Adviser Ratings is delighted to bring you our 2nd annual Financial Advice Landscape report following possibly the most tumultuous 12 months in the history of the Australian retail wealth management industry. Attached is an outline of our 700+ page report and the contents it will detail. This is a report for every person considering their response to the relentless force of change sweeping through the industry, driven by consumer, market and regulatory forces. The following excepts provide examples of the breadth and detail the full report contains.

You can check out and download some of our other reports such as our Quarterly Musical Chairs reports from the Adviser Ratings pro-site here.

Who Wants To Sell?

Adviser Ratings and our insights unit, AR data having almost finalised the Financial Advice Landscape Report for 2019, can now answer the following question:

How many advice practices are willing to sell in this market and what do they look like?

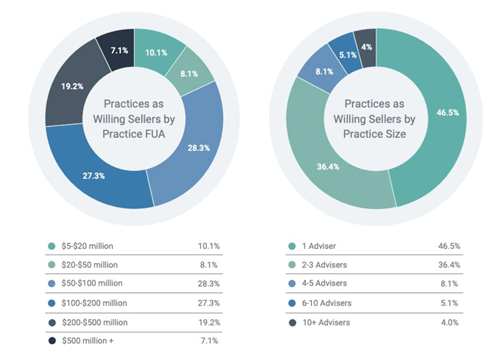

It is a question answered by the thousands of responses we had as part of this year's advice landscape report, with a subset of certain results in the chart. We can see that more than 80% of those respondents who were willing to sell, were practices of 3 advisers or less. More than half of all respondents were answered by over 500 practice principals.

With the collapse of the institutional market, an arbitrary 2.5 times revenue outcome imposed by AMP, and the pending abolition of grandfathering there is now a stark difference in the value of different revenue segments. We delve into this in detail in this year's report & highlight which institutions and practices are benefiting and where the market is forecast to head. How are licensees and practices responding?

Advice Practice Risk

Advice Landscape 2019 - In today’s climate, advice businesses are facing severe headwinds as the overall industry & individual businesses go through a very difficult transformation. It follows that the level of business risk is elevated & the degree of scrutiny from a range of counterparties is rising:

- Regulators have raised their game following the public shaming of the Royal Commission;

- Lenders are increasing their quality of surveillance, monitoring covenant compliance & tightening lending standards;

- PI insurers are contemplating overall system risk & asking themselves should they continue to cover this sector;

- Financial product manufacturers, now captured under the Design & Distribution Obligations Act, are contemplating the need for proper risk assessments;

- Investors in & acquirers of advice businesses are going deeper than ever before on DD;

- And advisers are asking as many questions as they are being asked about the suitability & stability of their licensee.

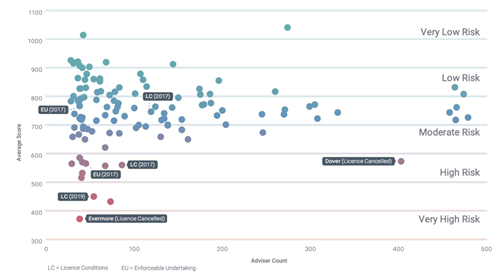

This graph looks at the aggregated commercial credit & company director risk scores of advice practices within the top 100 licensees in the last 24 months & the correlation to EUs / licence conditions / cancellations within that period.

This graph looks at the aggregated commercial credit & company director risk scores of advice practices within the top 100 licensees in the last 24 months & the correlation to EUs / licence conditions / cancellations within that period.

Risk Advisers Exit

Financial Advice Landscape 2019 - 36% of risk specialist advisers left the industry in 2019, 2.4 times more than the industry average.

In what has been a tumultuous year for the life industry & its participants, our report explores:

- The ongoing effects of LIF

- Impacts to the industry on insurer consolidation

- How the key recs from the RC are affecting insurers & advisers

- The role the new insurers are playing in retail life - NEOS Life, Integrity Life & MetLife

- The severe deterioration in profitability per recent Australian Prudential Regulation Authority quarterly results

- The intervention by APRA in the market by placing capital impositions as it relates to DII

- The eradication of Agreed Value Contracts from March

- The impact of PYS & PMIF legislation

- Data & tech & what each insurer is doing in this space

- The ongoing purchase decisions by advisers & the reason for those decisions

It has been a testing year & likely to get even tougher in the near term.

Advice Practices By The Numbers

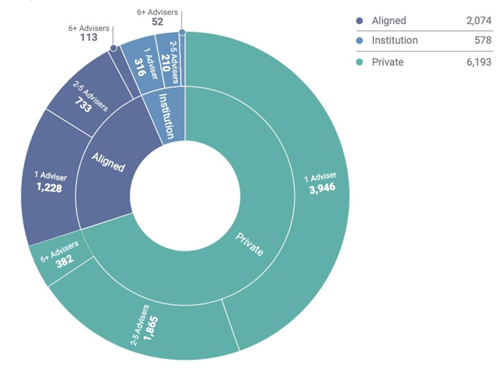

There are 8,845 advice practices today in Aust. The practice experience has to some extent depended on the segment in which they reside. Larger practices in the large institutions have left in large numbers & many have obtained their own licence. Overall, the last 24 months has been about a feeling of gaining greater control of their destiny having experienced uncertainty in their previous environment.

Practices of small to medium size have been less likely to obtain their own licence & have often joined larger, privately owned licensees. As a general comment, practices coming from the institutions have been through considerable transition stress. In addition, they have often seen their costs rise substantially as they move from a subsidised model to a more user-pays model, particularly regarding tech & compliance. On the other side, where they came from have repriced in this direction as well. We cover this in detail in our report (& what it means).

Early Bird pricing of the 2019 landscape Report ends soon. The 150 page national report & 600 pages of 50+ regions across Australia covers a cross section of issues you need to plan for in 2020. Contact Mark Hoven to purchase a copy.

Article by:

Comments0