If you’re after some informed reading to help you get into the swing of the new year, you could do a lot worse than get your hands on a copy of our newly released 2019 Australian Financial Landscape Report. It’s one of the most comprehensive documents you’ll find that deals with issues right across the financial advice industry. Chapters include Adviser Movements and what the continued fragmentation of the industry will mean, the future of digital advice and technology as well as advice business analysis. We include chapters on the investment and life insurance landscape, and we dedicated a whole chapter to FASEA & its implications.

Producing the FASEA educational analysis required extensive analytical work by Adviser Ratings data scientists which helped produce meaningful data from the public record.

We did extensive analysis of all 24k adviser qualifications submitted to the ASIC Adviser Register, including a very comprehensive data cleansing regime that has seen more than 50,000 data points amended in order to standardise the qualification data.

Nearly 20,000 amendments to qualification names have shrunk the 9,000 qualifications listed on ASIC by almost 30% to less than 6,500 unique qualifications. Of the over 30,000 educational institution names submitted to ASIC, the actual number of institutions was 1,615 unique education providers. We then mapped it all to FASEA’s approved degrees.

The upshot of all this work for existing advisers?

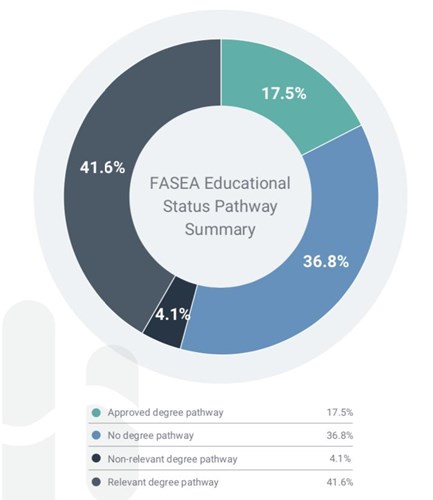

- Only 17% of advisers currently have a full FASEA approved degree

- 42% need to do up to 3 subjects

- 4% need to do up to 7 subjects

- 37% need to do all 8 subjects

We have looked at every licensee in Australia. Taking a snapshot of the top 20, JBWere has advisers that are most advanced in meeting FASEA education requirements – only 12% do not have an approved or relevant degree. At the other end, AMP's advisers have 57% that need to undergo onerous qualification improvements.

To see some discussion and implications for these FASEA numbers check out more here.

To purchase a copy of our Landscape report, contact Mark Hoven at mark@adviserratings.com.au

Article by:

Comments2

"Thanks for the comment Martin. We've slightly amended the article copy to reflect this. Without having full access to advisers’ transcripts, there were certain assumptions that had to be made when mapping to current FASEA approved degrees. In addition, as more courses / subjects are approved by FASEA and as more advisers / licensees update the register, we would expect this gap to close"

Adviser Ratings 13:03 on 23 Jan 20

"This detail is not quite correct. I have a relevant but not approved degree so fit into the 42% section however I only need to do 1 subject not 3. That subject being the Ethics course taht everyone has to do."

Martin Le Tessier 12:55 on 23 Jan 20