Can life get any more difficult for life insurers? As if LIF, the Royal Commission, and more recently APRA forcing an industry recapitalisation were not enough, a couple of weeks ago ASIC recently published a review looking at member experience with group life, with some damning findings for super funds that will have flow-on impacts for their group life partners.

Sales are down circa 10% for 2020 according to recent Plan For Life data and life insurers are playing a game of chicken with each other on repricing in order to get back towards profitability, although these premium step-ups have commenced and are understandably being met with great concern by advisers and their clients.

The life sector was also front and centre during COVID-19 as consumers, through a variety of experiences with death, illness, or losing work due to the economic crisis, “suddenly” woke-up to the entire life insurance topic. It has highlighted the need for major education of the consumer base around the product suite and what is included / excluded. COVID-19 had everyone reaching for their policy documents, in the same way consumers pore over T&Cs in their house insurance policies after a bushfire or flood.

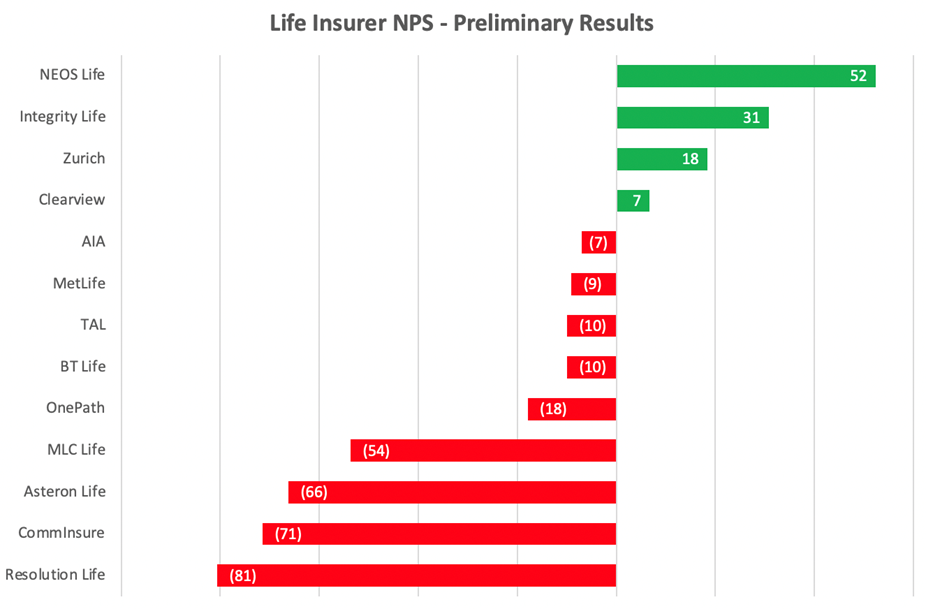

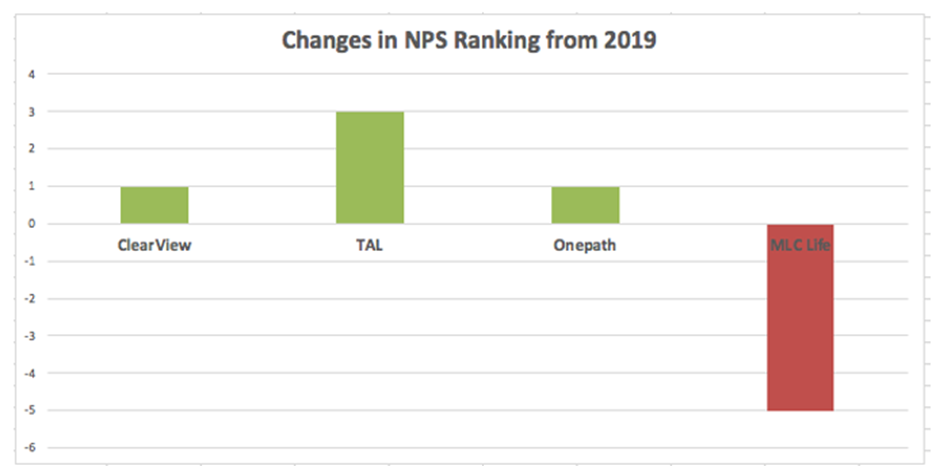

The early league table of life insurer NPS scores may not come as a major surprise then, as judged by advisers in our current 2020 Financial Advice Landscape benchmarking study. NEOS Life, Zurich and Clearview are the only firms in positive territory, with Clearview jumping into the top 3 for the first time, while TAL is the biggest improver jumping three places from last year. MLC Life has had a precipitous fall into negative territory, with advisers reacting harshly to management changes and impacts to functionality and support arising from a major technology transition project. The insurers that were acquired over the last 1-2 years did not score well, unsurprisingly for Asteron and CommInsure who are in run-off, although Onepath has been well supported by Zurich and remains open for new business.

Source: Adviser Ratings Financial Advice Landscape study, Nov 2020 (n=840)

Source: Adviser Ratings Financial Advice Landscape study, Nov 2020 (n=840)

In reviewing adviser qualitative comments, some interesting perspectives are emerging:

Corporate actions

The consolidation in the industry with Asteron, CommInsure and OnePath gobbled up by their acquirers has not improved adviser mood by reducing choice for new business, particularly with the remaining players struggling with performance. This has played perfectly into the hands of NEOS Life and Integrity Life as they are unconstrained by legacy systems and back book claims, and they have naturally focused on delivering great customer experience through their investment in technology, underwriting flexibility and value-for-money, and adviser support.

Policy term shifts

Given the recent experience of COVID-19 and the increased engagement from policy holders, it was surprising to see virtually no comments about the equity or otherwise of changing policy terms. The absence of feedback suggests that the life industry responded appropriately in adjusting for COVID-19 inclusions / exclusions. Damned with faint praise?

Non-core “inducements”

Although always couched in terms of “yes, but fix up your core service”, advisers nevertheless gave a big thumbs-up to the AIA Vitality program and the TAL Academy. It reflects adviser hunger for insurers to take a more holistic approach to helping them through their own personal and business transitions, as well as providing additional tools to build engagement with clients for a product that is largely set and forget.

Premium Increases

With premium increases of up to 40% reported by advisers from some insurers, advisers were understandably upset about these sudden jumps, particularly for existing customers. The practice by some insurers of offering first-year / second-year discounts were not generally well received, as this made product comparisons under best interests duty more complicated to perform, or at least explain to customers who may be seduced by the low entry point.

If you have some strong views on how Life Insurers are adjusting to support your business, please have your say at www.adviserratings.com.au/yoursay and be in the running to win from a $30,000 prize draw.

Article by:

Comments8

"Until Life Companies recognise the importance of Advisers/Agents and the service they provide, readjust the Commission and Claw Back situation along with New products, the Industry will continue to suffer and go backwards! The Educational requirements for long serving Advisers should have been cancelled, and "Grandfathering" permitted to allow continuing of service to be given. Common Sense just overlooked ! As an Industry veteran of 62 years, I see coalface experience is not valued by Academics, Bureaucrats and Politicians . So what hope is there for Life Insurance Agents/Advisers unless Common Sense is prevailed on and applied?"

Darryl Elsley 11:13 on 10 Dec 20

"The insurers have been shooting themselves in the foot for some time now and wonder why they are bleeding to death. Right now BT Life is offering a 25% upfront discount on new business. That should just be seen for the bullshit that it is. We wont have a life insurance industry in Australia soon and IT WILL BE THE INSURANCE COMPANIES FAULT."

Simon Leigh 09:13 on 10 Dec 20

"Is it any wonder Financial Advisers are not touching risk insurance anymore? Compliance is a nightmare. The business actually loses money unless Advice fee of at least $2,000 is charged and not many clients are willing to pay that. The Royal Commission has ripped the guts out of the FP industry. Changes needed to be made, unfortunately 50% of current Advisers (many with a wealth of experience) will leave the industry by the end of 2025, leaving a plethora of well educated Advisers with little experience. You reap what you sow!"

Jaxon B 18:34 on 09 Dec 20

"Completely agree with Bill's comments."

Richard Lynch 17:11 on 09 Dec 20

"It is interesting that sales were only down 10% - Frankly I would have thought it would be more given the number of advisors that have left the industry this year. They must be doing something right to replace the business these people would have written."

Mark 16:45 on 09 Dec 20

"Can life get any more difficult for Life Insurers? Advisers should be included, as they have felt the brunt of the pain, which has been reflected in thousands of Life Insurance Advisers exiting the Industry and holistic advisers who are now turning their backs on providing Insurance advice, with the resulting decline in New Business. WHY? It has become too hard. The solution is so simple and has been articulated on numerous occasions, though the lack of listening, has correlated with the decline of the Life Insurers revenues and profitability. This decline can be turned around quickly. All it will take is for the Government to start listening to the right people at the coal face, with vast experience and stop taking advice from vested interest groups whose sole purpose is to feather their own nests with no care or thought about the consequences of their actions."

Jeremy Wright 16:11 on 09 Dec 20

"Sadly going to get a lot worse before it get's better. Unfortunately there is no appetite to address the elephant in the room."

Matt 16:10 on 09 Dec 20

"Life companies seem to be motivated solely by their own survival and pay only lip service to assisting advisers: they seem incapable of understanding that the advisers are the "goose that lays the golden eggs" and once advisers leave the industry the whole industry will collapse. After nearly 50 years in the industry I see that advisers today are valued less than they were in past years; management has been so used to seeing business coming in the door that they have forgotten who generates this business and as a result there is little if any relationship that exists any longer between salaried insurance employees and advisers .Insurers have done little if anything to support advisers during the last few years of massive change and now are beginning to panic only because it is their own jobs that will soon be on the line. Life companies need to stand up for the industry instead of bowing to every regulatory change that is inflicted. I think the compliance industry has now become bigger than the industry it is meant to serve. I am extremely concerned at the threat of commissions being banned: I cannot see anything other than a looming disaster for clients as they will not want to pay $3000-$8000 for advice and so will remain either uninsured or inadequately insured. If politicians believe that this will benefit the people of Australia then they must live in La La Land."

Bill Medhurst 15:58 on 09 Dec 20