A January 2021 survey of more than 3,000 consumers by Adviser Ratings found the pandemic directly impacted the earning capacity of 30% of them. Whilst many of these consumers are back to full pay or have found a new job, there are still lingering effects on many.

The role the pandemic has played on the psyche of consumers and money management bodes well for the wealth management and financial planning industry. Many consumers have realised that job security is not guaranteed, whilst others had the opportunity to re-evaluate their financial positions.

This re-evaluation was felt across the full spectrum of consumers:

- Those negatively impacted through job losses or lower salaries have had the opportunity to reconsider risk in the context of spending, investing and saving.

- Those positively impacted through increased stimulus measures have been exposed to the value increased money provides in both flexibility and spending behaviours. In the younger segment, it has increased awareness of investing and trading – as evidenced by more than $11 billion in retail funds coming into the market to June 2020 (Source: Vesparum Capital), whilst institutional money stayed on the sidelines. And while there has been some reckless “investing / trading” activity, this creates an education for those consumers who wouldn’t traditionally be exposed to money management and the importance of it.

- Those who have not been directly impacted have been exposed to a jittery market, peers and family members losing their jobs and a changing dialogue around money from both society, media and government.

Twelve months on from the pandemic, March 2021 figures from the RBA shows the unemployment rate at 5.8% and underemployment at 8.5%. Commonwealth Bank economist Kristina Clifton said “The jobs lost in the early months of the coronavirus pandemic have now been fully replaced,” she said. “The next test for the labour market will be the expiry of the JobKeeper program.”

Notwithstanding, the recovery remains fragile, with stimulus measures still bolstering employment rates, banks still supporting consumers and a general weariness around the efficacy of a vaccine longer term.

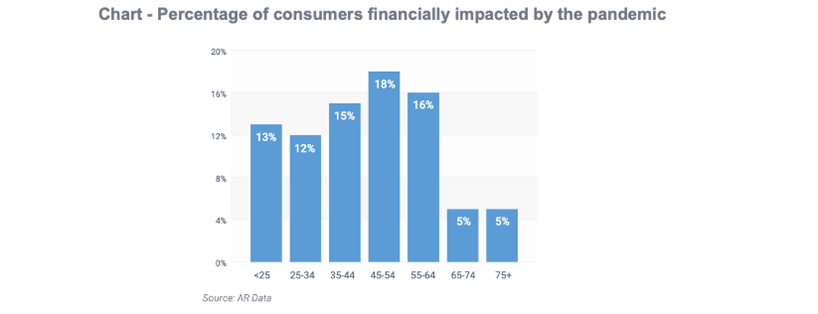

In January 2021, 13% of all consumers were still impacted financially by the pandemic. Whilst the younger cohort of consumers are recovering quickly when it comes to employment and wages, there still remains a concerning number of consumers in the 45-64 age groups that are either underemployed or have had a permanent salary reduction.

Pleasingly, the pandemic has rebased the demand for advice. In the seven years since Adviser Ratings has been in business, the volume of leads coming through our platform and our white-label platform has never been greater.

Article by:

Comments1

"I'd be interested for someone to dig deeper into the increase in demand for advice beyond counting simple inquiries or answering yes to a survey question... "Do you think you could benefit from financial advice?" As the cost of advice increases, the pool of those who can afford to pay for it and still benefit from it decreases. Many of those who are counted in these stats are not ideal financial planning clients in 2021, despite their need and desire to receive financial advice."

Daniel 12:41 on 01 Apr 21