Positive

Reviews above 3.0 stars

Negative

Reviews below 3.0 stars

Average

Average of all reviews

Reviews

Total number of reviews

Reviewer opinions

Overview

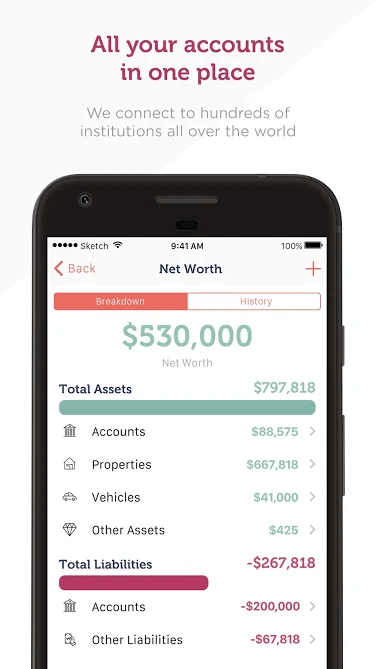

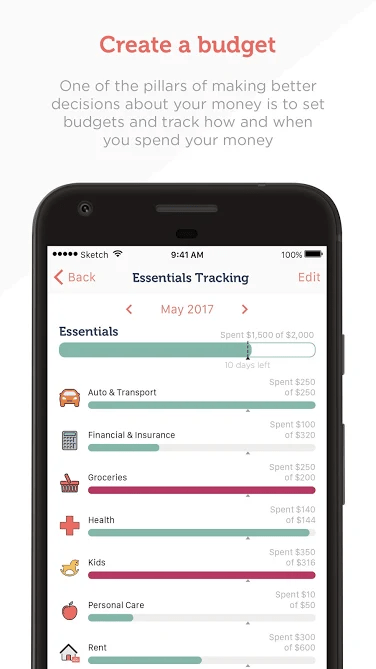

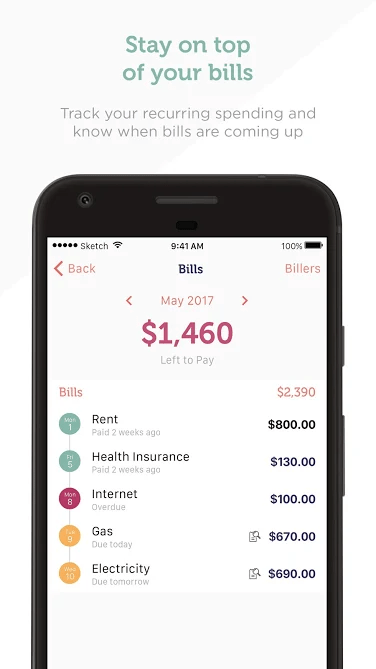

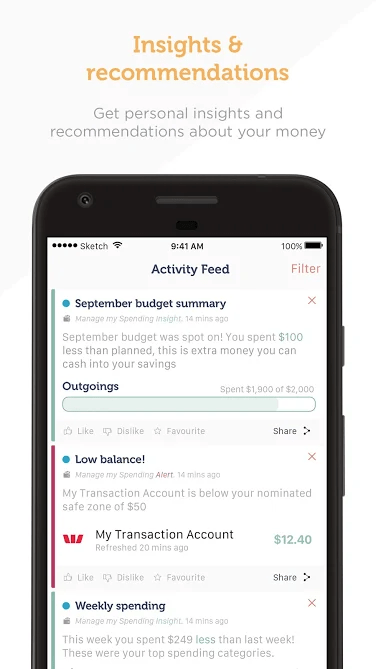

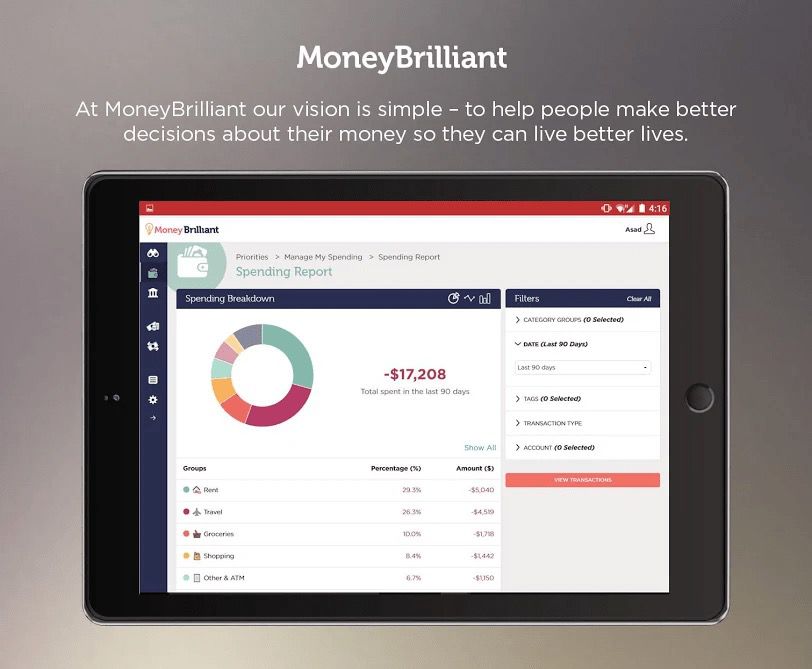

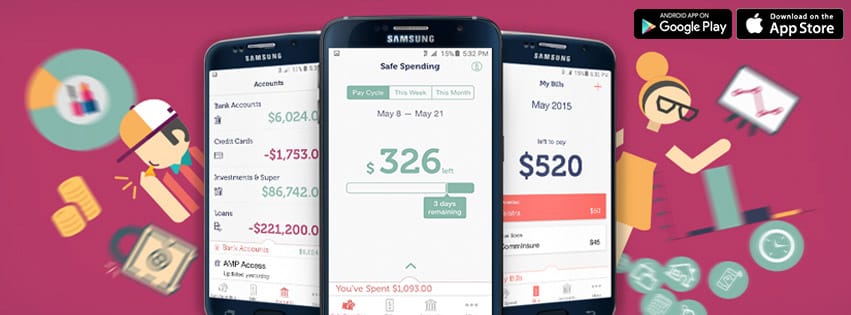

MoneyBrilliant provides the tools to help you make better decisions about your money. Being able to see all your money in one place allows you to easily get a complete view of your money and understand where you are financially. Get a comprehensive view of your financial situation by connecting your bank accounts, credit cards, loans, mortgages, and superannuation. Set your Money Priorities, detect bills and set bill reminders, create customised budgets and predictive tax deductions. Keep track of your progress with customised reporting and receive insights for better money management.

Reviews

4

out of 5 starsEve

46-55 years old"MoneyBrilliant pulls all my data together and has given me insights to help safe money and plan for the future. Good support when needed."

29 October 2018Aaron

25-35 years old"MoneyBrilliant was easy to use. I would definitely recommend it to friends."

21 February 2020Videos

Screenshots

Article coverage:

Key information

- Category

- General Information

- Budgeting

- Managing Cashflow

- Borrowing

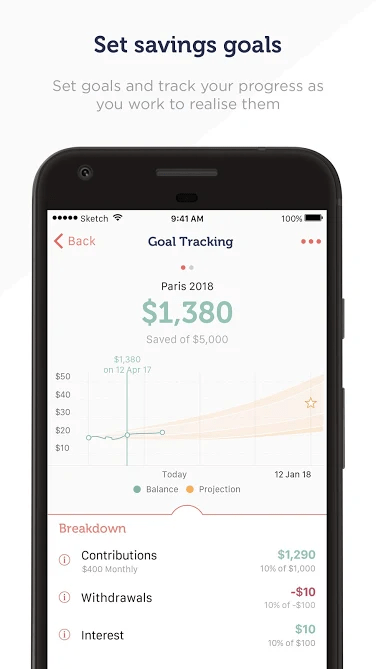

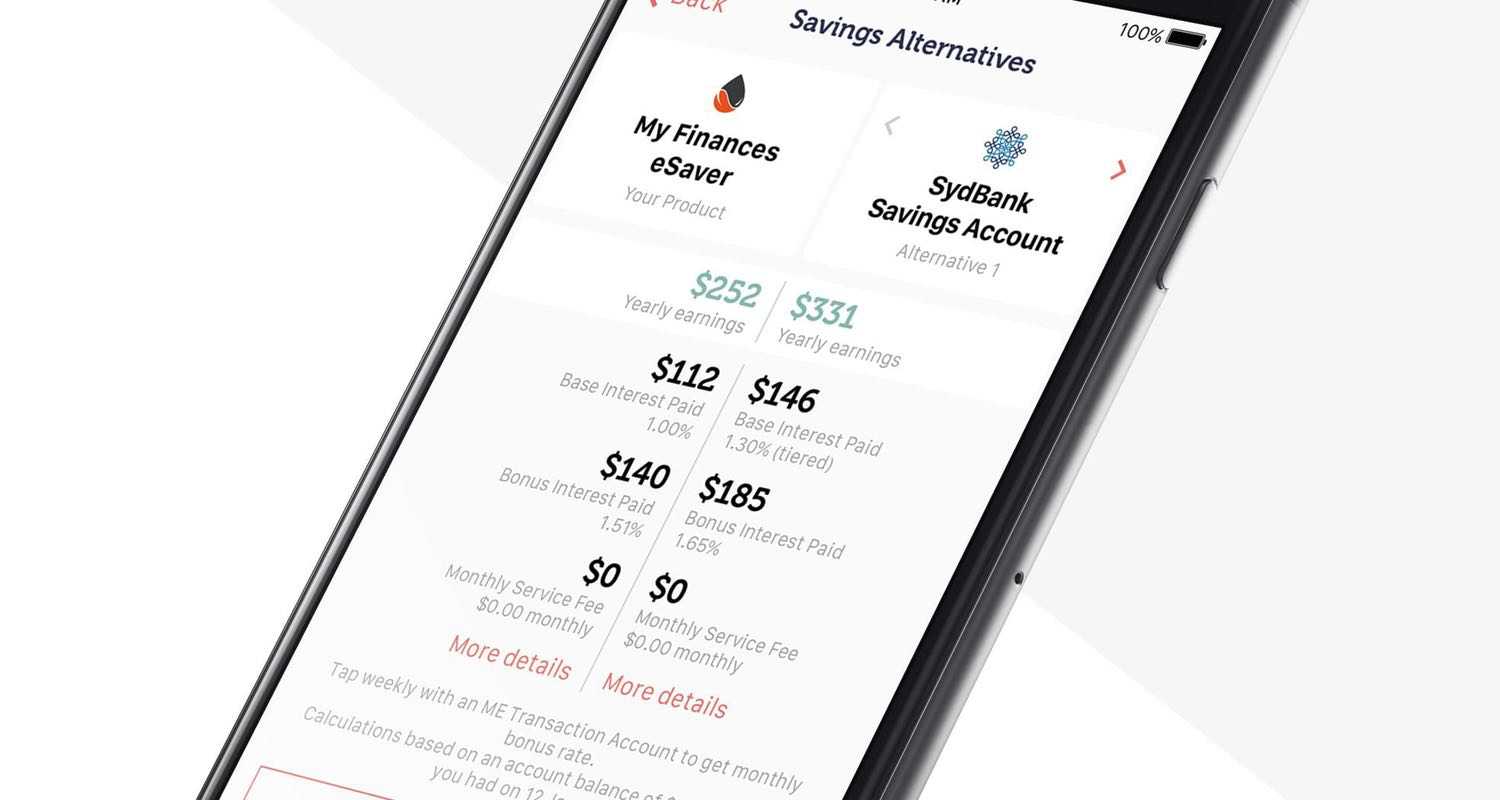

- Saving

- Tax Planning

- Life stage

- Starting Out

- Mid-Career

- Established

- Retiring

- Winding Down

- Financial plan produced?

- No

- Fee structure

- Free Service

- Subscription

- Is there a free trial?

- 1 Month

- Customer support

- Date founded

- 2011

- Company website

- Visit site

Start using MoneyBrilliant

How it works

MoneyBrilliant provides the tools to help you make better decisions about your money. Being able to see all your money in one place allows you to easily get a complete view of your money and understand where you are financially. Get a comprehensive view of your financial situation by connecting your bank accounts, credit cards, loans, mortgages, and superannuation. Set your Money Priorities, detect bills and set bill reminders, create customised budgets and predictive tax deductions. Keep track of your progress with customised reporting and receive insights for better money management.

- Category

- General Information

- Budgeting

- Managing Cashflow

- Borrowing

- Saving

- Tax Planning

- Type of help

- DIY Tool

- Where can I get this?

-

Online

App Store - Are there any other availability restrictions?

- Services Offered

-

- Will I learn what type of risk taker I am?

- Yes

- Will it produce a financial plan?

- No

- What types of investments are available?

- Not Applicable

- How many investment portfolio options are available?

- Where can I invest?

- Not Applicable

- Who manages my investments?

- Not Applicable

- In whose name are investments held?

- Not Applicable

- Is there professional research available on the investment options?

- Not Applicable

- Will it allow me to trade automatically?

- Not Applicable

- Will it automatically rebalance my portfolio?

- Not Applicable

- Will it provide reports on my investment performance?

- Not Applicable

- Cash management account

- Not Applicable

- Automated alerts and updates

- Yes

- Can I access other professional help through this service?

- No

- On which platform can I use this?

- Computer

- Tablet

- Smartphone

- Account opening & closing

-

- How do I create an account?

- Online

- Account opening speed

- 5 minutes

- Will it capture my personal financial information automatically?

- Yes

- Will I be asked questions about my situation?

- Complex (> 5 questions)

- How fast can I get my invested money back?

- Not Applicable

Who it's for

- Accessable by

- Myself

- Life stage

- Starting Out

- Mid-Career

- Established

- Retiring

- Winding Down

- Type of customer

- Consumer

- Advice stage

- Define Where I Need Help

Define My Goals & Objectives

Assess My Financial Situation

Review My Progress

Multiple Stages - What is the minimum amount I have to invest?

- Not Applicable

- What is the minimum amount I have to be earning?

- Not Applicable

- Customer service & support

-

- Is there general financial education information provided?

- Yes

- Customer support

- Who do I complain to as a last resort?

- Not Applicable

What it costs

- Fee structure

- Free Service

- Subscription

- Minimum contract period

- 1 month

- Free Trial

- 1 Month

- Payment method

- Credit Card

Is it legitimate & secure

- Trading name

- MoneyBrilliant Pty Ltd

- Who owns the company

- AMP New Ventures Pty Limited

- Who runs the business

- Peter Lalor

- Date founded

- 2011

- Number of staff

- 10-20

- Security & Regulatory Compliance

-

- Will it verify my identity?

- Online

- Will it send me a confirmation security number to sign-up?

- No

- Are my records destroyed when I leave?

- Unknown

- Is there detailed documentation about the product?

- Not Applicable

- What company holds the financial license?

- Not Applicable

- Financial Services Guide?

- Not Applicable

Contact Information

- Website

- Visit website

- Send email

- Phone Number

- 02 8014 8611

- Address

- PO Box 640 Darlinghurst 1300

- Social Media

Start using MoneyBrilliant

Eve

46-55 years old"MoneyBrilliant pulls all my data together and has given me insights to help safe money and plan for the future. Good support when needed."

29 Oct 2018Customer opinions

Aaron

25-35 years old"MoneyBrilliant was easy to use. I would definitely recommend it to friends."

21 Feb 2020Customer opinions

Start using MoneyBrilliant