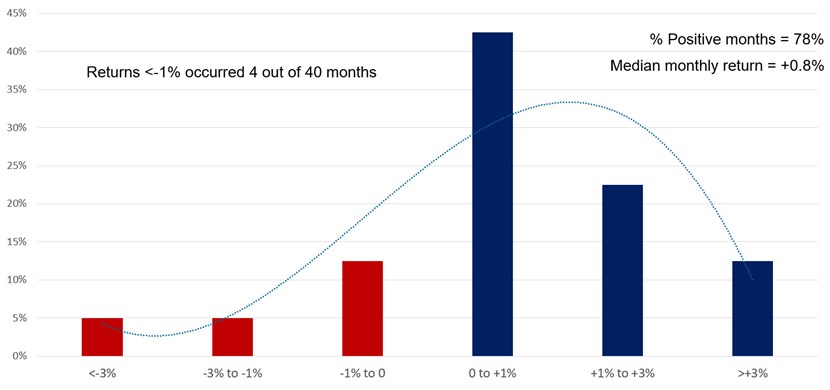

Chart 1 shows that the distribution of the Fund’s monthly returns since inception. As can be seen it is skewed in favour of positive returns, with over three-quarters (78%) of monthly returns to date having been positive. The median return is +0.8% per month, while negative returns of more than -1% have only occurred in 4 of the Fund’s 40-month track record.

Chart 1: Investors Mutual Private Portfolio Fund – Monthly Returns Profile

Source: Investors Mutual; 1 July 2018 – 31 October 2021

Past performance is not a reliable indicator if future performance.

For highly risk-conscious investors concerned about the effect of sudden market downturns on their investments and their ability to sustain their lifestyle, the Private Portfolio Fund’s investment approach and its active risk management focus allows for effective management of ‘downside risk’ during periods of significant market volatility.

These are characteristics likely to appeal to many investors seeking reasonable capital growth and income over time from a very carefully managed investment in the sharemarket. The Private Portfolio Fund aims to provide a middle ground in the risk/return balance between the relative capital stability of cash, and sufficient but conservative returns from sound companies on the sharemarket. The Fund aims to achieve the middle ground between at one end of the spectrum - low-yielding cash investments which will not enable the investor to meet their current and future needs, and at the other end, the highest-risk and potentially more volatile sharemarket.

Portfolio manager Tuan Luu will discuss more about how the Investors Mutual Private Portfolio Fund can help address the investors conundrum at a webinar on Thursday 25 November at 11am (AEDT). Register here

Article by Tuan Luu and Anton Tagliaferro

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Past performance is not a reliable indicator of future performance. Investors Mutual Limited is the issuer of the Investors Mutual Private Portfolio Fund. Applications can only be made by reference to the current Product Disclosure Statement. The Product Disclosure Statement can be obtained by contacting Investors Mutual or at www.iml.com.au/funds/private-portfolio Potential investors should consider the Product Disclosure Statement and TMD before deciding whether to invest, or continue to invest in the Fund.

Article by:

Comments0